DOE publishes list of EVs eligible for new tax credit

Teslarati

AUGUST 17, 2022

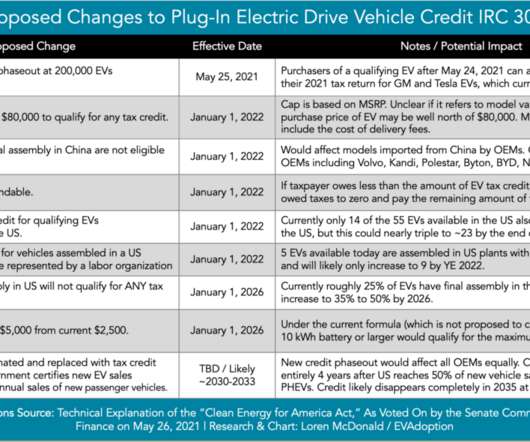

Department of Energy’s Alternative Fuels Data (DOE) published a list of electric vehicles that are immediately available for the new $7,500 EV tax credit. Under the new law, only EVs assembled in North America qualify for the credits. Ford Escape PHEV. Ford F Series. Ford Mustang MACH E.

Let's personalize your content