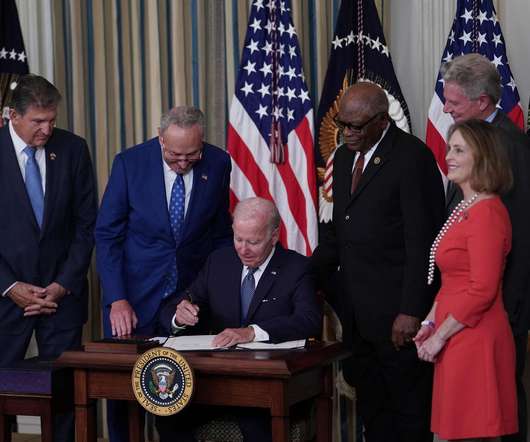

Biden Administration mulls over reprieve from EV tax credits for automakers

Teslarati

NOVEMBER 29, 2023

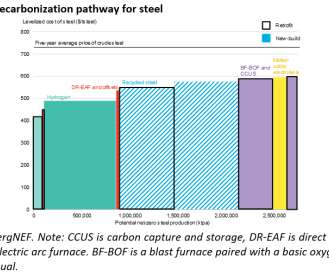

The reprieve would concern the eligibility of electric vehicles for the IRA’s tax incentives. One of the biggest concerns about the IRA’s requirements for EV tax credit eligibly regards battery packs, cells, and the materials used to manufacture them. The Teslarati team would appreciate hearing from you.

Let's personalize your content