Germany EV Sales Report: Back to the Past

After the subsidies-derived sales rush of December, Germany’s plugin vehicle (PEV) market was bound to have a hangover month in January. And it did, by scoring some 37,000 registrations. While that is a 40%-plus increase over the January 2023 result, it is important to remember that a year ago, the German EV market was experiencing another hangover month, related to the end of PHEV subsidies in December 2022. So, comparing January 2024 with January 2022, this year there was a 9% drop. So, one can say that the removal of incentives, both to BEVs (end of 2023) and PHEVs (end of 2022), pulled the market backwards by two years. January 2024 looks more like January of 2022 than January of 2023.

One example of that is the recovery of plugin hybrids (PHEVs), which jumped this year by 63% YoY. Meanwhile, full electrics (BEVs) were up “just” 24%, to 22,474 units. Pure electrics thus started the year losing a significant portion of their advantage compared to plugin hybrids (61% vs 39% in 2024, against 67% vs 33% in 2023).

Having said that, the BEV vs PHEV ratio isn’t as balanced as the result in January 2022 (53% vs 47%) and 2022 as a whole (56% vs 44%). It seems evident that with BEVs losing access to subsidies in 2024, PHEVs will recover part of their importance in Germany.

This performance allowed the plugin vehicle (PEV) share to start the year at 17%, with BEVs alone hitting 11%. That is below the January 2022 market share (22% PEV, 11% BEV), but expect these numbers to climb throughout the year, eventually surpassing last year’s result (25% PEV, 18% BEV), and maybe even that of 2022 (31% PEV, 18% BEV), which is the current high mark. We should see a few 40%-plus months in Germany in 2024, especially towards the end of the year.

Looking at the January best sellers, we should make a disclosure first: with several brands playing the “pre-registration” game at the end of 2023, do not give too much value to these initial results, as they could be impacted by the previous pre-registrations.

Still, there are a few trends that are already visible, one of them being the race between Tesla and Volkswagen Group. But while on paper all seems the same as last year, looking closer, there are a few differences.

The Tesla Model Y once again started the year on top, but while it had an amazing 4,108 registrations last January, this time it “only” got 2,393 registrations. And while last year’s result might have already settled the discussion regarding the 2023 best seller title (in January), this year, the advance that Tesla’s crossover has is some 900 units. While already significant enough to place it as the main candidate for this year’s title, this still allows some hope for the competition….

… Namely, January’s silver medalist, the Skoda Enyaq. With 1,457 registrations, it doubled the number of registrations it had in the same period last year. The posh Audi Q4 e-tron also started its career in 2024 on the right foot, by delivering 1,424 registrations. That’s twice as many as twelve months ago, and it allowed Audi to finish January in the last place on the podium.

As for the expected Volkswagen Group best sellers, the VW ID.3 and ID.4, well … it was a slow month. The hatchback started the year in #17 with 507 units, its worst result in almost two years. Its crossover sibling, which was 18th in January, had 504 registrations, also underperforming.

Plugin hybrids were back in the top spots, with the Ford Kuga PHEV leading the pack in 4th with 1,067 registrations, followed by a pack of Mercedes PHEV models (GLC in 5th, E-Class in 9th, GLE in 13th, C-Class in 15th). This brings another 2022 flashback, because while in January 2023 there were only four PHEVs in the top 20, and only one of them was a Mercedes, in January 2022, there were six PHEVs, with three of them being Mercedes (GLC, GLE, A-Class). So, now we have seven PHEVs and four Mercedes models….

The German brand seems to be the only one taking full profit from the PHEV technology, helped by the fact that its PHEV models have usable electric range (over 100 km of WLTP electric range), which is thanks to 25 to 30-ish kWh batteries and fast-charging capabilities. While still below the specs of the best Chinese EREVs, they stand one level above their legacy OEM competition, which have their PHEVs still in the 15-ish kWh levels.

