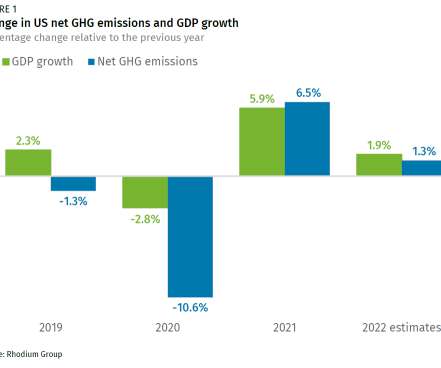

Rhodium Group estimates US GHG emissions rose 1.3% in 2022

Green Car Congress

JANUARY 11, 2023

Despite efforts to continue stimulating the US economy in the wake of the pandemic, high inflation put a damper on economic growth, which was exacerbated by a spike in oil prices as a result of Russia’s invasion of Ukraine. below 2005 levels. Consequently, the US economy grew 1.9% in 2022, down from a 5.7% GDP increase in 2021.

Let's personalize your content