The Internal Revenue Service (IRS) is inviting consumers to share comments on the electric vehicle tax credit qualifications. Tesla and electric vehicle supporters have been vocal about the Inflation Reduction Act’s qualified cars for the EV incentive. Some variants of the Tesla Model Y and the Ford Mustang Mach-E will not receive any incentives from the IRA at all, yet some vehicles that use fossil fuels will. Those vehicles are classified as electric vehicles because they are plug-in hybrid EVs.

Messed up!

— Elon Musk (@elonmusk) January 3, 2023

The IRS gives specific instructions on how to submit the comments. Comments can be submitted by mail or email. For those submitting by email, you need to include OMB Control No. 1545-2137 in the subject line and send it to pra.comments@irs.gov.

For those wanting to mail in comments, comments should be addressed to Andres Garcia, Internal Revenue Service, Room 6526, 1111 Constitution Avenue NW, Washington, DC 20224.

Teslarati reached out to Garcia and the IRS for a comment. We’ll update you if/when we receive one.

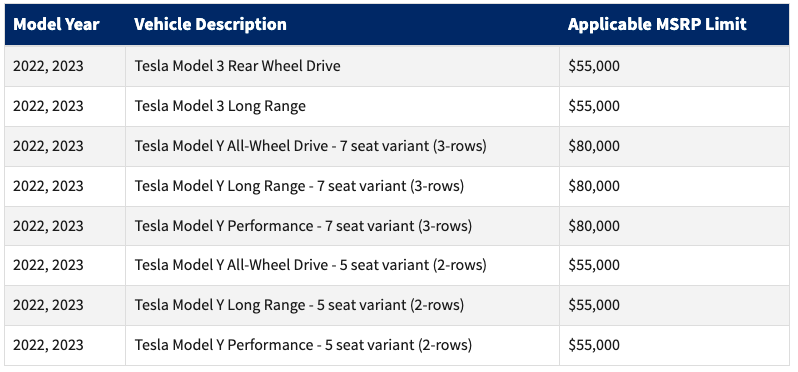

In December, the IRS announced the vehicles that qualified for the 2023 EV tax credit. Some of these vehicles include plug-in hybrid EVs that use gas and batteries. Although there were several Tesla Model Ys on the list, the only ones that qualified as an SUV with an $80,000 MSRP limit were the seven-seat varieties.

The Model Y all-wheel drive, long-range, and performance five-seat variants do not qualify for the tax rebate because their MSRP exceeds the IRS $55,000 threshold. The graph below shows which Tesla vehicles qualify for the EV tax credit.

Farzad Mesbahi, who pointed out this fact and received a response from Elon Musk, launched a petition titled, Fix the Inflation Reduction Act EV Tax Credit. At the time of this article, the petition has 19,525 signatures. The petition pointed out that the IRS isn’t categorizing the Tesla Model Y as an SUV even though the Environmental Protection Agency does

“This means Tesla Model Y, a pure EV with a 330-mile range, 117 MPGe (very efficient), and SUV form factor is not eligible for the $7,500 tax credit.”

Disclosure: Johnna is a $TSLA shareholder and believes in Tesla’s mission.

Your feedback is welcome. If you have any comments or concerns or see a typo, you can email me at johnna@teslarati.com. You can also reach me on Twitter at @JohnnaCrider1.

Teslarati is now on TikTok. Follow us for interactive news & more. Teslarati is now on TikTok. Follow us for interactive news & more. You can also follow Teslarati on LinkedIn, Twitter, Instagram, and Facebook.