With less than eight years for the United States to meet the

objective of a 50-percent reduction in greenhouse gas emissions, many environmental advocacy groups argue that an even faster transition to EVs is mandatory. For instance, the Rocky Mountain Institute (RMI) estimates that 1-in-4 light-duty vehicles, or about 70 million EVs, must be on US roads by 2030 to meet the GHG reduction target. The latest Edison Electric Institute projection is that only about 26.4 million EVs will likely be on the roads by then, although some others estimate the number could be as high as 35 million. However, that is still far short of RMI’s 70 million target.

To accelerate EV uptake, the Zero Emission Transportation Association, a lobbying group formed by Tesla, Lucid and Rivian along with some EV charging suppliers, asserts that sales of new internal combustion vehicles must be banned by 2030 and diesel trucks by 2035. Greenpeace, agrees, and argues that sales of all diesel and petrol vehicles, including hybrids must end by 2030. In addition, gasoline vehicles 15 years or older and diesel trucks over 10 years old should not be allowed on US roads, as is happening in some Indian cities.

The EV Transition Explained

This is one in a series of articles exploring the major technological and social challenges that must be addressed as we move from vehicles with internal-combustion engines to electric vehicles at scale. In reviewing each article, readers should bear in mind Nobel Prize–winning physicist Richard Feynman’s admonition: “For a successful technology, reality must take precedence over public relations, for Nature cannot be fooled.”

There is also a push to make those who own SUVs pay a steep annual registration fee to discourage their ownership, as is happening in Washington, D.C. Furthermore, there are demands that policies should be enacted to cease construction or upgrades of gasoline stations as is happening now in some California cities.

The 50 percent GHG emission reduction target by 2030 is indeed entirely possible according to a report from the Lawrence Livermore National Laboratory. This can be accomplished by building upon the above EV and ICE vehicle policy recommendations, coupled with 100 percent methane capture, retiring all coal-fired electric generation as well as converting the US electric grid with 80 percent clean energy by 2030. A coordinated effort by US policy makers is all that is preventing this happening, the report states.

Recommendations on how to complete the numerous global and domesticate systems engineering efforts across multiple industries required to carry out such policies in such a short time frame is conspicuously absent from LLNL’s report, however.

California dreaming

Even for California, the approach outlined above is an EV too far. California’s Air Resources Board (CARB) Chair Liane Randolph toldReuters that its 2035 EV mandate was the “sweet spot,” given “where the automakers are, where the supply chains are, and where the production vehicles are.” Not all CARB members are so confident, however, with some questioning whether the board had enough information to set such an aggressive mandate.

Even if California does meet its 2025 mark, more than 400 charging ports would still have to be installed every day to meet the 2030 objective.

One reason to be skeptical about the state’s ability to meet that mandate is that California’s EV infrastructure support is a bit fraught. For instance, California’s Energy Commission (CEC) projects the state will need 1.2 million public and shared EV charging ports at workplaces, multi-unit dwellings and other public spots by 2030. However, CEC Commissioner Patty Monahan admits the state, with 79,000 EV charging ports installed to date (up from 73,000 from 2021) is unlikely to meet its 2025 target of 250,000 charging ports. The number also assumes that most charging stations will be in good working order, something that EV drivers unhappily have not found.

Yet even if California does meet its 2025 mark, more than 400 charging ports would still have to be installed every day to meet the 2030 objective. It is uncertain whether given the rapidly rising demand for charging stations across the U.S. and elsewhere, enough can even be manufactured to meet California’s need in time.

