Honda Speaks About Near Future, EV Plans

Honda has sent us a brief on its hopes and plans for the near future.

Not surprisingly, there's a fair amount of optimism and some gestures toward EV plans.

Of course, corporations are going to put their best foot forward in these types of media briefs, so you can take things with a grain of salt (or maybe Jimmy Buffett's lost shaker), but here are the highlights:

- As of the end of the 2023 fiscal year that ended on March 31, Honda has cut fixed costs by more than 10 percent since fiscal year 2019. The company also says its break-even point based on the percentage of production capacity being utilized is down about 10 percent, again since fiscal year 2019. Honda also says it's continuing to aim to reach a goal of a 7 percent return on sales by fiscal year 2026.

- Honda is touting increased relationships with semiconductor manufacturers, including Taiwan Semiconductor Manufacturing Company Limited.

- Like many OEMs, Honda has ambitious EV goals -- goals we've generally been skeptical about. In this case, Honda wants to be 100 percent EV and fuel-cell EV by 2040. To that end, the company is making vague promises about working on procuring and developing batteries, as well as procuring materials for battery-making from recyclers.

- Honda has plans for a mid- to large-size electric vehicle to debut for sale in North America in 2025, based on a dedicated platform. An EV based on the N-ONE will go on sale in Japan in 2025, with two small EVs following in 2026. One will be an SUV.

- The company has a focus on software and plans to double the number of hires already planned and will add an executive to be in charge of user experience.

- Finally, the company is sinking 100 billion yen into the research of "next-generation mobility." The company doesn't say what that is, but we suspect autonomous vehicles are involved somehow.

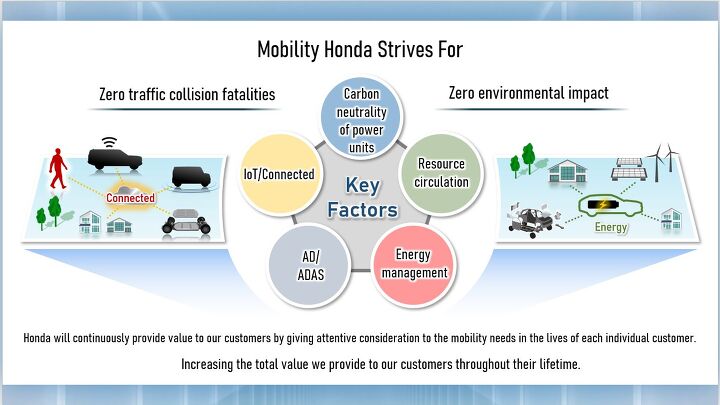

There's more. Honda is focusing on zero traffic collision fatalities and zero environmental impact, and it plans to aim to accomplish those goals via carbon neutrality, using vehicles as an energy source, circulating resources, automated driving and advanced driver-assist systems, and the connected Internet of things.

It's not just electric cars the company has set its sights on. Honda claims to be launching 10 electric motorcycles globally by 2025. The ultimate goal is electric motorcycle sales of 3.5 million units, or 15 percent of overall sales, by 2030. That includes the launch of the EM1e, an electric scooter with a swappable battery, in Indonesia, Europe, and Japan before the end of this year.

Swappable batteries aren't the only approach -- the company is researching other power sources for electric motorcycles.

Back to cars: Honda is going to launch the e:NS2 and e:NP2 EVs in China early next year, along with models based on the e:N SUV xu concept that will launch later in the year. Overall, the company is aiming for 10 new EVs in the Chinese market by 2027, with 100 percent electrification by 2035.

The North American market will see the Honda Prologue and Acura ZDX launch in 2024 next year, along with the aforementioned EV on a dedicated platform. Japan will also get a mini-EV based on the N-VAN for commercial use in the first half of next year.

Honda is planning to dive deeper into the charging business too, using the power supply provided by EVs. There will also be some sort of partnership with an existing company that does public charging so that Honda can better provide public charging options to its EV customers.

Honda is, as we know, working with GM on Ultium batteries for the North American market, and it's working with suppliers Contemporary Amperex Technology Co., Limited in China and Envision AESC in Japan.

That's for the short term -- Honda will work on creating semi-solid-state and all-solid-state batteries in-house further down the road. It's also going to work with GS Yuasa International on high-capacity, high-output liquid lithium-ion batteries. Honda is projecting that it will be bringing all-solid-state batteries to the market by the second half of this decade.

The company will work with SES AI Corporation on semi-solid-state batteries.

