Akora Resources lays out its Bekisopa project and explains how it is assisting the iron and green steel industry.

Akora Resources (AKO.ASX) is well-placed to become a significant supplier of clean iron products to the green steel industry. AKORA is developing high-grade iron ore projects in Madagascar.

The main project, Bekisopa, hosts a large iron ore body with a strike length of at least six kilometres and depths in some parts down to 500m. Testing has demonstrated that concentrates with high grades suitable for direct reduced iron (DRI) pellet feedstock for the green steel industry, and low impurity levels, can be achieved at relatively coarse sizes.

Further, there is a meaningful quantity of high-grade weathered material that is suitable for conventional direct shipping ore (DSO) operations. This will allow for a low capital-cost startup and the generation of early cashflows.

Bekisopa boasts several significant and sustainable geological and geographical advantages. AKORA is led by Chief Executive Officer Mr Paul Bibby. Mr Bibby is a highly experienced metallurgist with more than 35 years of experience in technical and managerial roles within the mining industry, including Rio Tinto Iron Ore (formerly Hamersley Iron), where he was manager of metallurgy at Paraburdoo and the Dampier port. Mr Bibby later became Chief Development Officer at Nyrstar and then CEO of several ASX-listed companies.

Bekisopa is a rare and valuable resource

AKORA’s maiden inferred resource, from drilling along only two kilometres of the six-kilometre strike and published just 16 months after the December 2020 IPO, stands at 194.7 MT at a head grade of 32% Fe for 75.4 MT of iron concentrates at a grade of 67.6% Fe.

Defined within this resource is an indicated DSO resource of 4.4 MT grading 61% Fe and an outstanding initial green steel resource of 34 MT at an average head grade of 45% Fe shown to deliver a DRI concentrate at 68.7% Fe.

The iron mineralisation at Bekisopa is readily upgradable

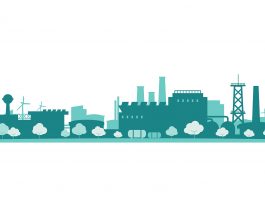

Davis tube tests (DTT) demonstrate the iron mineralisation at Bekisopa is readily upgradable with average concentrate grades of 67.6% Fe achieved from head grades of greater than 15% Fe and concentrates grading 69.7% Fe achievable from head grades of more than 25% Fe, all at a coarse 75 micron grind size.

DRI processes require higher quality iron ore than the conventional blast furnace. Typical DR-grade iron concentrates have Fe content greater than 67%, aggregate SiO2 and Al2O3 content less than 3.5%, ideally below 2%, and phosphorus (as P2O5) less than 0.015%. The level of impurities impacts the performance of the electric arc finance (EAF). Higher impurity levels both absorb more energy and lower the melting yield, thereby raising costs.

Based on the existing resource, Bekisopa has a combined SiO2 and Al2O3 of 2.4%. Within this overall resource, the first to-be-mined green steel resource has a very low average impurity level of just 1.4%. Iron ore deposits that can deliver such quality green steel concentrate are incredibly scarce, see Fig. 1. Only around 3% of global seaborne iron ore shipments are greater than 66% Fe.

Processing efficiency at Bekisopa

Davis tube recovery (DTR) measures how much iron ends up in the final product. Higher DTR results mean less material must be mined and processed to produce one tonne of concentrate. At Bekisopa, only 2.6 tonnes of material needs to be mined and processed to achieve one tonne of DRI concentrate, an unusually low amount, which leads to lower capital and operating costs than other projects, which have typically around six-to-seven tonnes of mined feed per tonne of product-grade concentrate.

Bekisopa’s initial green steel resource, with a 45% Fe head grade and DTR of 58%, requires mining only 1.7 tonnes to produce a high-grade green steel concentrate, see Fig. 1.

Importantly, at Bekisopa, this upgrading is achieved at a relatively coarse grind size of 75µm (microns). This is a major advantage over other projects that require finer grinding to 10-40µm to achieve acceptable DRI concentrate grades.

