For several years, the automobile industry has grappled with a straightforward question: Is it possible to produce a powerful, efficient, and mass-producible synchronous motor that contains no rare-earth elements at all? A newly announced partnership between General Motors and the startup magnet company Niron Magnetics suggests a resounding “yes.”

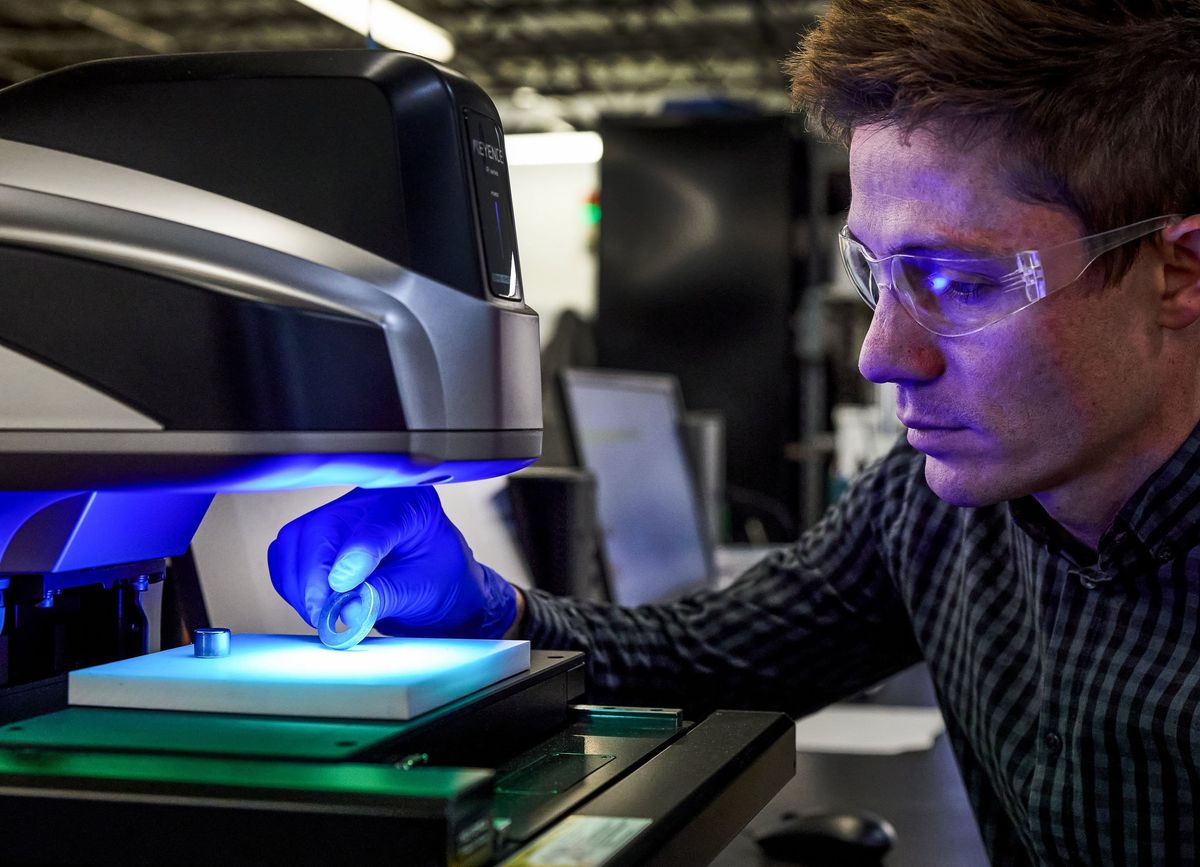

That was how the media reported it on 8 November, after GM Ventures, Stellantis Ventures, and several other investors disclosed a US $33 million infusion into Niron’s iron-nitride magnet. At the same time, GM and Niron announced that they had agreed to form a strategic partnership to codevelop rare-earth-free permanent magnets “that can be used in future GM EVs.”

However, many experts in magnetics are doubtful. They question whether it’s possible to mass-manufacture an economical magnet free of rare earths that is strong and tough enough for EV propulsion.

“There’s a compound there,” says Alexander Gabay, a researcher at the University of Delaware, referring to the iron nitride in the magnets being developed by Niron. But “it’s not intrinsically capable of making a good magnet. It’s that simple. This is well-known in the community.”