But it wasn’t only in the PHEV category that Mercedes had a good month, because the compact EQA electric crossover ended the month in 7th, with 803 registrations, twice as many as it had a year ago when it started 2023 in 19th.

Heck, even the big Mercedes EQE had a strong start, ending January in 14th with 656 sales, allowing it to be 4th in the full size category.

And this is another early trend that we can see. Because the BEV subsidies had a price cap that excluded most of the full size models, there was no end-of-year sales rush in that category, which meant that sales kept on going in January like nothing had happened. Add this to the sales hangover in lower categories, and this month we see full size models over-represented, with four full size models in the top 20, three of them coming from Mercedes (#9 E-Class, #13 GLE, #14 EQE). The 4th representative was the longtime category leader, the Audi Q8 e-tron, which once again started the year in the lead, in 8th, with 759 registrations.

In the second half of the table, the #16 Cupra Formentor PHEV continued to sell pretty well in Germany, scoring 518 registrations in January. In the last positions on the table, two models made a surprise appearance, with the Volvo XC60 PHEV showing up in #19, with 501 registrations, while a position below, the Opel Astra showed up for the first time with 498 registrations, divided between 389 PHEVs and 109 BEVs.

Just outside the top 20, in #21, we have the Porsche Cayenne PHEV, with 495 registrations, the model’s best score since December 2021. Only one unit behind, we find the #22 Volvo EX30. In its first volume month, the EX30 had 494 registrations. Much is expected from the compact Volvo, and a top 20 position in Germany seems well within reach.

Finally, the Renault Megane EV had a solid 471 sales in January. The compact hatchback seems to be doing its job of holding down the (Renault) fort, at least until the upcoming (and tentative value for money king) Scenic land. Regarding the Renault 5’s career in Germany, it is a big unknown, because while the Zoe was best seller material in its heyday, having been the #1 EV in Germany from 2018 until 2020, the market has moved on since then, and one wonders how much of an impact the French EV will have in 2024. Discuss.

