Tesla (Still) #1 in World BEV Sales — 2023 World EV Sales Report

Following up on our stories about the best selling plugin vehicles in the world and the automotive brands that sell the most plugin electric vehicles in the world, we’re now closing out the 2023 World EV Sales Report series with a look at the automotive groups or alliances that sell the most plugin electric vehicles and that sell the most pure 100% electric vehicles.

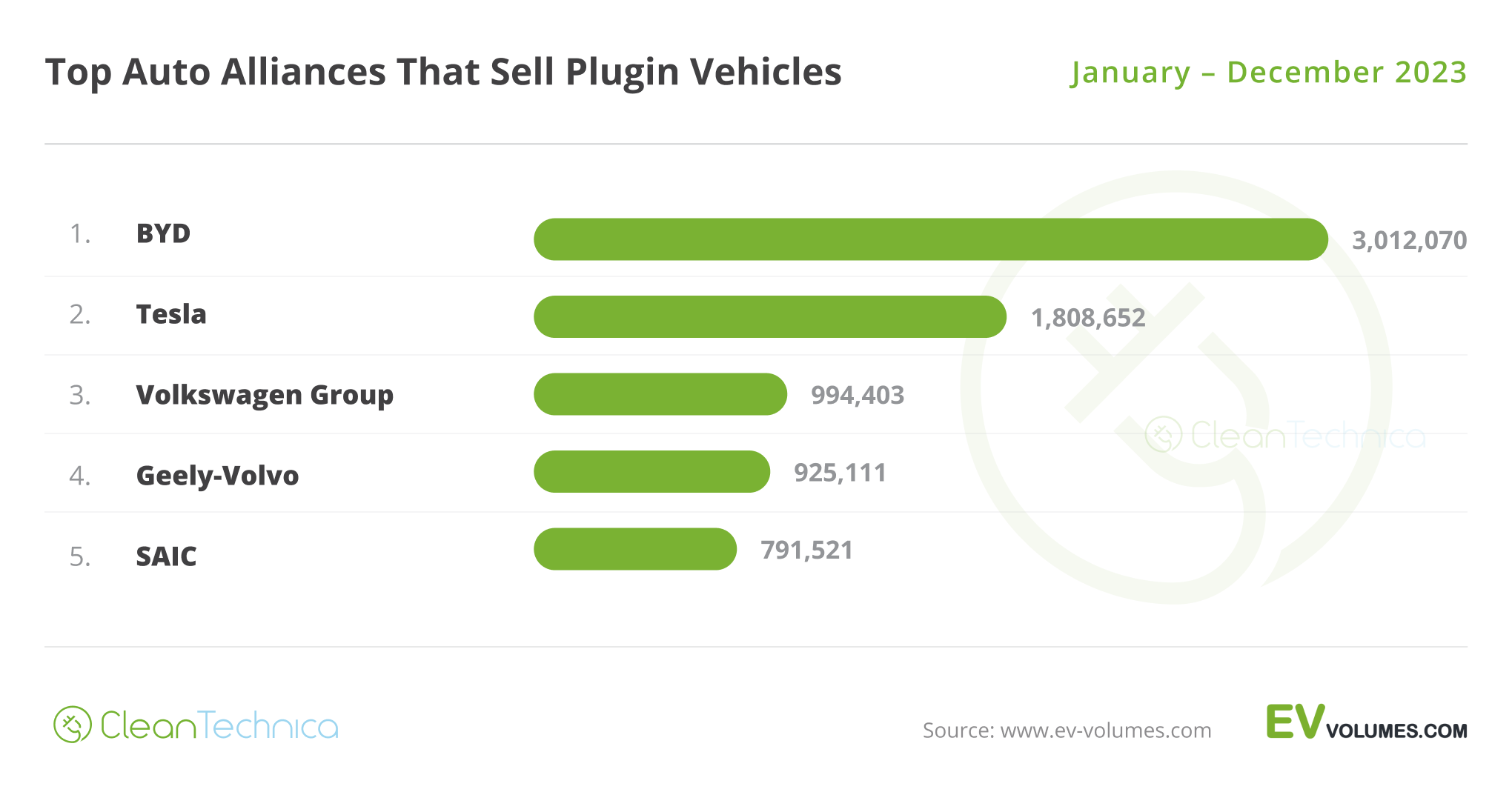

If we gather plugin vehicle sales by automotive group, BYD (22% share of the plugin vehicle market) repeated the 2022 title win, with an 8.8% share (or over 1.2 million unit) advantage over Tesla (13.2% share). BYD gained 0.1 percentage point compared to Q3 2023, and a significant 3.6% points compared to a year ago, while Tesla dropped 0.8% compared to Q3 and gained 0.2% compared to 2022.

