Tesla, VW and several other EVs that qualify for the new 2023 US EV tax credit

Teslarati

DECEMBER 29, 2022

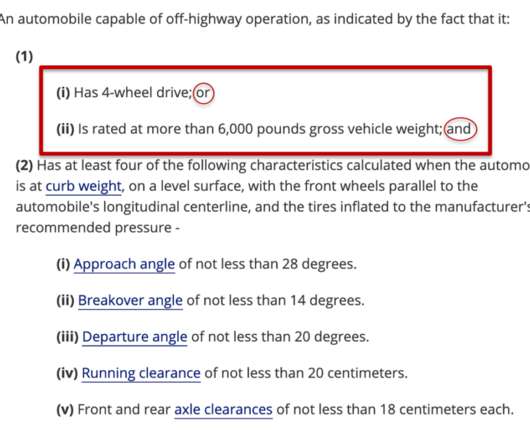

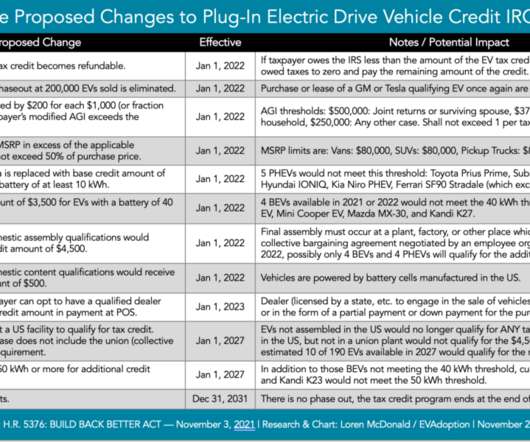

EV tax credit. The Internal Revenue Service (IRS) announced the vehicles that qualify for the 2023 EV tax credit. federal tax credit includes EVs made by fourteen manufacturers. The full list is as follows: 2023 Audi Q5 TFSI e Quattro (PHEV). 2022-2023 Ford Escape Plug-In Hybrid. 4 AWD Pro S.

Let's personalize your content