The IRS has just released new guidelines to enable dealers to take the $7,500 electric vehicle tax credit from the buyers and apply it directly to the purchase of new and used electric vehicles.

It should make the experience a bit easier.

When the EV tax credit reform was announced last year, it included a provision to introduce a new “point of sale” option after a year into the program – starting January 1, 2024.

Today, the IRS issued its guidelines to make it happen:

The Internal Revenue Service issued proposed regulations, Revenue Procedure 2023-33 (PDF) and frequently asked questions today for the transfer of new and previously owned clean vehicle credits from the taxpayer to an eligible entity for vehicles placed in service after Dec. 31, 2023.

What the IRS calls a “transfer” is the ability of a new EV buyer to give the tax credit to the dealer that is selling the electric vehicle to them. In exchange, the dealer can give the equivalent “in cash or in the form of a partial payment or down payment.”

In short, you will get the benefits of the tax credit, which is up to $7,500, directly at the purchase rather than waiting for tax season.

However, all the same eligibility criteria still apply even with a transfer, including the buyer having a federal tax burden.

The buyer must give the dealer all their tax information, which will then be submitted to the IRS. The dealer is not required to verify the information, and therefore, the disclosure falls on the buyer.

All the other vehicle requirements, like MSRP limits, and for the buyers, like income limit requirements, apply here.

The only requirement that this update allows you to avoid is your tax burden. If, for some reason, you can afford to buy a new car and yet you happen to have a tax burden smaller than the full amount of tax credit you are eligible for, the IRS says that it won’t “recapture” the difference.

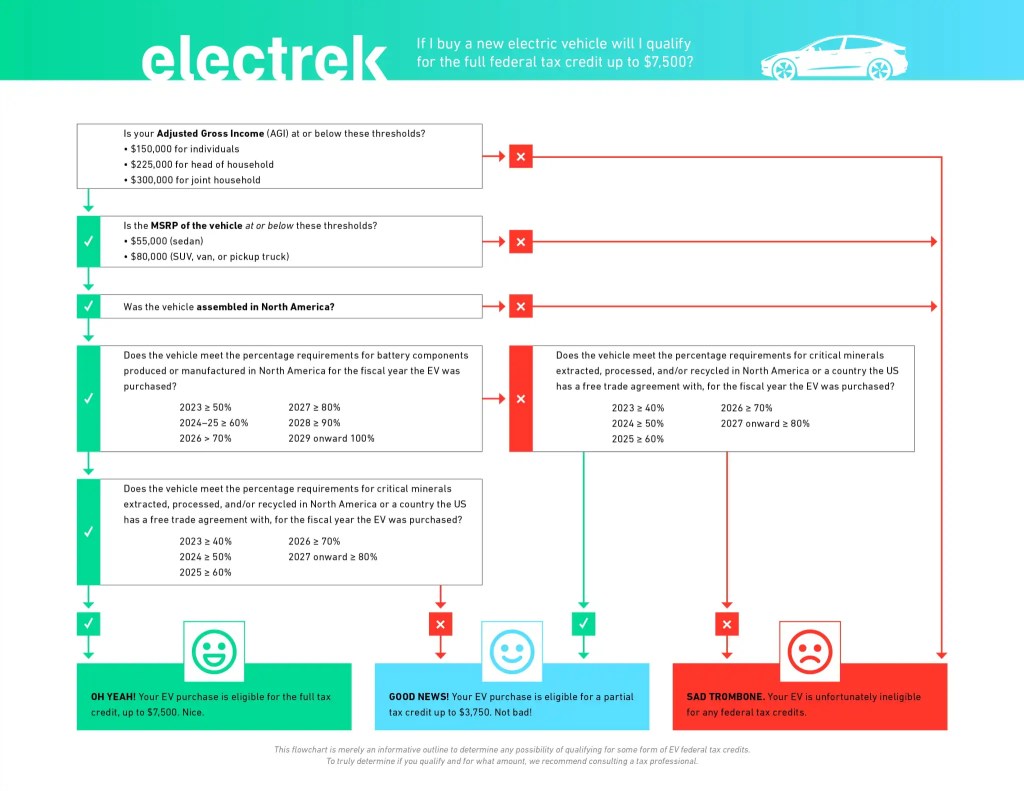

Here’s a flow chart we put together to see if you and the electric car you want to buy are eligible for the tax credit:

Basically, if you arrive at an “Oh Yeah!” or a “Good News!” answer above, you will be eligible to transfer the tax credit to your dealer if you are buying the car after December 31, 2023.

The dealer will then be able to slash the price of your vehicle by the same amount rather than wait for next year’s tax season.

Is Tesla eligible?

This has been a recurring question since the point-of-sale credit was announced because Tesla doesn’t operate “dealers” in the traditional sense, and “dealers” were always mentioned as the only ones able to take advantage of this new provision.

Top comment by Bastian

Using income levels without any consideration for local cost of living is a great disservice to would be EV purchasers. $150k in Missouri is rich, in places like SF Bay Area it’s really not much. Sigh, guess I’m keeping my ICE till prices without tax credit come down.

Reading through the guidelines today, I don’t see anything that would prevent Tesla from offering this to customers.

While Tesla doesn’t operate third-party franchise dealers like legacy automakers, it is a licensed car dealer in most states that has enabled direct sales in the US.

The guideline doesn’t say anything about manufacturers not being able to get access to the program. It only says that dealers need to register with the IRS to take advantage of it.

The same goes for other EV startups using the same business, like Rivian and Lucid.

FTC: We use income earning auto affiliate links. More.

Comments