EIA projects increases in global energy consumption and emissions through 2050

Green Car Congress

OCTOBER 7, 2021

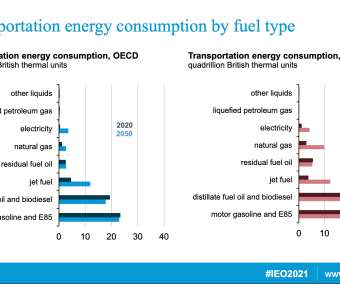

In its International Energy Outlook 2021 (IEO2021), EIA projects that strong economic growth, particularly with developing economies in Asia, will drive global increases in energy consumption despite pandemic-related declines and long-term improvements in energy efficiency. —Stephen Nalley.

Let's personalize your content