Tesla’s cheapest Model 3 with the 2024 tax credit might surprise you

Teslarati

JANUARY 2, 2024

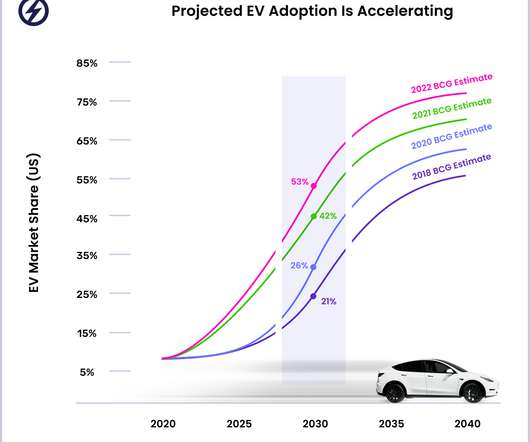

Treasury’s updated guidance on the federal electric vehicle (EV) tax credit has officially taken effect. With some of Tesla’s vehicles losing access to the credit in 2024, one Model 3 configuration is currently looking more appealing than ever. However, sightings of the Model 3 Highland in the U.S.

Let's personalize your content