Canada’s Budget 2022 calls for C$3.8B to launch Critical Minerals Strategy

Green Car Congress

APRIL 8, 2022

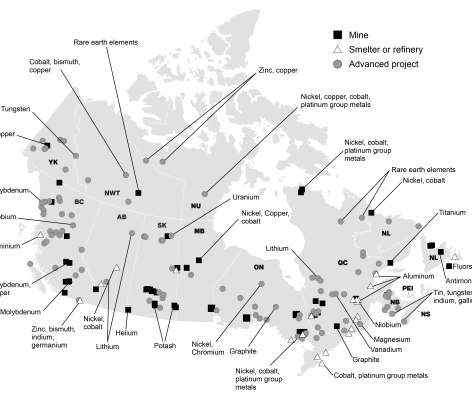

million over five years on a cash basis, starting in 2022-23, for Natural Resources Canada to provide public access to integrated data sets to inform critical mineral exploration and development; and. Canada’s list of critical minerals. Specific measures proposed in Budget 2022 to support critical mineral projects include: Up to $1.5

Let's personalize your content