What Businesses Should Know about Changes to the 30C Tax Credit

EV Connect

FEBRUARY 13, 2023

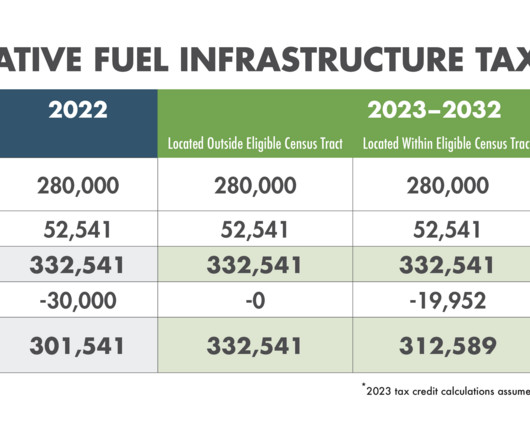

Since 2018, the gold standard of federal tax credits for EV chargers has been U.S. Code 30C , more commonly known as the "Alternative Fuel Infrastructure Tax Credit" or the “30C Tax Credit.” Formerly, the 30C tax credit gave businesses back 30% of eligible costs up to $30,000 per site.

Let's personalize your content