In a coordinated push through federal agencies, the Biden administration on Friday released a revised set of regulations applying to the EV tax credit that will ultimately make the credit easier to claim for a wider range of vehicles in 2025 and 2026 but no easier for Chinese companies to gain a foothold on the market.

The news came in updated rules posted Friday by the U.S. Department of Energy (DOE), the Department of Transportation (DOT), and the Internal Revenue Service (IRS), each relating to their respective areas in defining and enforcing the credit rules as laid out by the 2022 Inflation Recovery Act.

More time to cut China out of EV supply chain

The good news for automakers, and especially for battery and related component plants in North America, is that after Friday’s clarifications they have two extra years to comply with much more stringent requirements on the origin of battery minerals.

EV tax credit requirements - 5/2024 revisions

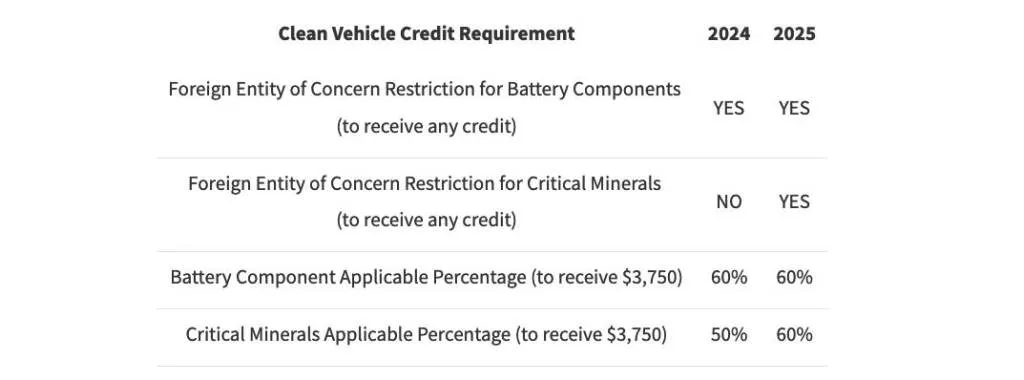

Under the original IRA framework, EVs won’t qualify for the full EV tax credit in 2024 without 60% of their battery parts originating in the U.S., and without at least 50% of their critical battery materials mined or processed in the U.S. or a favored trade partner such as Japan, South Korea, or the European Union.

Those requirements were set to become even stricter in 2025 with even tighter limitations on the origin of battery materials; vehicles with any source minerals from China or other designated Foreign Entities of Concern would be disqualified. But under Friday’s regulations, companies have until 2027 to comply, allowing automakers and supply companies to get more serious about how they track their supply chains between now and then.

2024 Kia EV9

“Today’s actions from Treasury and DOE provide clarity and certainty to an EV marketplace that’s rapidly growing,” said John Podesta, the senior advisor to the President for International Climate Policy, in a Biden administration summary statement. “The direction we’re headed is clear—toward a future where many more Americans drive an EV or a plug-in hybrid and where those vehicles are affordable and made here in America.”

Secretary of Treasury Janet Yellen, in a release on the final rules, also pointed out that in Tennessee, North Carolina, and Kentucky “how ecosystems have developed in communities nationwide to onshore the entire clean vehicle supply chain so the United States can lead in the field of green energy.”

EV tax credit requirements carry over

The Treasury Department and Internal Revenue Service clearly laid out which portions vehicle makers will need to comply with in 2025 versus 2024. At present, vehicles earn a maximum of $7,500 if assembled in North America, while half of that full amount relates to critical minerals and half of it relates to battery components.

The tax credit only applies to those with a modified adjusted gross income limitation of $300,000 for married couples filing jointly, $225,000 for head of household, and $150,000 for other filers, and the IRA tax-credit rules set price limits of $55,000 for new cars and $80,000 for new trucks, SUVs, and vans.

2024 Ford F-150 Lightning Flash

Existing rules have left a relatively small portion of vehicles that qualify for the full $7,500 credit amount. For 2024, the credit also became an instant rebate at the dealership, although not all dealerships have registered with the IRS to make that available.

The new rules revealed Friday also backstop the program with “integrity measures,” requiring an upfront review of compliance “to ensure that qualified manufacturers are accurately representing their battery contents” so taxpayers won’t be penalized if vehicles are found to be nonconforming.

The new rules include upfitters in the definition of a manufacturer—an especially important consideration for commercial vehicles aiming to claim the related 45W credit.

2025 Polestar 3

No easier for EVs from China

So-called Foreign Entity of Concern (FEOC) requirements written into the ruleset have been a serious concern for companies with partial or full Chinese ownership that aim to set up shop in North America for the EV supply chain or EV assembly.

Remarks within the revised rules place jurisdiction on the DOE for determining whether or not a company complies. According to the DOE, which also released refined rules on Foreign Entity of Concern restrictions, its 25% threshold on voting rights, equity interests, and board seats of a company seeking to claim the tax benefit would each be evaluated independently and qualified by the agency.

Given the present equity stake of China’s Geely in Polestar, that might render it disqualified for the full credit over the long term, even though it plans to assemble vehicles in the U.S. It would also mean that a host of Chinese suppliers that have already built plants in the U.S. for other aspects of the auto supply chain, seeking to get in on the EV supply chain, would not be eligible. So of all these agencies, the DOE may have the most significant, and globally political, role of all in following the money.