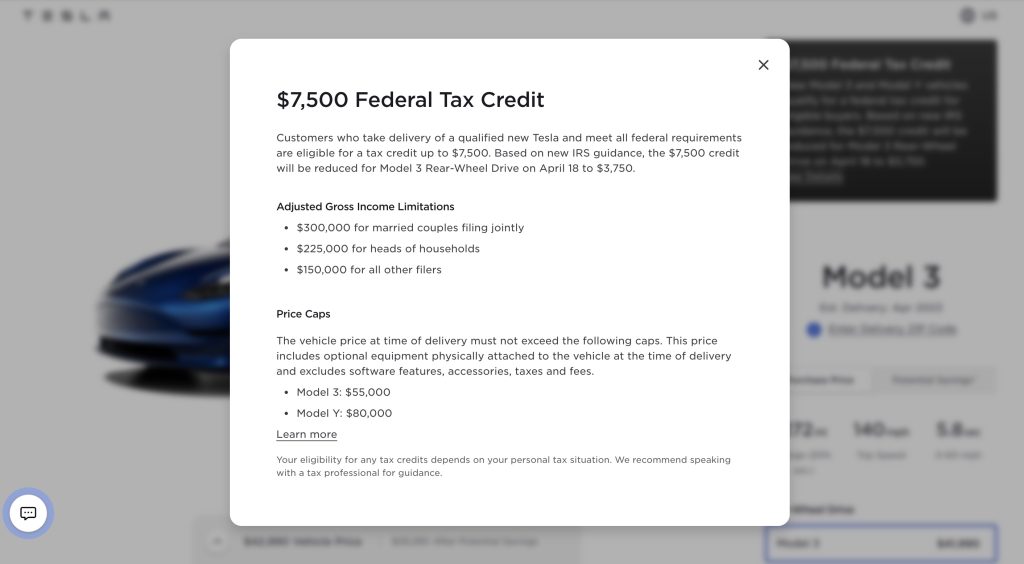

The Tesla Model 3 RWD, the most affordable vehicle in the company’s lineup, will see its federal tax credit reduced from $7,500 to $3,750, as confirmed by an update on Tesla’s official Model 3 page. The reduction in the federal tax credit for the Model 3 RWD will take effect on April 18.

Last month, reports emerged that the base Model 3 would lose its $7,500 federal tax credit, and this was followed up by a notice on the all-electric sedan’s order page. At the time, the remaining federal tax credit for the Model 3 RWD was not listed by the electric vehicle maker at all. Tesla’s recent update effectively confirms that the Model 3 RWD is still eligible to receive a $3,750 federal tax credit.

Customers who purchase more expensive variants of the Model 3, such as the Model 3 Performance, will still be eligible for the full $7,500 tax credit. With this in mind, the Model 3’s updated federal tax credit structure could then serve as an incentive for potential buyers to consider purchasing higher-end variants of the all-electric sedan.

The Tesla Model 3 RWD’s battery pack, produced and assembled in China, falls short of the qualifications required for the IRS’s $7,500 EV tax credits. According to the US Treasury’s battery guidance, a minimum of 50% of EV battery components must be produced and assembled within the United States or in a country with a free trade agreement. This requirement is met by the battery pack of the Model 3 Performance, which is produced at Giga Nevada.

Due to the Model 3 RWD’s battery pack utilizing CATL’s LFP cells sourced from China, it does not meet the eligibility criteria under the current battery sourcing guidance. The upcoming battery guidance stipulates that at least 40% of the minerals used in an EV’s battery must be obtained from the United States or a country that has a free trade agreement with the US.

It is important for Tesla customers to be aware of the adjusted gross income limitations for claiming the electric vehicle tax credit. These limitations are as follows: $300,000 for married couples filing jointly, $225,000 for heads of households, and $150,000 for all other filers.

Don’t hesitate to contact us with news tips. Just send a message to simon@teslarati.com to give us a heads up.