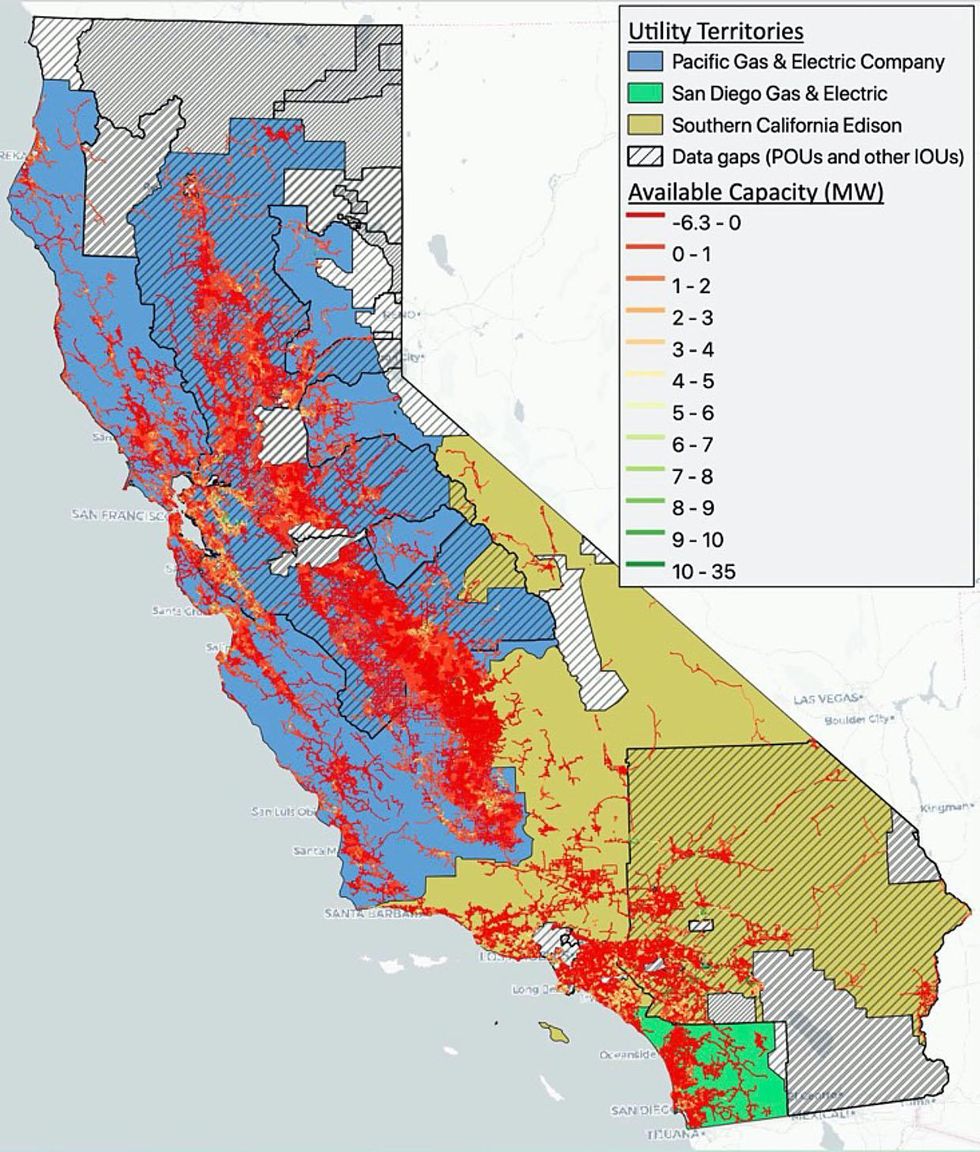

Further, the California Air Resources Board states in its environmental analysis of transitioning to EVs by 2035 that “special attention” and “investment in transformers, meters, breakers, wires, conduit, and associated civil engineering work will be necessary.” California’s electricity distribution grid, especially in the rural areas, the report states, will need to be upgraded to handle the increased electricity demand by up to 25 percent in the morning and 20 percent in the evening.

Red lines indicate areas where the grid cannot accommodate additional load without any thermal or voltage violations. Grey hatched areas indicate regions where gaps in utility grid data exist. Colored lines, keyed in the legend, indicate the available circuit capacity in megawatts.

