President Biden calls on Congress, States for fuel tax holiday; increase in refinery capacity

Green Car Congress

JUNE 23, 2022

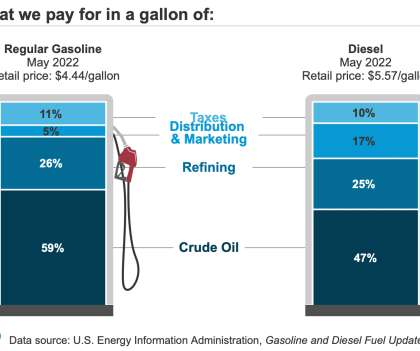

He also continued his calls for the oil industry to increase refinery capacity to increase production. An update was due 21 June, but EIA said that data product releases scheduled for this week—20 June 2022—will be delayed as a result of systems issues.) However, the cost of refining in other nations is currently higher.

Let's personalize your content