The transition to green steel will create a huge demand for cleaner feedstock

Steel, though ubiquitous in modern life, is energy and carbon-intensive to produce. Iron and steel production accounts for more than a quarter of final industrial energy consumption and about a quarter of all industrial CO2 emissions.

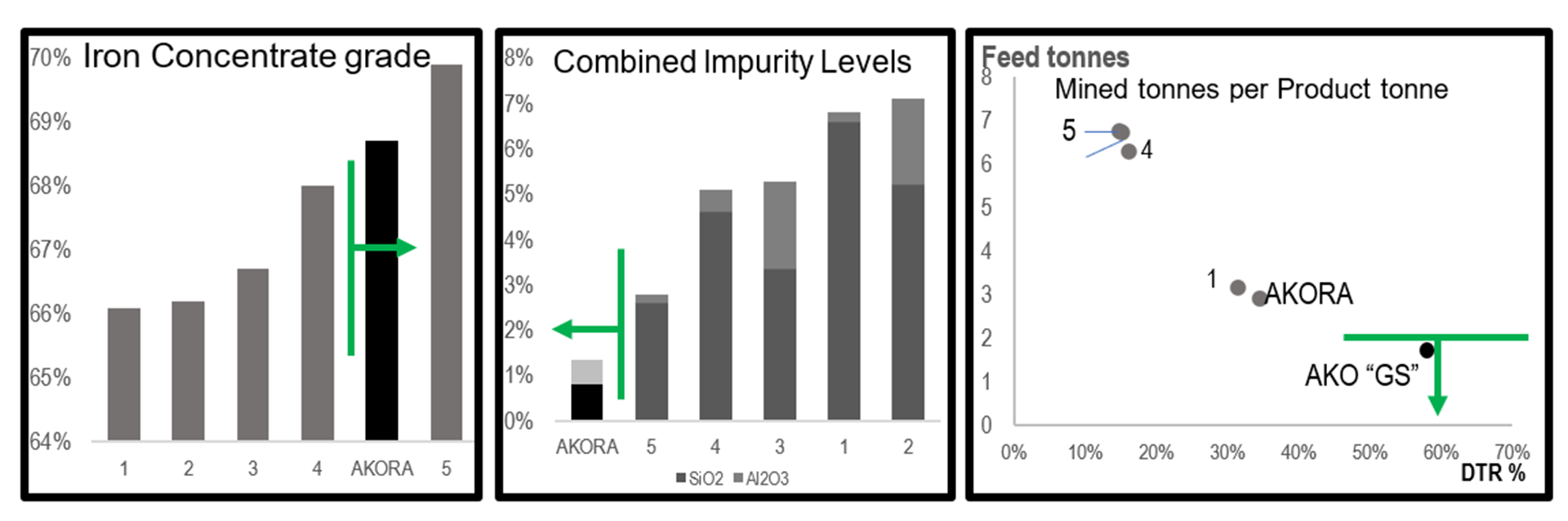

Limiting the rise in global temperatures to 1.5°C in line with the Paris Agreement will require huge changes, including commercialising technologies such as hydrogen-based DRI and a wholesale switch to EAFs or equivalent processes. Crucially, it will require higher-quality feedstock. Wood Mackenzie estimated the consumption of high-grade iron ore pellet feed will have to increase 5-fold to 758 MT by 2050.

Without massive new investment from global iron ore miners amounting to $75-$125bn, according to Wood Mackenzie, the market for DRI pellet feed looks likely to be in deficit by the mid-2030s, with a deficit of as much as 350 MT or so by 2050, see Fig. 2.

As steel sector decarbonisation gathers pace, deposits that can meet DRI specifications, such as Bekisopa, are set to become of far greater importance and value.

