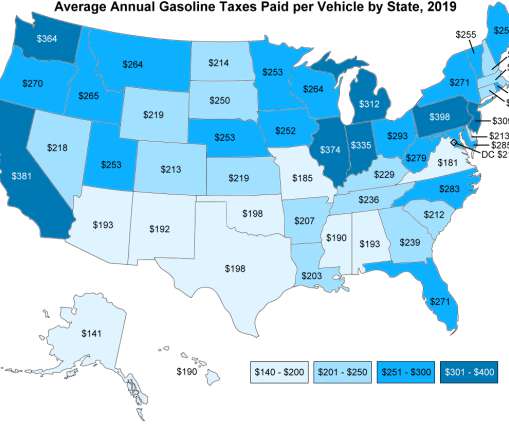

DOE: Average annual gasoline taxes paid per vehicle, by state, 2019

Green Car Congress

DECEMBER 3, 2019

Since taxes are charged on a per-gallon basis, someone with a more efficient vehicle will pay less in taxes over the course of a year. Based on average mpg and miles driven, a person owning a gasoline vehicle pays between $141 and $398 in fuel taxes each year, depending upon the state in which the fuel is purchased.

Let's personalize your content