These trends say that BYD has probably already peaked when it comes to market share growth, which is actually healthy for the plugin market, as a balanced and competitive market should not have players with over 20% share.

As for Tesla, after a strong beginning of the year, no doubt thanks to the aggressive price cuts of a year ago, it has spent the rest of the year slowly returning to where it was back in 2022.

Still, these two brands live in a league of their own, with 35.2% share of the market between the. No other brand can even dream of being at their level right now.

In the B League, Volkswagen Group remained in 3rd, gaining 0.1% market share compared to Q3 and losing 0.9% compared to 2022. One can say that the German OEM is without any doubt the leader among legacy OEMs, and the only company able to keep up the pace of the remaining B League players.

In 2023, Geely–Volvo (6.8%) replaced SAIC (5.8%, up from 5.6% in November) in 4th, but the Shanghai automaker rebounded in the last quarter of the year, gaining 0.4% share compared to Q3, thus reducing its yearly losses to just 1.4% YoY.

As for #4 Geely–Volvo, the rise and rise continues.Aafter ending 2021 with 4% global share, things have only gotten better, ending 2022 with 6% share, and now ending 2023 with 6.8%. The lion’s share of the growth (0.7%) was concentrated in the last quarter of the year.

With the growth trend surely continuing throughout 2024, and with Geely–Volvo just half a point below #3 Volkswagen Group, expect a fierce fight for the bronze medal between these two in 2024.

With all the fresh metal coming from the Geely stable next year, which is probably the most prolific in the world, I will even say the Chinese OEM is starting the year as the favorite….

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

In the C-League, Stellantis (4.2%) remained in 6th, but has lost half a percentage point compared to the end of 2022. On the bright side, it reached close to 600,000 units last year. The multinational conglomerate should reach the critical level of scale (aka 1 million units) for EV profitability by 2025/26, which means the promised land is already on the horizon and the reports of Stellantis’ death were greatly exaggerated.…

BMW Group (4.1%) rose to 7th place and the German OEM should be competing for 6th place with Stellantis throughout 2024.

The major loser in this league during 2023 was Hyundai–Kia(!), which dropped from 7th in 2022 to its current 9th position, losing almost a full percentage point along the way, going from 4.6% in 2022 to its current 3.7%.

The Korean OEM’s case is something of a paradox, because while Kia and Hyundai EVs have been praised as some of the best in the market, in 2023, sales didn’t follow through. Their absence from the Chinese market has a lot to do with this, something that they will start to address in 2024 with the introduction of the Kia EV5 there. Though, the fact remains that Stellantis is also not in China, and nevertheless, it has grown faster than the Korean group. What to they need to return to the front of the C League? Higher production capability? Wider choice of models? Lower prices? All of the above? Discuss.

Besides BMW Group, the Korean OEM was also surpassed by a rising GAC in 2023, which ended the year with 3.8% share.

Regardless of what happens in 2024, the big gainers in 2023 were BYD and Geely–Volvo.

