The charge of the utility vehicle (UV) battalion continued in CY2023 in the booming Indian passenger vehicle (PV) market and how. As per the data released by apex industry body SIAM on January 12, 2024, total sales of UVs (SUVs and MPVs) last year were 23,53,605 units, clocking handsome 22% growth (CY2022: 19,22,805 UVs).

While UV sales have crossed the 2-million-units milestone for the first time in a calendar year, it also means that the UV share of PVs in CY2023 has jumped to 57% of the 4.10 million (41,01,600 units) PVs sold. This is a strong 7 percentage-point increase over the 50% that UVs contributed to PV sales in CY2022.

The Top 10 models account for 13,55,656 units or 33% of total UV sales in CY2023, indicating their dominant market positions and popularity.

A number-crunching exercise of the estimated wholesale numbers of the top-selling 25 UVs in India reveals aplenty. While these 25 best-selling models cumulatively add up to 21,49,844 units or 52% of total UV sales last year, the Top 10 models have each sold in excess of 100,000 units (and the Top 4 over 150,000 units each). These Top 10 models account for 13,55,656 units or 33% of total UV sales last year, indicating their dominant market positions and popularity amongst consumers.

In terms of body style, the shift in consumer demand for larger UVs is apparent in the Top 25 table – the popular compact SUV segment, which has topped the charts for a number of years, now finds stiff competition from the midsize SUV segment – in CY2023, both segments have 11 models each, along with three MPVs (Maruti Ertiga, Toyota Innova Crysta / Hycross, Kia Carens). While the 11 compact SUVs lead in terms of overall numbers (10,98,867 units), the 11 midsize SUVs (768,491 units) reflects their growing demand. The three MPVs accounted for 282,038 units.

Maruti and Mahindra battle it out with 5 models each in Top 25

In terms of OEM share of the Top 25, Maruti Suzuki (Brezza, Ertiga, Grand Vitara, Fronx, XL6) and Mahindra & Mahindra (Scorpio, Bolero, XUV700, Thar, XUV 300) have five models each. They are followed by Tata Motor (Nexon, Punch, Harrier), Toyota Kirloskar Motor (Innova/Hycross, Urban Cruiser Hyryder, Fortuner), Hyundai (Creta, Venue, Exter) and Kia (Seltos, Sonet, Carens) with three models each. MG (Hector), Skoda (Kushaq) and Nissan (Magnite) wrap up the Top 25 UV table with one model each.

However, when it comes to pure numbers from an OEM perspective within the Top 25 models, Maruti Suzuki India leads the table (as under), given that it has a UV market-leading position and a 25% share.

Maruti Suzuki (546,950 units)

Mahindra & Mahindra (423,103 units)

Tata Motors (344,140 units)

Hyundai Motor India (333,602 units)

Kia India (252,667 units)

Toyota Kirloskar Motor (161,918 units)

MG Motor India (31,009 units)

Skoda India (25,931 units)

Nissan India (30,074 units)

Maruti Suzuki has 5 models in the Top 25 – Brezza (170,588 units), Ertiga (129,968 units), Grand Vitara (113,387 units), Fronx (94,393 units), XL6 (38,614 units). And the Brezza has become the new SUV leader in India.

Maruti Brezza wrests SUV crown from Tata Nexon, wins by 276 units

There is an upset at the top of the UV best-sellers table – the Maruti Brezza has gone ahead of the Tata Nexon – India’s best-selling UV and SUV in CY2022 and CY2021 – with sales of 170,588 units, just 276 units more than the Nexon’s 170,312 units. A strong sales trajectory throughout CY2023 means the Brezza’s CY2023 sales jumped 30.65% over CY2022’s 130,563 units and its ranking also jumps from fourth to No. 1.

Averaging monthly sales of 14,215 units in CY2023, the popular Maruti Brezza built on the momentum it has sustained since its launch in March 2016. In fact, in early December 2023, the compact SUV surpassed the million-sales milestone. What has helped accelerate sales is the launch of the new CNG variant, which has possibly helped the Brezza nose ahead of the Tata Nexon and become India’s new SUV leader.

A resurgent Maruti Suzuki India, which has benefitted hugely with the launch of new SUVs like the Grand Vitara, Fronx and the Jimny, has expanded its UV market share to over 25% in CY2023. In fact, the company has five models in the Top 25 – the Brezza (170,588 units), Ertiga (129,968 units), Grand Vitara (113,387 units). The Fronx is ranked 11th (94,393 units), while the XL6 (38,614 units) is No. 20 and the Jimny No. 31 (16,206 units). The new Invicto MPV sold 3,389 units in the seven months since launch.

Scorpio (121,420 units) leads M&M’s charge, followed by the Bolero (108,319 units), XUV700 (74,434 units), Thar (61,748 units), XUV300 (57,182 units).

SUVs power Mahindra’s CY2023 sales to a record high

Mahindra & Mahindra matches UV leader Maruti Suzuki when it comes to the models in the Top 25 list: five. The company, which has eight SUVs (Bolero, Bolero Neo, Scorpio, Scorpio N, Scorpio Classic, Thar, XUV300, all-electric XUV400 and XUV700) and a sole sedan (eVerito), is making the most of the surging wave of demand for UVs amidst an ultra-competitive market.

