Blazer EV pause, Mercedes EV updates, affordable EVs, clean hydrogen rules: The Week in Reverse

Baua Electric

DECEMBER 30, 2023

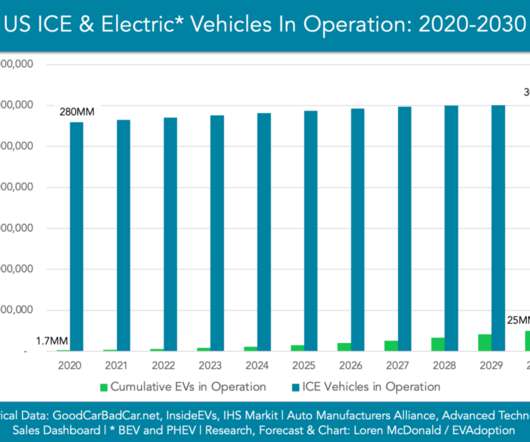

We rounded up all the affordable EVs that are arriving in 2024 and 2025 , and if automakers hold to their word—or at least their hints—it’s going to get better for those who don’t have a luxury budget. 2019 Tesla Model 3 And get ready for more confusion about the EV tax credit, beyond just the uncertainty about which vehicles are eligible.

Let's personalize your content