Red lines indicate areas where the grid cannot accommodate additional load without any thermal or voltage violations. Grey hatched areas indicate regions where gaps in utility grid data exist. Colored lines, keyed in the legend, indicate the available circuit capacity in megawatts.California Air Resources Board

Included in the CARB environmental analysis is the California Electricity Commission’s electric capacity assessment map above depicting in “red lines where the grid cannot handle any additional loads because of thermal or voltage violations.” Gray hatched areas indicate regions where gaps in utility grid data exist (mostly in Publicly Owned and Investor Owned Utility service areas). Colored lines, keyed in the legend, indicate the available circuit capacity in megawatts.

Automakers divided

Automakers are also split over governmental EV policies in the U.S. and elsewhere. As mentioned, pure EV automakers and EV charging companies would like ICE vehicles to be banned by 2030 in the U.S., for obvious reasons. GM, too, is in favor of an accelerated EV mandate, believing this gives the automaker a commercial advantage over its rivals. GM wants the US Environmental Protection Administration (EPA) to make the Administration’s aspirational 50 percent EV sales goal by 2030 a national mandate instead.

However, automakers like Stellantis and Toyota are not enthralled with current EV mandates or the proposed outright bans of ICE vehicle sales. Stellantis CEO Carlos Tavares has been very vocal in saying the speed demanded for the transition to EVs by politicians is “beyond the limits” of what the auto industry can support, and worries it could end up being counterproductive.

Toyota President Akio Toyoda, who has been receiving strident criticism for not committing the company to an all-battery EV strategy, reportedly stated that meeting the California EV requirements will “realistically speaking … be difficult to achieve.” He also believes that BEVs will take longer to become the dominant everyday vehicle than “the mainstream media” touts. Toyoda also argues that only selling EV powertrains would not serve Toyota’s customers well in other countries, a similar argument made by automakers BMW, Mazda and VW.

One issue that all automakers can agree on is that the new US electric vehicle incentives need revision. For example, to receive the full $7,500 tax credit available, 40 percent of a battery’s critical minerals must be extracted from or processed in the United States or a US free-trade agreement partner, or be recycled in North America; 50 percent of the battery components must be manufactured or assembled in North America before 2024. Thereafter, the percentages go up by 10 percentage points each year. Additionally, there are also price caps on the EVs that are eligible,—$55,000 for autos and $80,000 for SUVs or vans. Further, once a particular EV model reaches 200,000 in US sales, the EV tax credit is phased out.

“I don’t think that you can transform the mineral production and extraction within the next two to three years. You cannot change the sources from Congo, China and other places within two to three years.” —Pablo Di Si

There are also income caps. Even if a US taxpayer buys an EV that meets the credit, but their tax liability is not at least $7,500 in the year they purchase the vehicle, they do not reap the full benefit. An individual using the standard tax deduction would have to earn around $70,000 to get the full federal tax benefit. So the value of the credit means little to the less well-off.

Automakers had previously agreed they could meet the Biden Administration’s 2030 EV sales objectives, providing there are substantial subsidies given to potential EV buyers. However, under the current incentive scheme, automakers say it will be nearly impossible to meet the content requirements. The Alliance for Automotive Innovation, which represents GM, VW and other major automakers warns the credit structure likely will “jeopardize our collective target of 40-50% electric vehicle sales by 2030.”

President and CEO of Volkswagen Group of America Pablo Di Si adds, “I don’t think that you can transform the mineral production and extraction within the next two to three years. You cannot change the sources from Congo, China and other places within two to three years.”

The automakers do have a point. Only about 20 EVs on the market today are currently eligible for the tax credits. The US Congressional Budget Office (CBO) further estimates only some 11,000 new EVs will be sold in 2023 that meet the component requirements. The CBO further states that only 237,000 incentive-meeting EVs will be sold between 2022-2026. Automakers were hoping to sell at least 6 million mostly subsidized EVs over that period.

