81% of EVs Sold in 2023 Still Qualify for the Federal EV Tax Credit

EV Life

MAY 19, 2023

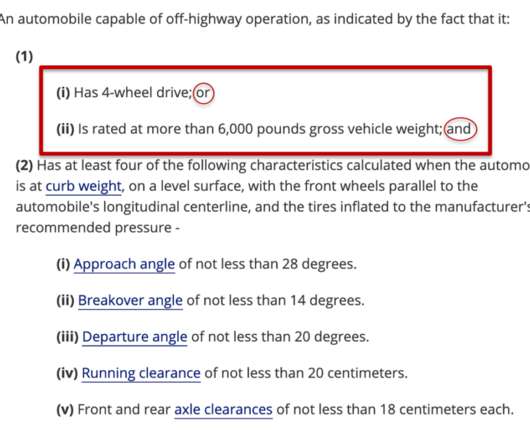

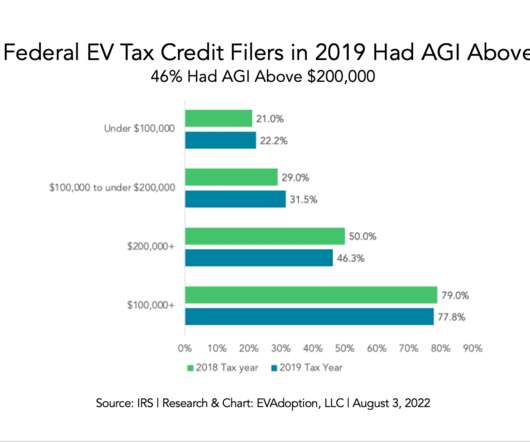

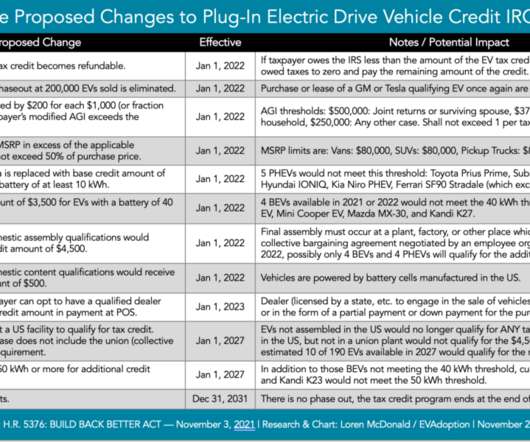

The Inflation Reduction Act of 2022 (IRA) introduced new guidelines for a federal EV tax credit aimed at helping qualified drivers purchase an electric vehicle. The tax credit is part of a broader plan to make 50% of new vehicles sold in the United States hybrids or plug-ins by 2030. dependence on China.

Let's personalize your content