Q&A with Jon Jacobs of Westwater Resources

Everyone in the EV industry is talking about the IRA and the BIL, two sets of federal regulations that include strong incentives for automakers to establish domestic supply chains for EV raw materials and components. Not everyone is happy about the requirements, and there are a number of issues that need to be considered as the new regulations are finalized. However, bringing mining and processing raw materials closer to the sites of vehicle production is necessary both for reasons of sustainability and national security.

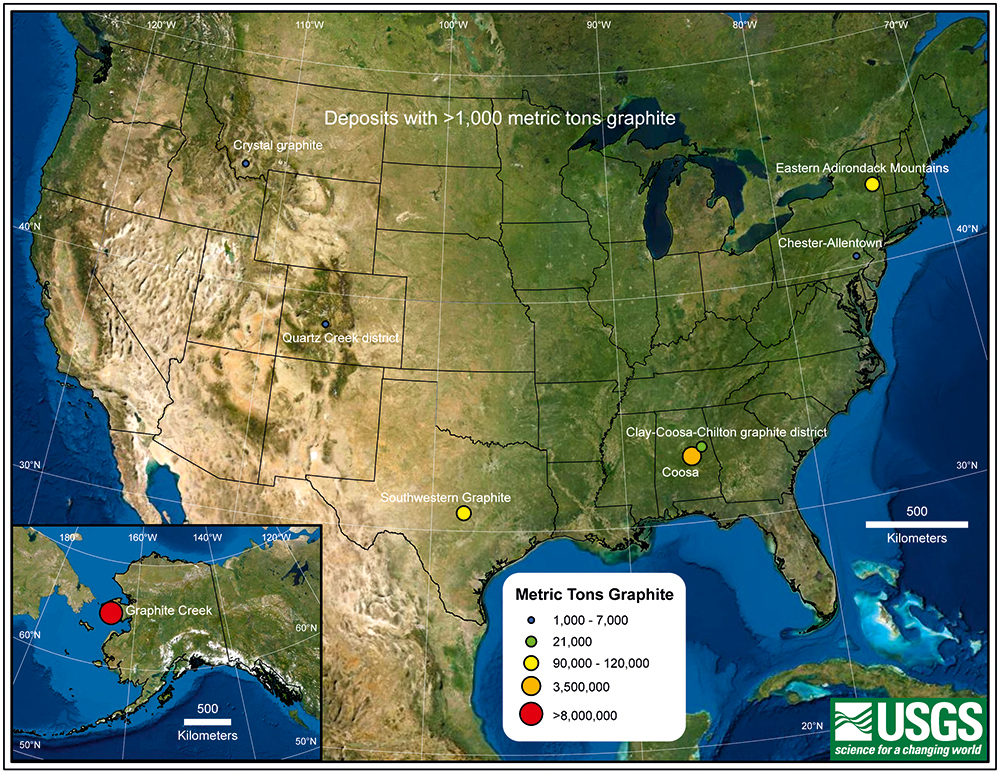

For certain key raw materials, much of the mining and almost all of the processing currently takes place in China, and in other countries that are geographically distant, have environmental or human rights issues, or all three. One of these materials is graphite, which is the main ingredient in EV battery anodes. The few companies that have access to graphite mines in North America are the belles of the EV ball at the moment. One of these is Westwater Resources, which controls what it says is the second-biggest graphite deposit in the US (the biggest is in a remote region of Alaska).

Westwater holds mineral rights to the Coosa graphite deposit, which is located across 42,000 acres in Alabama. The company is currently building a graphite processing plant in Kellyton, Alabama. The first phase of plant construction will produce 7,500 metric tons of refined graphite each year.

We first met Jon Jacobs back in 2013, when he was working at Wildcat Discovery Technologies, a battery research firm that developed an innovative process to rapidly synthesize and evaluate energy storage materials. Now Jacobs is Chief Commercial Officer at Westwater Resources, and he spoke to Charged about his company’s plans to start supplying graphite anode material in the heart of the Battery Belt.

Charged: Graphite’s a hot property these days. Tell us about Westwater’s plans.

Jon Jacobs: Westwater Resources is positioned to be the only vertically integrated natural graphite supplier in the United States. Prior to my joining Westwater, I was really naive about the importance of graphite and the fact that none of it is currently produced in the US. Much like lithium was ten years ago, graphite is a sleeping giant that is about to get a big awakening. The growing EV market and the IRA are now driving incredible demand for domestically produced graphite.