Operational advantage: DSO start-up

Another key geological advantage of the Bekisopa project is that there is an amount of outcropping and high-grade weathered material that is suitable for DSO. DSO requires mining, then crushing, screening, and blending to produce a saleable lump or fines iron ore product. This has significant potential advantages in terms of capital and operating costs.

The initial operation of mining DSO material is expected to be relatively straightforward as the ore is at or near the surface. Strip ratios (waste to ore mined) should be very low.

It means that AKORA could earn substantial cash flow from DSO operations before committing to further processing for either fines or green steel DRI concentrate products. Few other projects have this advantage.

Bekisopa’s regional potential

There is a huge potential exploration upside at and around Bekisopa. Ground magnetic surveys completed in 2019 showed that magnetite mineralisation continues at depth, with geophysical modelling suggesting magnetite at least 500m deep in some places. Wardell Armstrong International, the consultants that prepared the IPO Independent Geologist’s Report, put forward an exploration target of 500 MT to 1,000 MT grading 30-60% Fe at Bekisopa alone.

Historical magnetic surveys of the wider region highlighted several significant magnetic anomalies. At AKORA’s Satrokala tenements, located 40km southwest of Bekisopa, the anomaly suggests a strike length of about 10km and a width of about 1,200m. That is, bigger than at Bekisopa.

In AKORA’s rock chip sampling, two-thirds of the 103 samples returned an average Fe grade of 64.5%. Satrokala has the potential to host mineralisation suitable for DSO, with the underlying fresh iron mineralisation upgradable to green steel concentrate grades. It is also 40km closer to the Toliara port.

West of Bekisopa, on tenements held by AKORA, three other large magnetic anomalies have had no rock chip sampling or drilling work completed to date and offer further exploration potential. Altogether, including Bekisopa and Satrokala’s regions, these anomalies have a total strike length of about 40km. AKORA has only drilled 2km. AKORA is about to launch a ground magnetic survey at the Satrokala project that should help define the extent of mineralisation and identify drill targets for follow-up in 2024.

In addition to the phenomenal opportunity at and around Bekisopa, AKORA owns the Tratramarina and Ambodilafa projects on the east coast of Madagascar. The company conducted rock chip sampling and a seven-hole drilling programme at Tratramarina in 2009-2012, returning solid results.

Management views the project as a priority exploration target with excellent potential for upgradable magnetite iron ore grading 25-35% Fe.

Madagascar’s geographical advantages

Shipping routes to the growing India and Middle East steel industry are less than half the distance than to China. Shipping to the nearest neighbours will also reduce greenhouse gas emissions.

The Indian steel market is both large and transitioning towards higher value-added products as the country seeks to reduce its reliance on imports. In 2021, Indian crude steel consumption was 118 MT, representing about 6% of world demand, with plans to increase output to >250 MT by 2030.

ArcelorMittal Nippon Steel India described India as the “next frontier of accelerated growth.” The group is expanding the capacity of its Hazira plant in Gujarat from 7.6 MTpa to 15 MTpa, with longer-term ambitions to reach a capacity of 30 MTpa.

In DRI production, iron oxide is reduced using carbon monoxide and hydrogen, which can be derived from natural gas. Saudi Arabia has significant advantages in the supply of gas.

In September 2022, Essar Group said it would invest $4bn in a new integrated flat steel works in Saudi Arabia that is expected to come on stream in 2025. The plant will have two DRI plants, each with a capacity of 2.5 MTpa. An obvious destination for AKORA’s high-quality Bekisopa DRI concentrates.

AKORA is attracting interest

With a high-grade, low-impurity iron ore asset, and a compelling supply-demand outlook, it is no surprise that AKORA has seen strong interest from strategic investors, including major mining companies and commodity trading groups.

Indeed, there are relatively few mid-tier independent iron ore companies with high-quality projects, such as Bekisopa, with the potential to deliver iron concentrates for the green steel future.

Please note, this article will also appear in the sixteenth edition of our quarterly publication.