Rivian emailed customers about the Internal Revenue Service’s (IRS) recently released guidance regarding the EV tax credits under the Inflation Reduction Act (IRA) of 2022.

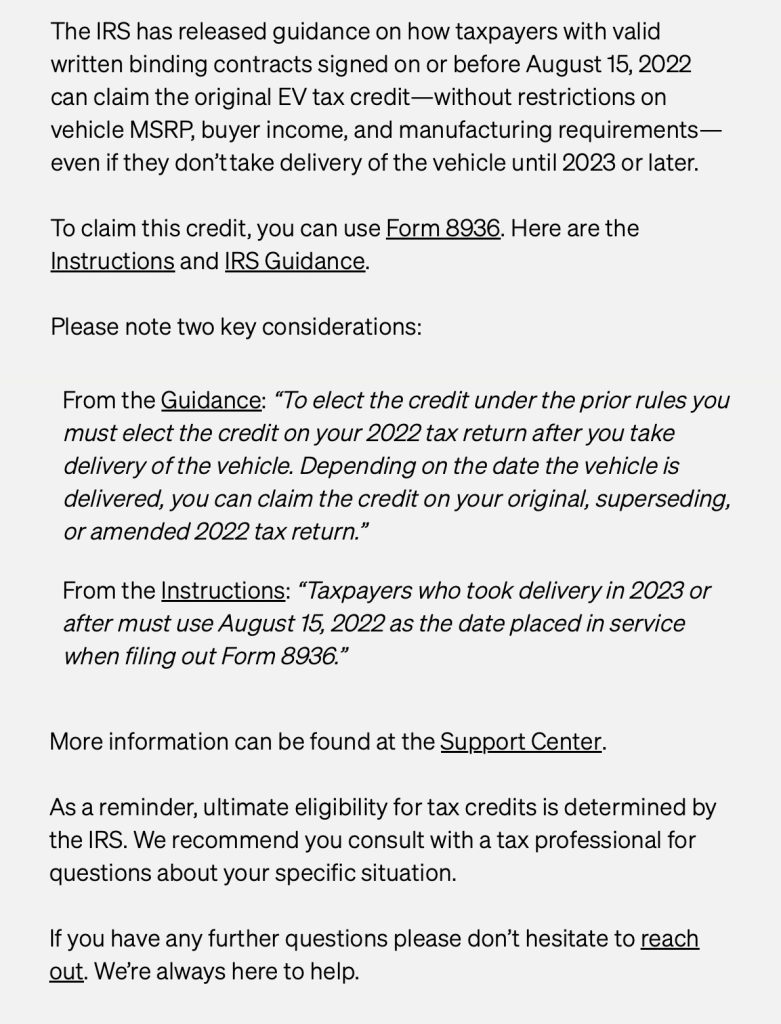

“The IRS has released guidance on how taxpayers with valid written binding contracts signed on or before August 15, 2022 can claim the original EV tax credit—without restrictions on vehicle MSRP, buyer income, and manufacturing requirements—even if they don’t take delivery of the vehicle until 2023 or later,” said Rivian’s emails to customers.

Foley & Lardner LLP explained the latest IRS guidance regarding EV tax credits. The guidance provided details on changes in the Inflation Reduction Act’s Plug-In Electric Drive Vehicle Credit (EV Credits) section.

As per the IRS’s imposed changes, to qualify for EV tax credits, vehicles placed in service after December 31, 2022 and before January 1, 2033, must undergo “final assembly” in North America—including the United States, Canada, and Mexico.

Below are the other qualifications an electric vehicle must meet to be eligible for the EV credit. These qualifications applied as of January 1, 2023.

- The original use of the motor vehicle must commence with the taxpayer.

- The motor vehicle must be acquired for use or lease by the taxpayer and not for resale.

- The motor vehicle must be made by a “qualified manufacturer.”

- The motor vehicle must be treated as a motor vehicle for purposes of Title II of the Clean Air Act.

- The motor vehicle must have a gross vehicle weight rating of less than 14,000 pounds.

- The motor vehicle must be propelled to a significant extent by an electric motor that draws electricity from a battery that has a capacity of not less than 7 kilowatt hours and is capable of being recharged from an external source of electricity.

- The final assembly of the motor vehicle must occur within North America, which for this purpose means the United States, Canada, and Mexico.

- The person who sells any vehicle to the taxpayer must furnish a report to the taxpayer and to the Secretary of the Treasury, including the following information:

- The name and taxpayer identification number of the taxpayer;

- The VIN of the vehicle;

- The battery capacity of the vehicle;

- Verification that original use of the vehicle commences with the taxpayer;

- The maximum credit under Section 30D of the Code allowable to a taxpayer with respect to the vehicle; and

- In the case of a taxpayer who makes an election to transfer the credit to an eligible entity under Section 30D(g)(1) of the Code, any amount described in Section 30D(g)(2)(C) of the Code that has been provided to such taxpayer.

Electric vehicle customers qualify for up to $7,500 in tax credits if their purchase meets the abovementioned requirements. EV customers must also meet specific requirements to be eligible for EV tax credits under the IRA of 2022, listed below.

- Single taxpayers cannot have a modified adjusted gross income of more than $150,000.

- Couples filing jointly can not have a modified adjusted gross income of more than $300,000

- Only electric SUVs, vans, and pickup trucks less than MSRP $80,000 qualify for the tax credit.

- Only sedans and other EV types—not mentioned in requirement #3—with less than MSRP $55,000 qualify for the tax credit

To claim EV tax credits under the IRA of 2022, fill out Form 8936.

The Teslarati team would appreciate hearing from you. If you have any tips, contact me at maria@teslarati.com or via Twitter @Writer_01001101.