Automakers have spent enormous sums in recent years preparing for a transportation future dominated by electric vehicles. Part of that preparation has focused on rare-earth elements. For every 100 kilowatts of peak power, an EV motor uses an average of 1.2 kilograms of neodymium-iron-boron permanent magnets, according to Adamas Intelligence. And for automakers, there are two big problems associated with rare earths: Processing of the elements from ore has been a typically environmentally ruinous affair so far. And nearly 90 percent of processed rare earths come from China, which means a supply-chain dependence that spooks car companies in the United States, Japan, Europe, and Korea.

“Permanent-magnet design is a great opportunity for us to reduce our costs and environmental impact of our EV motors while also localizing our EV supply chain in North America,” said Kai Daniels, supervising principal at GM Ventures, at the November press conference announcing the partnership with Niron.

GM isn’t the only automaker on a hunt for rare-earth-free permanent magnets. Last March, Tesla’s director of power-train engineering caused a minor commotion by declaring that the company’s “next drive unit” included a permanent-magnet motor that would “not use any rare-earth elements at all.” But essentially all of the experts contacted by IEEE Spectrumdismissed the assertion as wishful thinking.

There are no simple principles of physics and chemistry that preclude the possibility of a powerful and durable permanent magnet that uses no rare-earth elements and whose magnetism survives at high temperatures. Indeed, such a magnet already exists—platinum cobalt (which often incorporates boron as well). However, the magnet is far too expensive for commercial use. It also requires cobalt, whose supply is so fraught that magnets incorporating the element make up a relatively small percentage of the permanent-magnet market.

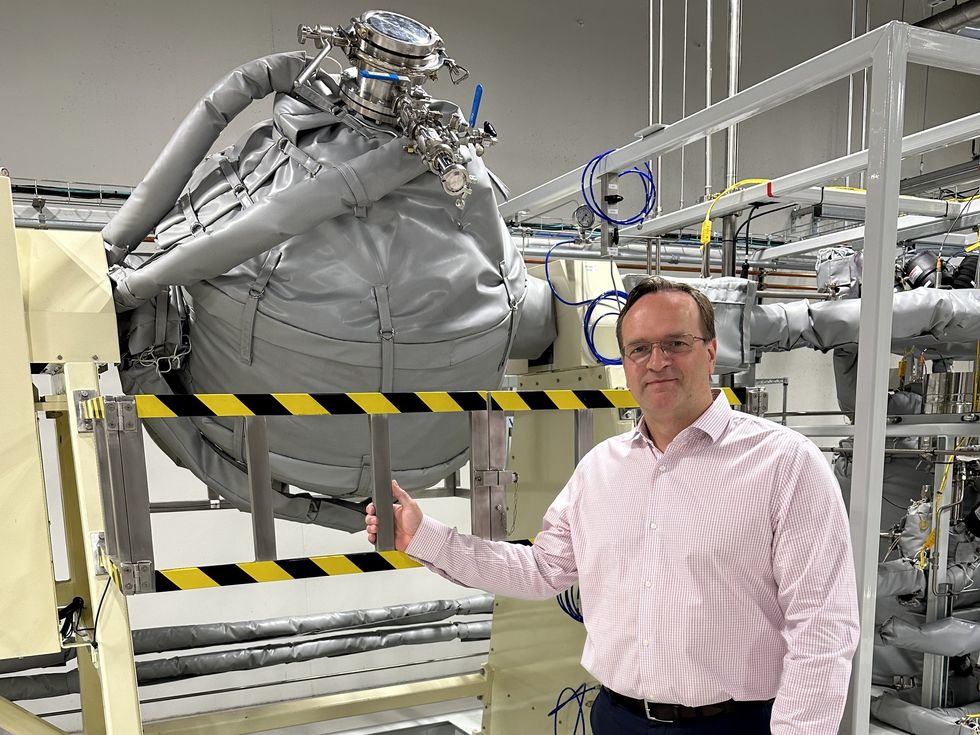

“I call it the perversity of nature,” jokes Matthew Kramer, Distinguished Scientist at Ames National Laboratory, in Iowa. “The more expensive it is, the more toxic it is, the better the materials that will come out of it.”

