Syrah Resources signs binding offtake agreement with Tesla for natural graphite active anode material

Green Car Congress

DECEMBER 24, 2021

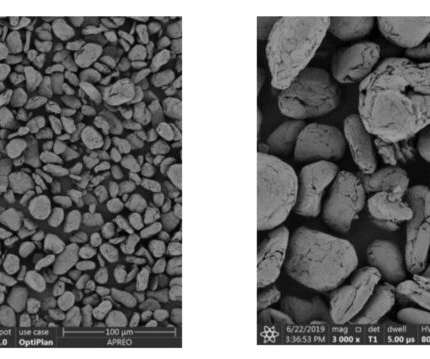

Tesla will offtake the majority of the proposed initial expansion of AAM production capacity at Vidalia at a fixed price for an initial term of four years commencing from the achievement of a commercial production rate, subject to final qualification. Balama mine operation in Mozambique. Vidalia battery anode material project site.

Let's personalize your content