IEA: global electricity demand growing faster than renewables, driving strong increase in generation from coal

Green Car Congress

JULY 15, 2021

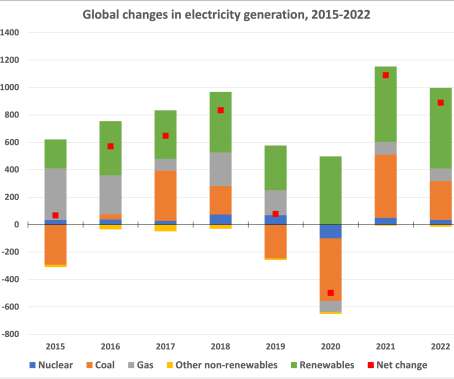

Renewables are expanding quickly but not enough to satisfy a strong rebound in global electricity demand this year, resulting in a sharp rise in the use of coal power that risks pushing carbon dioxide emissions from the electricity sector to record levels next year, according to a new report from the International Energy Agency.

Let's personalize your content