EV Supply Chains May Be Dirtier Than You Think

The Truth About Cars

DECEMBER 27, 2023

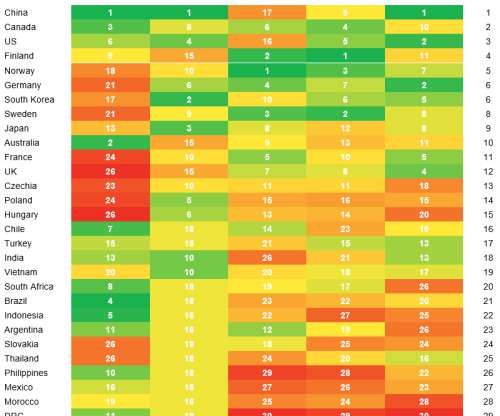

Materials like manganese mined in South Africa can have significant negative impacts on local communities and the people doing the mining. is working to expand its supply chain through legislation like the Inflation Reduction Act and other efforts. As The Washington Pos t points out, the U.S.

Let's personalize your content