In CY2023, M&M registered total wholesales of 433,172 units, which is 98,084 units more than it sold in CY2022 (335,088 units), to record robust 29% YoY growth. Of this total, UVs are estimated to have sold 433,001 units.

Leading the charge is the Scorpio with 121,420 units, followed by the sturdy workhorse Bolero (108,319 units), flagship XUV700 (74,434 units), Thar (61,748 units), and the XUV300 (57,182 units). The all-electric XUV400 saw sales of 8,489 units and the Marazzo MPV 1,409 units.

While the Scorpio (ranked 7th) and the Bolero (ranked 9th) are in the Top 10, the XUV700 is ranked 14th, followed closely by the Thar (ranked 16th) and the XUV300 (ranked 17th).

Given the massive number of bookings the company has for many of its high-selling SUVs like the XUV700, Thar, Scorpio N and Classic and the XUV300, expect M&M to clock sales in the region of 450,000 units or more in FY2024.

Meanwhile, in an effort to cater to the surging consumer demand, M&M, which had expanded its SUV manufacturing capacity from 29,000 units per month to 39,000 units in December 2022, is implementing plans to further increase output to up to 49,000 units in the current financial year or 600,000 units per annum.

The Nexon (170,312 units), Punch (150,182 units) and the Harrier (23,646 units) are the three Tata Motors’ models in the Top 25 list.

Nexon accounts for 47% of Tata Motors’ UV sales, Punch 41%

The Nexon, now ranked No. 2 in the UV chart, remains Tata Motors’ best-selling vehicle – in CY2023, which saw the company record its best-ever PV sales of 550,838 units, up 45% YoY, the Nexon accounted for 170,312 units or 31% of total sales. Tata Motors is estimated to have sold 362,654 UVs in CY2023. This means the Nexon accounted for 47% of Tata’s UV sales, followed by the Punch (150,182 units) which has a 41% share.

The company, which retails seven PVs – Altroz, Tigor, Tiago, Nexon, Punch, Harrier and the Safari – in the domestic market, has capitalised on surging demand for its SUVs, particularly the Nexon and the Punch compact SUVs. What also helps the company is that Tata Motors’ UV portfolio covers petrol, diesel, CNG and electric powerplants, thereby expanding its consumer reach.

What has also helped Nexon sales is its first-mover advantage in the fast-growing electric vehicle market. The new Nexon EV was launched a few months ago and has recently been joined by the Punch EV. Furthermore, Tata also benefits from a multi-fuel strategy given that the Nexon is available with petrol, diesel and electric power, and the Punch has petrol, CNG and more recently electric powertrains.

Creta (157,311 units) remains Hyundai’s best-seller and third best-selling UV in India. While the Venue (129,276 units), the new Exter sold 47,015 units.

Hyundai Creta retains top midsize SUV title, Venue No. 6 rank, Exter checks in

Hyundai Motor India has all of seven SUVs in the market – three midsizers (Creta, Alcazar, Tucson), two compact SUVs (Venue, Exter) and two EVs (Ioniq 5 and Kona).

The Creta maintains its longstanding title as India’s best-selling midsize SUV with sales of 157,311 units, up 12% YoY (CY2022: 140,895 units). The Creta, which is ranked second in CY2022, is now the No. 3 as a result of the Brezza wresting the No. 1 title from the Nexon.

The Creta, Hyundai Motor India’s best-selling model, contributed 44% to the company’s total UV sales of 360,823 units last year. Creta sales will get a boost this year when the much-awaited facelifted model sees its global debut on January 16, 2024 and launch later. The tech-laden new Creta’s engine line-up includes two petrols and one diesel, and those who have booked the existing Creta will have the option of converting their bookings to the new model.

The Venue, Hyundai’s first-ever compact SUV, maintains its sixth rank of CY2022 in CY2023 with sales of 129,276 units, 619 units less than CY2022’s 129,895 units.

What added wind to Hyundai’s UV sales in CY2023 was the launch of the Exter, which is its fourth highest seller at 47,015 units, followed by the Alcazar (21,831 units) at No. 28, Tucson (3,692 units), Ioniq 5 EV (1,195 units) and Kona EV (501 units).

The Seltos (104,891 units), Sonet (79,776 units) and Carens (68,000 units) are the three Kia models in the Top 25 list.

Seltos remains Kia’s best-seller, Carens MPV sells 68,000 units

As it did in CY2022 with 101,569 units, the Seltos midsize SUV remains Kia’s best-seller in CY2023 with 104,891 units, improving by 3,322 units, and is ranked 10th in the Top 25 model list. Seltos sales were tepid in the first half of the year – 39,892 units – but following the launch of the new facelifted Seltos in July, the numbers picked up and the July-December period saw sales of 64,999 units.