Any permanent magnet must have a ferromagnetic element, such as iron or cobalt. To understand why, start with the basics: Permanent magnetism occurs in certain crystalline materials when the spins of electrons of some of the atoms in the crystal are forced to point in the same direction. The more of these aligned spins, the stronger the magnetism. For this, the ideal atoms are ones that have unpaired electrons swarming around the nucleus in what are known as 3d orbitals. Iron has four unpaired 3d electrons, and cobalt, three.

But unpaired 3d electrons aren’t quite enough for a really strong and practical permanent magnet. To get superlative performance, you need to space those atoms out in the crystalline lattice with certain atoms containing unpaired 4f electrons. These particular atoms all belong to the group of rare-earth elements.

“There are very interesting underlying physics associated with the rare earths that the other transition metals just don’t have,” explains Kramer. “And that involves those inner, 4f, electrons. It gives you the ability to have atoms that can sort of push the other transition metals further apart. Because the trick to getting a really good ferromagnet is, you need to get a lot of spins—but those spins all need to be separated in just the right distances relative to which transition metal you’re looking at [iron or cobalt].”

The specific rare-earth elements are neodymium, praseodymium, samarium, and dysprosium. What that spacing does is provide a stable ferromagnetic structure in the crystal, which in turn promotes an inherent characteristic of the crystal called magnetic anisotropy. When the crystal of a magnetic material is relatively easy to magnetize along certain axes compared with others, the material is said to have strong magnetocrystalline anisotropy. This characteristic is essential for producing a good and useful permanent magnet, because without it the magnet cannot have what is known as high coercivity—the ability to resist demagnetization.

“Nature does not want the magnetization to be aligned in one direction; it wants it to break down into oppositely directed domains,” says Gabay. “That’s why you need strong anisotropy—to hold the magnetization in line,” he adds.

Magnetocrystalline anisotropy is the question mark hanging over Niron’s magnet, iron nitride. A practical measure of this type of anisotropy is its magnetic hardness, a “hard” material being defined as one that strongly resists demagnetization. In a 2016 paper, researchers at the University of Nebraska and Trinity College, Dublin, analyzed dozens of real and hypothetical permanent-magnet materials and came up with a parameter, κ, to compactly indicate this hardness. They asserted that “by drawing the line for magnetic hardness at κ = 1, the rule of thumb for possible success in compact permanent magnet development is that the material should be hard”—in other words, have a κ greater than 1.

The paper included a table of magnetic materials and their κ values. The standard permanent magnet used in EV motors, neodymium iron boron, has a κ of 1.54, according to this table. For iron nitride, the authors gave a κ value of 0.53. (Neodymium-iron-boron magnets, by the way, were invented in the early 1980s separately by two groups of researchers, one of which was at General Motors.)

If Niron has found a way around the apparent anisotropy problem of iron nitride, they would of course carefully guard such immensely valuable intellectual property. The global market for neodymium magnets is well in the billions of dollars per year and growing.

But Gabay isn’t buying it. “In our field, the major gathering is called the International Workshop on Rare-Earth and Future Permanent Magnets. [At the most recent one, in September] Niron had a presentation, where they were saying a lot of words, but they never showed any data. People asked them to show something, but they never showed anything.”

Asked about the anisotropy issue with iron nitride, Niron’s chief technical officer, Frank Johnson, responded in an email: “The first reaction of many in the magnetics community is to say that iron nitride can’t act as a drop-in replacement for rare-earth magnets in EV motors. They are, of course, absolutely correct. Iron nitride is a new magnetic material with its own balance of properties. Making the most of a new material requires design optimization…. Partnering with world class e-machine designers, including those at investors GM and Stellantis, is the link between breakthrough material properties and the next generation of rare-earth-free motors.”

At the November press conference, GM Ventures’ Daniels and two members of GM’s communications team declined to say when GM expected the iron-nitride magnets to be ready for use in a mass-market EV traction motor. But in an interview with Spectrum this past March, Niron’s executive vice president, Andy Blackburn, suggested that magnets suitable for use in EV motors could be available as soon as 2025.

- The Rare-Earth-Metal Bottleneck ›

- The Magnet That Made the Modern World ›

- What Is Tesla’s Mystery Magnet? ›

- The Coming Boom in Rare Earths - IEEE Spectrum ›

Glenn Zorpette is editorial director for content development at IEEE Spectrum. A Fellow of the IEEE, he holds a bachelor's degree in electrical engineering from Brown University.