Honda is going to work with Hanwa Co., Ltd on procuring materials such as nickel, cobalt, and lithium. The recyclers Honda will work with for materials include Ascend Elements, Inc., Cirba Solutions, and POSCO Holdings, Inc.

EVs will be built right here in the States, with the Marysville and East Liberty plants in Ohio being retooled along with the Anna Engine plant, which is also in Ohio.

Speaking of plants, Honda claims that the Saitama plant in Japan will be carbon neutral by the end of fiscal year 2026. In addition to reducing carbon emissions from its plants, the company is going to use automation and artificial intelligence as part of its plans to both adjust to how the future workforce changes, and to be able to shift to building EVs quickly.

Finally, you might see a new Honda tagline -- "How We Move You" -- working with "Create, Transcend, Augment" and the current "Power of Dreams" slogan.

That's a lot, and I spent a lot of time translating corpo-speak while writing this post. We are skeptical of most automaker's timelines when it comes to full electrification, for a lot of reasons (tech developing slower than planned, infrastructure issues, some remaining demand for ICEs (maybe in limited applications like sports cars), an ever-shifting regulatory environment, and more). So we're skeptical here, too. That doesn't mean we're cynical --Honda and other automakers certainly could hit their targets -- just that it won't be easy.

That said, Honda has laid out its strategy for electrification and other key aspects of its business for the next few years. Your author won't predict here if the company will be successful or not, but the company does at least have a fairly clear road map forward.

[Image: Honda]

Become a TTAC insider. Get the latest news, features, TTAC takes, and everything else that gets to the truth about cars first by subscribing to our newsletter.

Tim Healey grew up around the auto-parts business and has always had a love for cars — his parents joke his first word was “‘Vette”. Despite this, he wanted to pursue a career in sports writing but he ended up falling semi-accidentally into the automotive-journalism industry, first at Consumer Guide Automotive and later at Web2Carz.com. He also worked as an industry analyst at Mintel Group and freelanced for About.com, CarFax, Vehix.com, High Gear Media, Torque News, FutureCar.com, Cars.com, among others, and of course Vertical Scope sites such as AutoGuide.com, Off-Road.com, and HybridCars.com. He’s an urbanite and as such, doesn’t need a daily driver, but if he had one, it would be compact, sporty, and have a manual transmission.

More by Tim Healey

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Jetcal 'there will be one-and two-blade variants"- What is the blade he's referring to? Is that another term for the rotor?

- Jalop1991 stick shift knowledge is important.But the simple fact is, kids today don't even want to drive. My son, now 25, didn't drive until he was...18? something like that. Was NOT interested. But then he found a girl...And even if the car is for the teen to use for school and related activities, it should be fuel efficient--because the parent is paying the gas for that.

- MKizzy My humble opinion.When it comes to waiting to go big on BEVs, Toyota has little to worry about as long as it remains attuned to the needs of the markets where it does business and can quickly pivot to compete once the next generation of BEVs with improved battery and charging tech is ready for prime time. Toyota has enough of a loyal customer base who would happily wait on them and snap up as many Toyota/Lexus BEVs as they can build. It's main threat is competition-based and whether another automaker can build a full lineup of high quality, uncomplicated, and reliable BEVs to entice and hang on to them.Mazda is a niche automaker that is counting on continuing to differentiate itself via its blend of near-luxury performance and is hopeful regulatory environments remain accepting of ICE to PHEV variants to maintain its uniqueness. Else I don't see how Mazda can differentiate itself enough to survive in a world of 300+ hp BEVs with cookie cutter performance and giant fancy touchscreens. Subaru is in the worst position, at least in the U.S.. It's customer base is more likely to be progressive and solely interested in BEVs and Subie has nothing substantial to offer them. I can see Kia, and perhaps Rivian as their biggest threats if their future smaller/cheaper offerings are a hit. Also, in a market filled with AWD Crossovers, the only unique characteristics Subaru can hang its hat on is its weirdly bland styling and somewhat affordable pricing versus competitors.

- Henry It's pretty clear that Toyota's hybrid strategy is paying off handsomely. They sell every one they make, maintain pricing discipline, and avoided over-investing in EV technology when the market and the infrastructure were clearly not ready.

- Ollicat something practical - since your teen SHOULD pay their own gas. I would think a used Jetta or Civic

Comments

Join the conversation

So all Hondas will be completely soulless lumps by 2040, just like the new “Accord.”

Got it!

Too little. Too late.