GM’s CEO Mary Barra says she expects that its EVs will qualify for the full $7,500 tax credit within the next two to three years. If they do not, GM’s $50 billion in projected future revenue and healthy profit margins from EVs will be at risk. Ford, which has previously stated before the new content rules that it did not expect its EV business to be fully profitable until model year 2025, may also need to redo its profitability calculations. Rising EV battery prices do not help. It is undoubtedly one reason that Ford, along with other automakers, is lobbying fervently for a liberal interpretation of the EV content requirements.

Consumer subsidies, industry incentives or both?

However, not everyone is sympathetic to the automakers’ plight. Some believe, as US Senator Joe Manchin (D-WV) famously stated, corporate EV incentives are “ludicrous”: If EVs are so much better than ICE vehicles, and there are year-long waiting lists to buy them, why do automakers need incentives to sell them?

The multitude of arguments and counter arguments over EV subsidies and incentives, their focus, efficacy and fairness illustrate just a small part of the conflicts, uncertainty and politics involved in EV policy making.

Manchin, chief architect of the current consumer-oriented subsidy regime, has recently cautioned that he will not favorably look upon efforts to weaken the scheme, because, he reasons, it’s the best way for the US develop its own EV supply chain capability. However, the US Treasury Department has delayed its final ruling on which electric vehicles might qualify for subsidies for a few months, setting up a potential political firestorm in early 2023 if more are added than Manchin believes should be.

Other observers contend that EV incentives are misdirected or misplaced altogether. For instance, a National Bureau of Economic Research (NBER) study indicates past incentives seemed to cannibalize fuel-efficient vehicles, leading to over-estimating emissions benefits supposedly gained by EVs by almost 40 percent. A Massachusetts government-sponsored study of the effects of the more than $50 million of EV subsidies the state doled out found that they did not influence EV buyers—they would most likely have bought one anyway.

World Bank data indicate that funding EV charging station expansion is more cost-effective than EV purchasing subsidies to getting people into EVs. The UK has gone this route, stopping its decade-long EV subsidy program to improve EV charging across the country instead.

Still other EV advocates contend that some form of EV purchasing subsidies will be needed probably until 2050 but paid through “feebates” rather than by taxpayers. Taxpayers themselves, however, want immediate rebates at the conclusion of the sale, and not tax credits that they may not qualify for.

Perhaps, other EV advocates say, but whatever subsidies or rebates are provided, they need to be targeted to support the less affluent EV buyer and not reward the well-off, which Massachusetts is now trying to do with its subsidies.

There are also concerns of what happens to EV demand if subsidies are stopped. China, which originally planned to stop EV subsidies at the end of 2020, extended the program to the end of 2023 based on a drop-off in EV sales. The UK decision to end subsidies has not gone without complaint, either.

The ending of government EV subsidies altogether is applauded by other groups, because they “ distort the competitive landscape.” Still others believe that with EV-ICE parity by 2025 or 2026, they are no longer needed anyway. Volvo CEO Jim Rowan recently claimed that parity in that timeframe is entirely possible.

The multitude of arguments and counter arguments over EV subsidies and incentives, their focus, efficacy and fairness illustrate just a small part of the conflicts, uncertainty and politics involved in EV policy making. The conflicts get even more complicated and fraught when EV policies must be put into engineering practice.

In the next several articles of this series exploring transition to EVs at scale, the challenges to implementing EV policies will be explored.

- California's First-in-Nation Energy Storage Mandate ›

- The EV Transition Explained ›

- How Engineers Can Help Protect Earth From Worsening Climate Change ›

- The EV Transition Explained - IEEE Spectrum ›

Robert N. Charette is a Contributing Editor to IEEE Spectrum and an acknowledged international authority on information technology and systems risk management. A self-described “risk ecologist,” he is interested in the intersections of business, political, technological, and societal risks. Charette is an award-winning author of multiple books and numerous articles on the subjects of risk management, project and program management, innovation, and entrepreneurship. A Life Senior Member of the IEEE, Charette was a recipient of the IEEE Computer Society’s Golden Core Award in 2008.