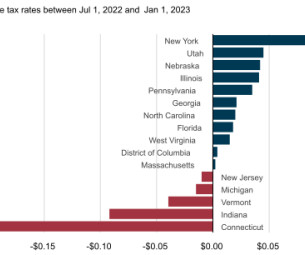

EIA: State tax rates for retail gasoline and diesel increased in 13 states in 2023

Green Car Congress

FEBRUARY 24, 2023

In January 2023, state taxes and fees on gasoline and diesel fuel averaged $0.3163 per gallon (gal) of gasoline and $0.3388/gal of diesel fuel, according to the US Energy Information Administration (EIA). These taxes have increased in 13 states since July 2022. These Superfund taxes include a $0.09

Let's personalize your content