T&E: Rising use of private jets sends CO2 emissions soaring

Green Car Congress

MAY 28, 2021

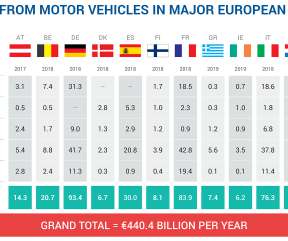

Despite the disproportionate climate impact, private jets are untaxed in most European nations because of exemptions from the EU’s carbon pricing scheme (EU ETS) and untaxed kerosene. T&E calculates that a jet fuel tax applied proportionately to flight distances could raise €325 million if applied to all flights departing from the EU and UK.

Let's personalize your content