If you spend time in the battery industry, you’ll find most of the discussion is about new and promising next-generation materials like silicon anodes or lithium metal. Yet, these technologies still face major technical challenges. Meanwhile, in terms of material by weight, there’s more graphite in a battery than anything else. Today, over 75% of all the battery graphite comes from China. Unbelievably, none of it currently comes from the US.

Along comes the Inflation Reduction Act. It’s amazing what the IRA is driving in terms of new companies and investment. Take Westwater as an example. Westwater transitioned from mining uranium, of all things, to becoming a graphite anode producer—all because of these new trade rules.

Natural graphite from China sells for about $7 a kilogram, yet companies setting up factories in the US are willing to pay more than that to get graphite domestically if it meets the IRA requirements.

Fast forward to today and Westwater is building a graphite plant in Alabama, and people are eager to buy our capacity. How much more are people willing to pay to get US graphite compared to Chinese suppliers? Natural graphite from China sells for about $7 a kilogram, yet companies setting up factories in the US are willing to pay more than that to get graphite domestically if it meets the IRA requirements.

This is roughly how the math works: In 2023, 40% of the critical materials in your battery must be “produced” in the United States or one a few designated free-trade partner countries. “Produced” refers to the percentage of value added during production. By 2027, the critical material requirement will increase to 80%.

Now, if you look at just the materials half of the $7,500 tax credit, there’s $3,750 available, and graphite is on a short list of critical materials, along with lithium, cobalt, nickel and a few others. If you do the math and make some assumptions, it means $550-600 of the total tax credit is attributable just to graphite. For US cars with 80 kWh packs, cell makers should be willing to pay as much as $7 per kilogram more than non-IRA sources just to get anode material from the United States.

Of course, a material supplier like Westwater will need to share the IRA value with the cell maker, the OEM and the end customer, so the real premium will be lower. But without the IRA, it would be difficult for a US company to stand up a facility and compete with China. To be fair, China got most of its battery business off the ground due to government subsidies of its own.

There’s an additional factor to consider too. The IRA value won’t necessarily be the same at every cell maker, as it’s not a linear calculation. For example, if a cell maker purchases 45% of its battery materials from IRA sources but is still 5% short overall, the company might be willing to pay a lot more to get that final 5% because that determines whether it gets the entire credit or not.

Charged: Tell us about the processing plant Westwater is building in rural Alabama.

Jon Jacobs: The plant is under construction in east-central Alabama in a town called Kellyton, conveniently located in the growing US Battery Belt. Prior to Westwater, the only major employer in the area was Russell Athletic, a company that makes jerseys and sporting apparel. At one time, Russell employed over 7,000 people in this area. Over the years, however, Russell moved most of its jobs elsewhere, leaving this beautiful part of Alabama in a lurch. I’ve heard as many as half the residents in the affected area moved away. Fortunately, the battery industry and the IRA are about to change everything, along with some good fortune that one of the battery industry’s most important minerals just happens to exist in that same area. Westwater’s plant will likely employ many of the people nearby. Who knows, maybe we’ll ask Russell to make our uniforms! It’s a great US story—the government got it right with the IRA, and it’s already generating tangible effects.

Charged: You recently signed a joint development agreement with SK On, a South Korean battery manufacturer that’s operating two EV battery plants in Georgia, and is building several more in the Southeast.

Jon Jacobs: Yes, and we hope to strike similar JDAs with other cell makers too. Every cell maker, because they’ve been using graphite for 40 years, has their own proprietary twist. That’s what the JDA is about—SK will come into our plant and say, “Okay, for our material, we want you to do this extra thing.” Another cell maker might ask us to do a different extra thing. A JDA enables us to openly collaborate with our customers to produce the specific material they want.

Charged: There’s some controversy around the IRA in Washington. For some reason Joe Manchin’s mad about it, and he was threatening to vote to repeal it.

Jon Jacobs: The main thing I’m hearing is that the rules pertaining to Chinese company involvement aren’t totally clear. SK, LG and SDI announced joint ventures, and that they’re going to build plants in the US, and nobody has an issue with that. Meanwhile, a few Chinese companies want to build plants in the US, but the reply from different states is inconsistent. Some say, “No way—I’m not going to support you.” Other states, like Michigan, say, “Your money’s as good as anybody else’s, so you’re welcome here.” There may not be a consistent response here until the IRA language is fully vetted.

There was also a long-anticipated update to the IRA language on March 31. An added restriction was placed on things like nickel, cobalt, lithium and graphite, requiring the initial mining to occur outside of China regardless of how much value-added processing occurs later. If interpreted correctly, that’s an added game-changer for Westwater with our rights to the largest graphite deposit in the contiguous US.