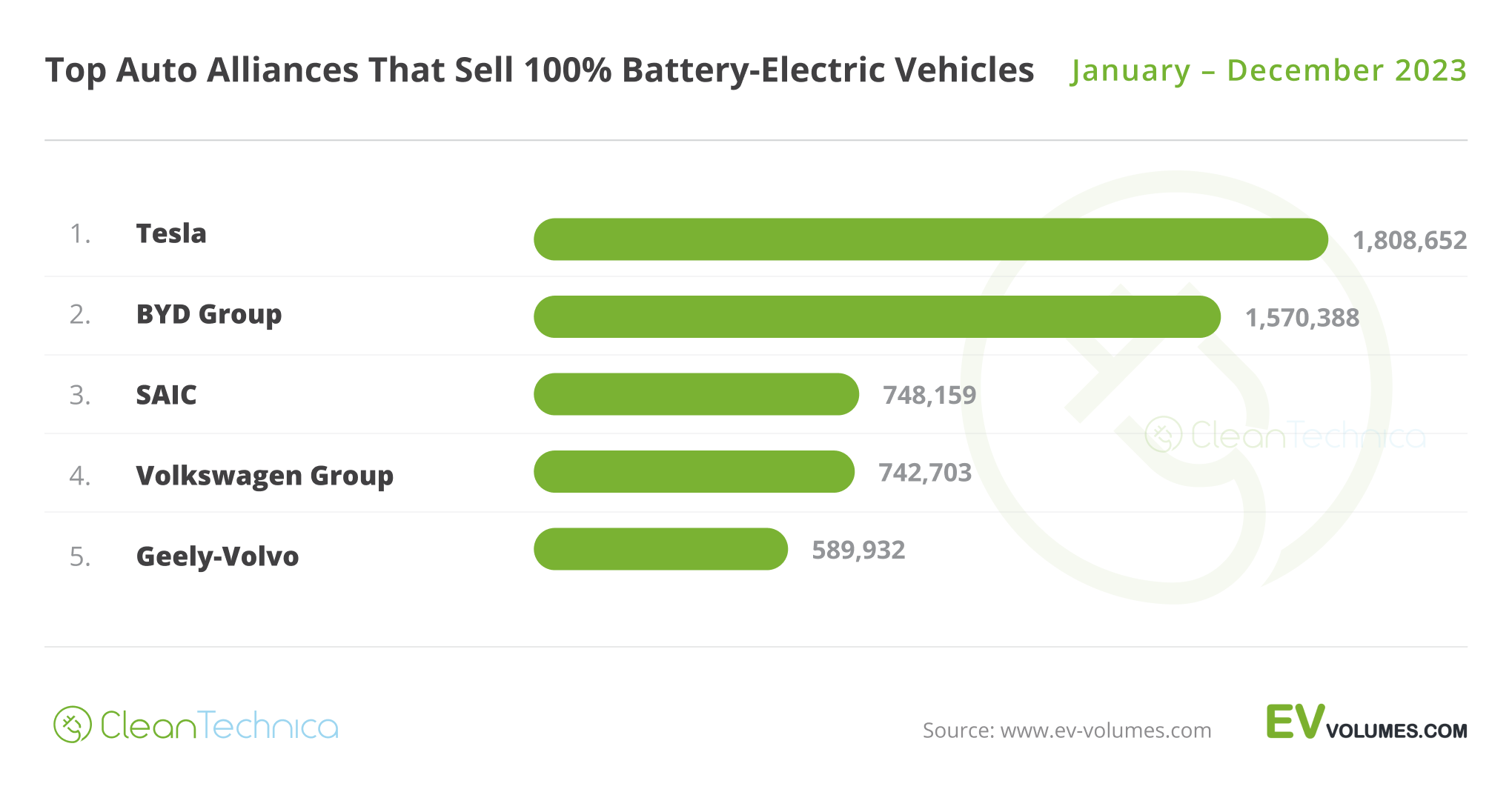

Looking only at BEVs, Tesla again got the title, with 19.1% share of the global BEV market. That is a gain from the 18.2% share of 2022, but a full one point less than it had in Q3 2023, and far from the 23% it had at the end of 2020. Still, 19.1% share is a notable feat considering the current diversification process.

The silver medal again went to BYD (16.5%), which gained 3.9% share compared to 2022! Compared to Q3 2023, the Chinese automaker grew by 0.6% share.

Now, the question many had been waiting for: Will BYD beat Tesla in 2024 in BEVs?

Hmmm … While a year ago, to that same question, I replied: “I think it is too soon.” And added: “It’s true, though, that if current trends continue throughout 2024, that might happen around the second or third quarter of that year.”

