How New Eligibility Criteria for the Electric Vehicle Tax Credit Affects You

Blink Charging

DECEMBER 15, 2023

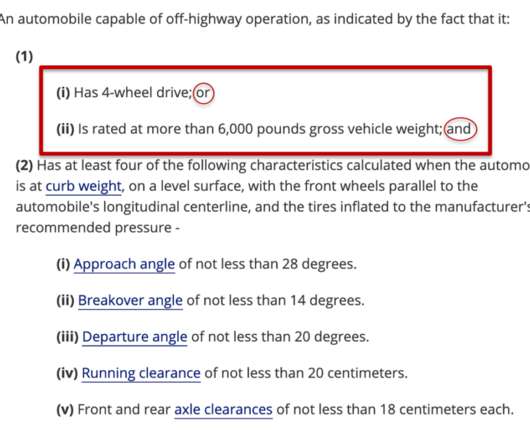

Opting for an electric vehicle and leveraging the EV tax credit to help with your next electric vehicle purchase is a smart move. This tax credit is applicable to qualifying clean vehicles placed into service within the current year, and it’s claimed in the year you take delivery. free-trade agreement partner country.

Let's personalize your content