Next 10-UC Berkeley study suggests additional tax revenue or income-based rate structure to make electricity more affordable for Californians

Green Car Congress

FEBRUARY 24, 2021

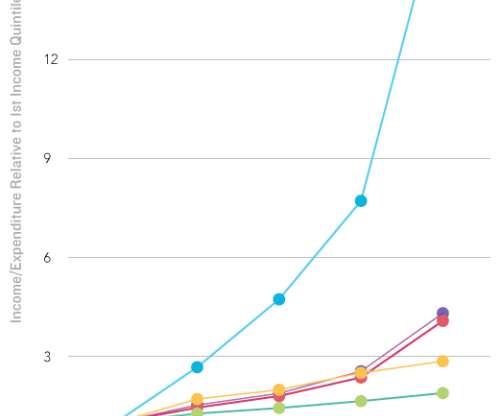

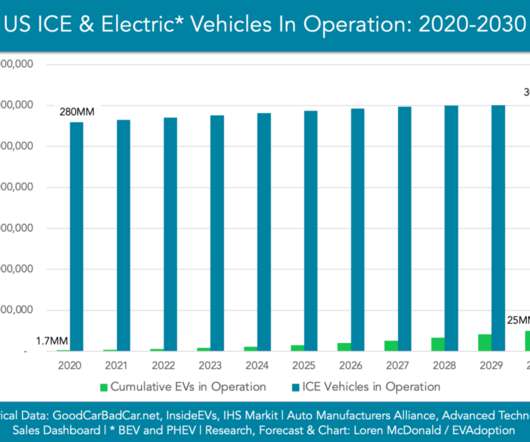

California’s current strategy of recovering a myriad of fixed costs in electricity usage rates must change as the state uses more renewable electricity to power buildings and vehicles, according to the findings from a new report from the Energy Institute at the UC Berkeley Haas School of Business and non-profit think tank Next 10.

Let's personalize your content