While Tesla’s market share should erode slightly during 2024, BYD will continue gaining share, one of the reasons being the fact that BYD’s lineup will become more BEV heavy this year (the Yuan Up and Sea Lion will play a significant role there). Another reason is that exports are basically focused on BEVs, with PHEVs only being used in select markets.

So, while BYD’s share in the plugin market might stagnate in 2024, because it will have a higher mix of BEVs, its share in the BEV-only market will continue to grow.

SAIC surpassed Volkswagen Group in the last month of the year, thus repeating last year’s bronze medal result. It ended the year with 7.9% share, up from 7.7% in November. The Shanghai-based OEM had a strong Q4 2023, having recovered 0.4% share compared to Q3 2023. Still, this wasn’t enough to recover to the 9.3% share it had at the end of 2022.

Volkswagen Group (7.8%) lost its podium position in the last stage of the race, ending the year again in 4th after having lost just 0.1% share compared with 2022.

In 5th, we have rising Geely–Volvo (6.2%). It gained 0.6% share compared to Q3 2023 and 0.9% share compared to 2022, leaving #6 GAC (5.3%) a sizable distance behind. Nevertheless, the Guangzhou OEM had a positive 2023, having gained 1.3% share, from 4% in 2022 to its current 5.3%.

Looking at these results in comparison to the BEV+PHEV tables and charts, it is the same top 5 players. The differences are position changes between BYD and Tesla (with Tesla profiting in the BEV chart from being 100% BEV) and something similar happening to SAIC against the others (as its lineup is much more BEV-based than the fleets of Volkswagen Group or Geely–Volvo).

But, overall, the players in the A, B & C Leagues do not change significantly, with or without PHEVs being included.

Now, some final thoughts on the future of each of the top 5 OEMs:

BYD

With the namesake brand already close to its demand ceiling in its domestic market, BYD is now more focused on going upmarket with its premium brands (Yangwang, Fangchengbao, Denza), than increasing its market share much further. With a higher average price, it is expected that margins can improve, so that BYD can have more pillow space to lower prices on its mainstream models if needed. And yes, with the Chinese EV market being as competitive as it is, if BYD wants to keep owning a third of the local EV market, it will not only need to keep its lineup fresh*, but will probably also have to lower prices to stay competitive. (*BYD will certainly keep its lineup fresh. In 2024, it will launch: Yuan Plus, Song L, Sea Lion 05 & 07, Qin L, and a pickup truck model, just to mention a few coming introductions.)

As such, the growth volumes will have to come from overseas markets, and BYD has been preparing the ground for that, not only buying its own ship carriers(!), but also building factories in places like Thailand, Indonesia, Brazil, Hungary … and, if rumors are to be believed, Mexico. A Mexico factory would give BYD a boost in that Latin American country, but also more crucially, into its northern neighbors….

So, while production won’t be a problem, demand could be and issue — not only organic demand (“Will buyers buy Chinese EVs?”), but also possibly from geopolitical issues (tariffs, etc.).

Back to 2024, expect BYD to stay in the lead in the next couple of years, and its lead should only be challenged by 2027.

Tesla

With 1.8 million units in 2023 and no fresh metal, except the Cybertruck ramp-up, which shouldn’t really move the needle in 2024 (I would say 100,000 units, tops), do not expect fast growth coming from the US automaker next year. I expect the final numbers will end around 2.1–2.2 million units.

And that is Tesla’s current issue — product planning, or the lack of.

The Model S is now 12 years old, so it should have already been on its 2nd generation; the Model X is on its 9th year, so the next generation should have been presented by now; while Tesla’s star products, the Model 3 (2017) and Model Y (2020), are now in full maturity and their successors should now be on the drawing boards. Only … they are not. Thinking differently and having a disruptive approach is great when you are a startup disrupting the establishment, but when you are making close to 2 million units per year, you are the establishment.

Adopting the product lifecycles that grown-up OEMs have would help Tesla at this point. But then, for that to happen, Tesla would need to have a more normal management team….

