US COVID-19 mitigation efforts resulting in significant decline in traffic, emissions and fuel-tax revenues

Green Car Congress

MAY 2, 2020

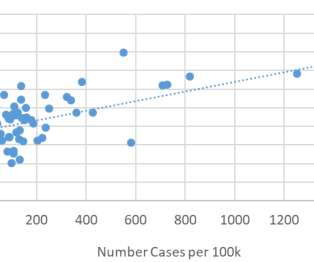

Nearby Washington DC saw the greatest drop of 90% fewer daily vehicle miles traveled. Fuel saved, tax revenue lost. Fuel use dropped from 4.6 Fuel use dropped from 4.6 It also resulted in fuel-tax revenue reductions, which vary by state. UC Davis Road Ecology Center). billion per week.

Let's personalize your content