The Sonet compact SUV sold 79,776 units to get No. 13 position but is down 7.50% on its CY2022 sales of 86,251 units. Expect sales to improve in CY2023, following the launch of the updated Sonet on December 14, 2023.

The premium Carens MPV with 68,000 units takes 15th position, improving on its CY2022 score of 62,756 units by 8.5 percent.

As a result of the growing demand for midsize SUVs and fresh market competition in the compact SUV as well as the MPV segments, the Seltos, Sonet and Carens witnessed a fall in their rankings in CY2023 from CY2022. The Seltos, which was No. 7 in CY2022, is ranked No 10 in CY2023; the Sonet, ranked ninth in CY2022, is now No. 13. The Carens MPV, ranked 11th in CY2022, gets No. 15 position in the CY2023 Top 25 UV list.

Innova Crysta/Hycross (84,070 units) remains best-selling Toyota. Urban Cruiser Hyryder sold 42,782 units and the Fortuner 35,066 units.

Toyota Kirloskar Motor: Innova Crysta-Hycross, Hyryder and Fortuner in Top 25

Toyota Kirloskar Motor, like Mahindra and Tata Motors, clocked its best-ever calendar year sales of 221,356 units, up 38% YoY (CY2022: 160,364 units) in CY2023 as a result of strong demand for its SUVs and MPVs.

The ever-popular Innova Crysta / Hycross maintains its position as the best-selling Toyota with 84,070 units which gives it 12th rank and improves on its 14th rank in CY2022 (56,569 units).

TKM is benefiting from its cross-badged models with Maruti and the Urban Cruiser Hyryder is proof of that. Launched in September 2022, the Hyryder’s USP is its strong-hybrid powertrain, which is meant to fill the void left by a lack of a diesel engine, as well as bridge the gap between petrol and electric vehicles. In January 2023, the Hyryder CNG rolled out and has helped accelerate sales. Total CY2023 sales for the Hyryder were 42,782 units, which puts it at No. 19.

The butch Fortuner is the third Toyota model in the Top 25 list with 35,066 units, which gives it No. 21 position. The recently launched Rumion MPV sold 3,916 units between August-December, followed by the Hilux pickup (2,335 units) and the luxurious Vellfire MPV (565 units), whose outgoing model was replaced by an all-new one in August priced at Rs 1.20 crore.

SUV buyers spoilt for choice in India: over 110 models, 800 variants

The hottest vehicle segment at India Auto Inc since the past three-odd years is UVs and every automaker worth its wheel wants to have a slice and more of this booming segment which continues a see a wave of sustained and surging demand. In fact, most of the top OEMs have long waiting periods for their popular models, some of them s-t-r-e-t-c-h-i-n-g to over six months to a year and more.

At present, 30 vehicle manufacturers offer an estimated 113 models with over 800 variants in India. This includes the luxury vehicle manufacturers

At present, 30 vehicle manufacturers offer an estimated 113 models with over 800 variants in India. This includes the luxury vehicle manufacturers

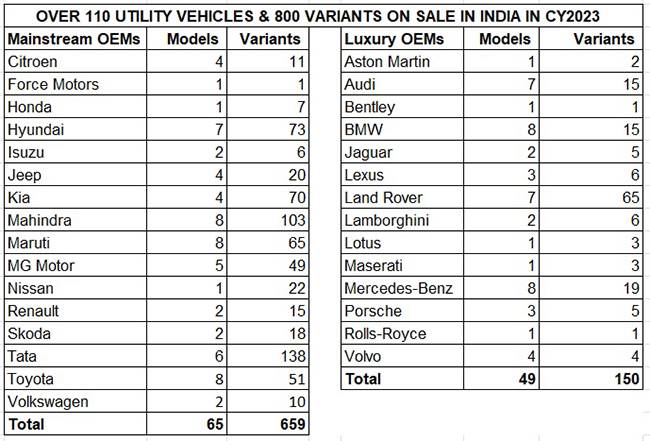

The consumer in this segment, particularly for SUVs, is truly spoilt – an analysis of Autocar India’s Buyer’s Guide (January 2024 edition) reveals that there are 30 OEMs with an estimated 113 UV models and a mind-boggling 809 variants!

There are 16 mainstream OEMs in the Indian market (who are SIAM members), and 14 luxury OEMs. Of the mainstream players, Mahindra, Maruti Suzuki and Toyota are the ones with the highest number of models – 8 each. While M&M’s SUV portfolio covers 103 variants, Maruti has 65 and Toyota 51 variants. However, Tata Motors, with six SUVs (including the Nexon EV and Punch EV), has the highest number of variants – 138!

The luxury pack comprises 16 carmakers encompassing 60 models and 150 variants. Luxury market leader Mercedes-Benz India and BMW India have eight models each, followed by Audi India and Land Rover India with seven models each. Given the surge in demand for luxury vehicles, it is not surprising that this German trio of Mercedes-Benz (17,408 units / up 10%), BMW (13,303 units / up 18%) and Audi (7,391 units / up 89%) have each clocked their best-ever calendar-year sales in India in CY2023. Expect SUVs to have contributed a major share of the demand.