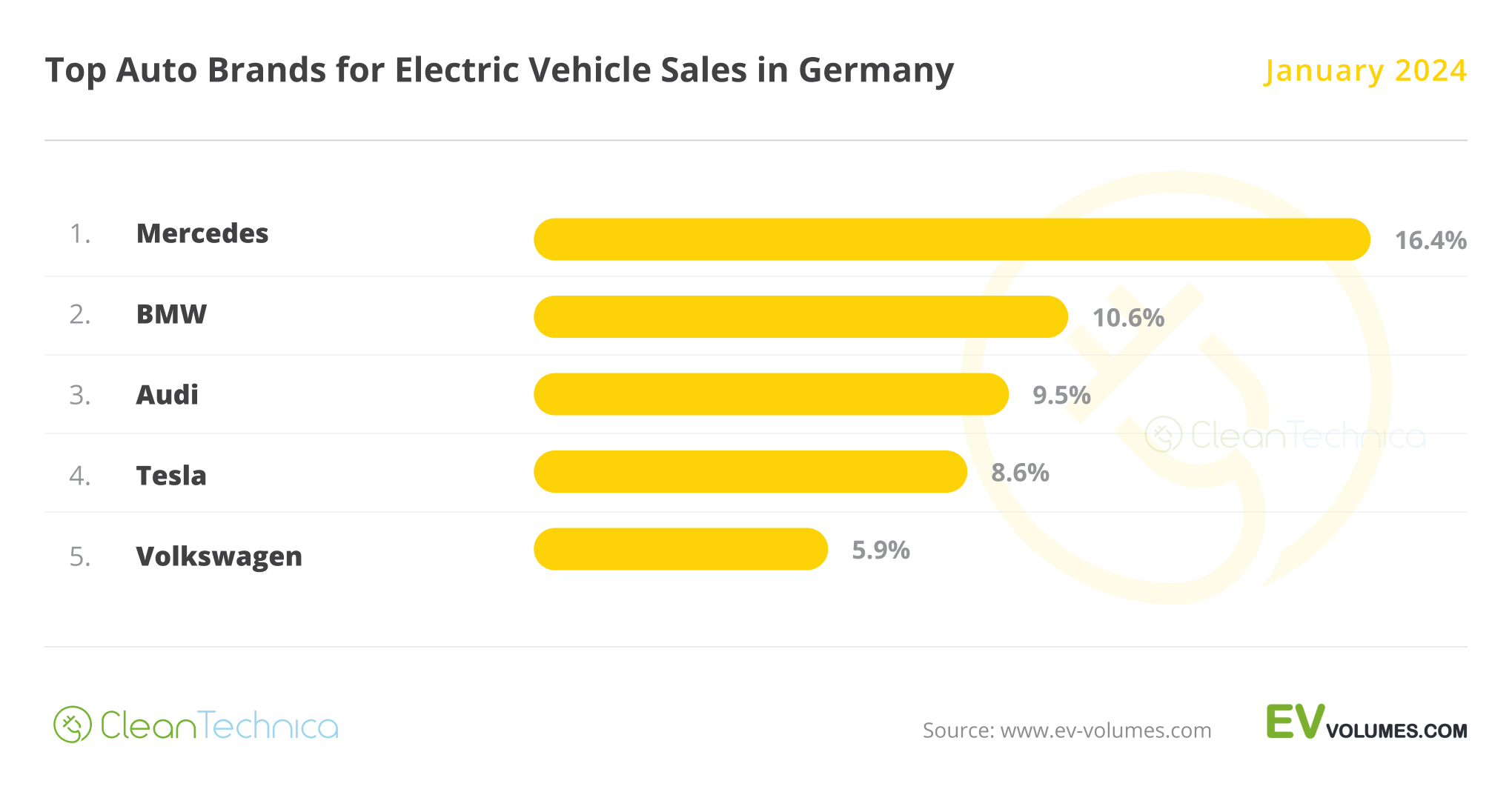

In the brand ranking, high-voltage Mercedes (16.4%) shocked the competition, starting the year in the lead with a significant advantage over BMW (10.6%). Does this mean that the three-pointed-star make will finally win the brand title? As for BMW, despite ending January in 2nd, it was nevertheless a positive start for the Bavarian make, especially considering that a year ago it was in 5th with 5.2% share.

Audi (9.5%) profited from strong results from the Q4 e-tron and Q8 e-tron to start the year in the last place on the podium, followed by Tesla in #4 (8.6%). The US make’s performance this January pales next to what it had a year ago, when it started in #1 with 17.1% share, but the year is still young and it will have plenty of time to recover.

The same can be said about Volkswagen, which started the year in an atypically low 5th place, with just 5.9% share, far from the 13.4% share it had twelve months ago.

These last two brands will have plenty of time to recover throughout the year, but this serves also to highlight that here, too, it is a return of some sort to 2022. While the current #1 and #2, Mercedes and BMW, started 2023 in 3rd and 5th, respectively, in this same period in 2022, they were actually in the same positions as they are in 2024, with Mercedes leading at the time with 13.1% share, followed by BMW with 10.1%. (this was the last “Great Scott!” moment, I promise)

Outside the top 5, a mention goes out to the good moment Volvo (5.1%) had. It could benefit from the future success of the EX30 to have a go at reaching the #5 spot.

