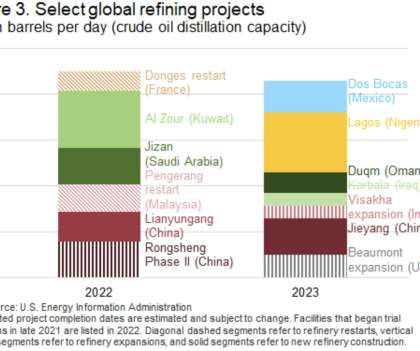

EIA: At least 9 new refinery projects to come online before end of 2023 in Asia and Middle East; 2.9 MMb/d

Green Car Congress

AUGUST 3, 2022

In the International Energy Agency’s (IEA) June 2022 Oil Market Report, the IEA expects net global refining capacity to expand by 1.0 More recently, the 615,000 b/d Al Zour refinery in Kuwait—the largest in the country when it becomes fully operational—began initial operations earlier this year. million b/d in 2023.

Let's personalize your content