But back to future plans. Expect 2025 also to be a slow growth year, but with the introduction of the future compact model towards the end of that year (something like 30 units delivered in November/December), expect Tesla to spend 2026 in production hell ramping up its new baby. Meanwhile, the Model 3 and Model Y will be 9 and 6 years old by then and probably on their 2nd refresh. They will start to suffer from old age and/or the Osborne effect, meaning that the first year of really fast growth from Tesla will be in 2027.

But then again, how will the market look by then?

Volkswagen Group

If it was a basketball team, its recent history could have been a tale of having three completely different coaches in command, from the sleeping at the wheel style of Martin Winterkorn, which originated the Dieselgate scandal; to the MEB-based disruptive strategy of Matthias Muller, which was then followed by Herbert Diess; and then on to the current counter-disruptive management formula of Oliver Blume. Volkswagen Group has been through a lot, with some highlights in the EV revolution, but also some bruises.

Still, it is by far the best performing legacy OEM, with close to 1 million plugins in 2023, so its survival in the long term is well assured. Funny enough, it was the quick EV turn made possible by the Dieselgate scandal that allowed this to happen.

So, what about growth prospects in 2024? Not a lot I am afraid, as the OEM’s bread and butter models are maturing, with the only new models being the VW ID.7, Cupra Tavascan, Skoda Elroq, Porsche Macan, and Audi Q6/A6 e-tron, so no real volume seller here.

In 2025, though, things will get interesting. The production version of the ID.2 concept, whatever it will be called, will surely be a big seller, with the question being: “How fast will the ramp-up be?” Will it get close to 2 million units?

The same applies to the multiple ID.2 siblings, which will debut somewhere around 2026. That will finally push sales onto the fast track (2.5 million in 2026?), with the final piece of the puzzle coming in 2027/2028 when the electric-only VW Golf, the ninth of its kind, will enter production based on the future SSP platform.

But then again, it is the same question as for Tesla: What will the market look like in 2027?

Geely–Volvo

So, on to Geely, and its 80 car brands…. The Chinese OEM has been steadily rising over the years in the OEM ranking, ending 2023 in 4th with over 900,000 units registered, some 70,000 units below #3 Volkswagen Group.

While the German OEM is not expected to grow significantly in 2024, Geely–Volvo will profit from having a global presence and a dizzying array of new models coming to its brands next year. It is surely the OEM with the highest output of new EVs per year. Expect the multibrand OEM, once considered the “Chinese Volkswagen Group,” to surpass the original one — if not already in 2024, then surely in 2025.

From then on, it will be pedal to the metal as they try to cut the distance between it and the two frontrunners. Will they achieve that goal?

No one really knows, just as no one really knows if Geely won’t buy a couple more brands in the meantime, like, say, … Renault?

One thing is true: if there is any OEM able to reach the future output of BYD or Tesla, then this is it.

SAIC

Here’s an OEM that excels in overseas markets, but could do better in its domestic market.

SAIC aims to sell around 1.4 million vehicles (including ICE models) in export markets in 2024, a number that is the envy of most of the other Chinese OEMs. It is also significant compared to the total number of vehicles made by SAIC (circa 5 million units in 2023). While others are still making their first steps outside of China, SAIC is already well established across the world, especially thanks to its MG brand, which still carries some cachet from its British roots.

And, with 14 new EVs coming by 2026, SAIC hopes to replicate the MG4’s success with other models, including venturing into the premium end of export markets with its new and so far successful IM brand.

Expect a new 5 station wagon, a new ZS crossover, and a flagship SUV model to be unveiled in 2024, which will help sales in Europe. Meanwhile, in China, the current Wuling lineup should pull sales up. And, of course, it would help if among all the other brands, there were at least a couple of hits. With all of that clicking, sales could end next year north of 1 million units.

Looking further into the future, expect a steady growth pattern from SAIC.

To finish, some food for thought: While it will be impossible for SAIC to buy General Motors, because of … you know, geopolitics, I could see SAIC buying the Buick brand from GM. After all, considering the level of neglect that GM is giving the brand outside of China, it might as well sell it to SAIC and earn a nice load of dollars to finance GM’s electrification efforts….

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Video

CleanTechnica uses affiliate links. See our policy here.