Charged: Are there going to be enough of these materials that manufacturers can source from places that will meet the requirements?

Jon Jacobs: That’s tough to predict, but it’s not going to be easy. To put things in perspective, Westwater will produce 7,500 metric tons per year of natural graphite after our Phase 1 construction is complete. Just one of SK’s plants in Kentucky or Georgia or Tennessee would require roughly that amount of graphite. Although Westwater will increase capacity to over 40,000 MT/year in 2028, there aren’t a lot of other IRA-compliant options available. I believe global EV market growth requires that 6-8 new gigafactories be built every year for the foreseeable future. These plants are going to require a lot of battery materials from somewhere other than China.

Now, add to that the ratcheting factor of the IRA. In 2024, only 50% of the critical materials need to be IRA-compliant. This then increases 10% each year until it reaches 80% in 2027. We and others intend to boost our capacity over time, but it will require flawless execution to keep material supply in line with demand.

Charged: Is the post-processing the slow part, or is it actually digging it out of the ground or scraping it off the surface?

Jon Jacobs: Once graphite is extracted from the ground, it must be purified, which usually takes place at the mine location. This can all take a couple days, plus several months to ship it from remote locations around the world to wherever it will be processed. In our case, the resulting feedstock material will be conveniently trucked 30 minutes up the road to our Kellyton processing plant to be converted into battery-grade anode material.

The processing of the feedstock into finished anode material is well understood. The Chinese have been doing this for decades. Although our overall process is similar, we are using what we believe to be superior manufacturing equipment and more sustainable processes, without the use of harmful acids. The basic steps involve reduction of the graphite particle size, turning it into spheres, removing contaminants and coating the surface of the finished material. The overall processing steps also take a couple days. So to answer your question, the two general steps are similar in duration.

Charged: How much graphite, and what kinds, go into a cell?

Jon Jacobs: That’s a good question. In a 60 kWh EV battery pack, there’s roughly 50 kg of graphite. Graphite comes in two flavors. There’s natural graphite, which is what Westwater produces, and there’s artificial or synthetic graphite, which is made, ironically, from oil refining by-products. Most batteries today are produced using a blend of natural and artificial graphite. Overall usage of each type by volume varies from year to year, but it’s roughly 50/50.

The downside to artificial graphite is that it’s nearly double the cost of natural graphite, but companies use it because it can offer cycle life advantages. Like any industry though, cell makers are incentivized to use lower-cost materials. Therefore, companies are still finding ways to improve natural graphite, and momentum is arguably in its favor.

Charged: Is any of the synthetic graphite produced in the US?

Jon Jacobs: There are a few companies ramping up production now, including Novonix and Anovion.

Charged: So, all of your direct competitors will import the raw material from somewhere else?

Jon Jacobs: I suppose that’s true if you’re talking about natural graphite competitors within the US. This is why we view the Coosa deposit as a long-term competitive advantage. It reduces graphite feedstock supply risk with the potential to lower costs from vertical integration.

Charged: Are there no other deposits anywhere in the US where you could start a mine?

Jon Jacobs: There are small deposits in Texas, and I think there is a company that has one up in the Adirondacks. There’s one deposit larger than ours in Alaska, but it’s likely too expensive given its remote location.

The IRA is probably here to stay. It is clearly working to generate investment and jobs across the US.

Charged: The activity is so great now that I’m starting to think that pressure from the industry will prevent the politicians from reversing the IRA in the future. There’s so many ribbon-cuttings going on right now, especially in the Battery Belt in the southern states, which presumably would be the people who would overturn it if they get power in a few years.

Jon Jacobs: I agree the IRA is probably here to stay. It is clearly working to generate investment and jobs across the US. This should appeal to both political parties in a large number of states, so I don’t think it will go away.

Charged: The EU has to come up with some kind of response, right? Otherwise, everything will be made here and shipped to Europe.

Jon Jacobs: It’s funny—Europe started pumping money into battery infrastructure three or four years ago while the US was doing very little. The IRA has now put the US back into the spotlight. It wouldn’t surprise me if Europe sweetens its own legislation related to EV tax credits to compete with what’s happening here. If they don’t, most new material and cell production investment could go to the US.

That said, there’s a lot of production in the EU that’s not going to be stopped due to their head start. Plus, the global battery and EV markets will eventually be big enough to require local supply.

After 100+ years of auto production, you still see companies throughout the supply chain producing things in all the main regional markets around the world. The transition to EVs is unlikely to change that dynamic once the market matures. But in the near term, it feels like the gold rush!

This article appeared in Issue 64: April-June 2023 – Subscribe now.