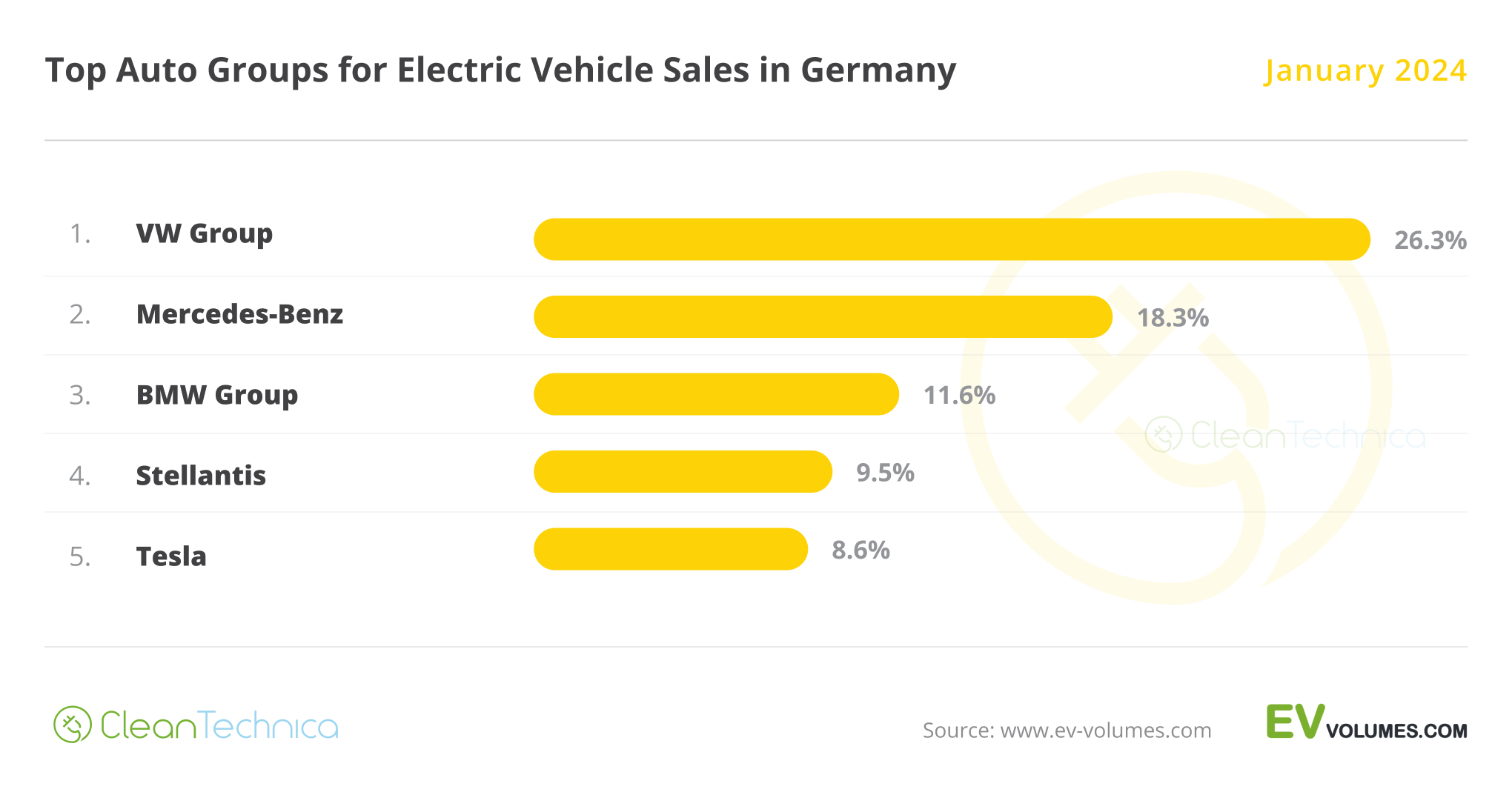

Looking at OEMs, Volkswagen Group (26.3%) started the year in its usual place. However, the rise of #2 Mercedes–Benz, at 18.3% share, surged it into 2nd place. Volkswagen Group should not be complacent with its Stuttgart rival competing for the OEM title in Germany.

BMW Group was 3rd, with 11.6% share, with the German OEM improving its score significantly over the same period last year (6.4%).

In 4th we have Stellantis (9.5%), followed by Tesla (8.6%), with the Korean Hyundai-Kia Group currently 6th, with 6.6% share.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Video

CleanTechnica uses affiliate links. See our policy here.