Innovation News Network spoke to Heather Arends, Mineral Potential Manager, and Ted Anderson, Assistant Director – Minerals at Minnesota’s Department of Natural Resources, about the great mining potential for emerging metals in Minnesota.

Mining in Minnesota holds immense potential for the state’s future economic growth and stability. With substantial reserves of high-quality iron ore and other valuable minerals, the industry is well-positioned to continue to supply the raw materials essential for many important sectors.

As global demand for steel and critical minerals remains robust, Minnesota’s mining sector is poised to play a crucial role in meeting these needs, creating jobs, fostering innovation, and bolstering the state’s economic vitality for years to come.

Moreover, with the potential for diversification into new and emerging mineral markets, the industry is positioned to adapt and thrive in a changing economic landscape.

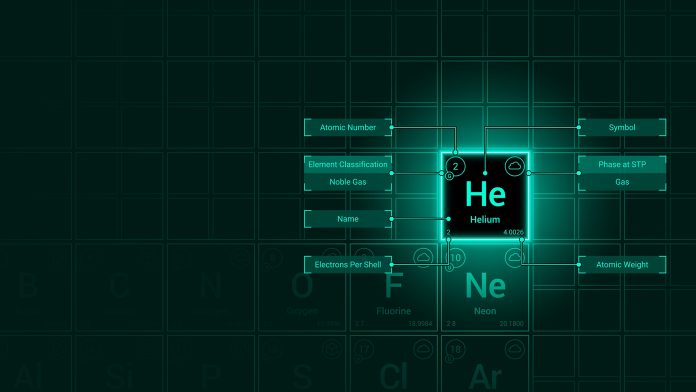

Like other raw materials, the helium market is on the rise.

The global helium market is currently valued at $4.6bn in 2023, and is forecast to reach $6.1bn by 2030.

Although helium is not yet on the US’ critical minerals list, it has many significant applications in various industries. For example, demand for the mineral is driven by its use in semiconductor manufacturing, healthcare MRI scanners, and space exploration. As emerging technologies continue to require more and more helium, this demand will only continue to increase.

With a rich history in resource extraction and home to the US’ largest iron ore operation, Minnesota is uniquely positioned to translate this expertise into the helium industry.

To learn more about mining in Minnesota and the potential of the state to produce helium, Innovation News Network spoke to Heather Arends, Mineral Potential Manager, and Ted Anderson, Assistant Director – Minerals at Minnesota’s Department of Natural Resources.

What is the importance of mining in Minnesota? What sets Minnesota’s mining industry apart from other US states?

Ted Anderson (TA): In terms of scale, we are in the top five out of the 50 states in non-fuel mineral production. Minnesota is also in the top three for the metallic minerals.

Iron ore mining in the state has been around for 140 years but we have been a significant producer for the last 100 years. We could have another 100 years of mining iron ore in the state with the current economy, as it is more than a $5bn industry.

In iron ore production on state lands in Minnesota, the average in royalties paid to the state has averaged about $35m per year. This is payable to the trusts the state represents, namely for K-12 public education, the University of Minnesota, and local taxing districts.

Heather Arends (HA): Our iron range and mineral potential competes on a global scale. One of the attributes that sets us apart is our robust infrastructure that supports mining.

The state can be accessed via rail. With this access, minerals can be transported to Canada and other facilities in the US for further beneficiation. We also have a robust port system that has access to the Great Lakes.

The state’s infrastructure is what sets our mining industry apart.

What potential does the state hold for delivering the minerals needed for the US’ energy future?

HA: Minnesota has amazing mineral potential. Much of Minnesota’s geologic terrane is a continuation of the mineral-rich Canadian Shield of Ontario and Quebec, which has yielded iron, gold, silver, zinc, copper, nickel, diamonds, and titanium. However, central Minnesota has more glacial overburden than Canada, which means minerals are not as easily accessible as they are in Canada.

The Duluth Complex is the third-largest undeveloped copper and nickel resource and fourth largest undeveloped resource of platinum group minerals (PGM) in the world. It is home to the largest undeveloped source of domestic cobalt. Also, there is current exploration of manganese in a district known to be the second largest undeveloped manganese resource in North America.

Some of the early results from that exploration are yielding a staggering concentration of manganese.

Lesser explored, there is titanium, palladium, graphite, and potential for lithium.

Minnesota also has copper, which is hugely significant, and nickel, which recently got added to the Critical Minerals List.

Talon Metals is exploring a high-grade nickel deposit. They are starting environmental scoping for the mine. It is estimated that they will go online as the other US nickel mine begins to close.

Does Minnesota have the resources to facilitate the production of helium?

TA: In the North of Minnesota, Pulsar Helium hit an occurrence of over 10% helium. This is a pocket of high-grade, pure play helium. It is called this because most of the helium produced in the US is taken out of high helium natural gas. This is then refined.

We are watching this; and it is exciting. However, it is only one occurrence.

Whilst we recognise the potential of helium mining in Minnesota, there is more work to be done on the helium project.

HA: Helium is new to Minnesota. We are not an oil and gas state. We also are one of 12 states that do not produce coal. So, the potential for energy and gas production is a recent development.

We are in the process of gathering information and seeing how this fits into our regulatory structure.

What is the state government doing to take advantage of Minnesota’s natural resources?

HA: Minnesota is a land grant state which means that certain sections within the state are set aside for revenue generation. It is in our constitution that the revenue generation of these certain sections go towards funding public schools. A smaller portion of land funds higher education.

As a land manager and a trustee, we have a fiduciary responsibility to manage these lands in a way that provides revenue in an environmentally-sound way.

TA: Since inception, iron ore has contributed almost one billion dollars to these trust funds. Just over the last ten years, mining in Minnesota has generated an average of $35m per year for these trusts.

We also administer leases for local taxing districts. Small townships boom when mining occurs in their area.

The administration of mineral lands on multiple state trust ownership, gives the state opportunities to develop larger scale mining projects when applicable.

HA: The school trust fund is around 2.5 million acres, and the mineral estate is around 5.5 million acres. Our total surface estate is around 5 million acres, and the mineral estate is 12 million acres.

It is unusual within the US states, except in Western states, to have such a large public mineral estate to manage.

While there is a regulatory gap in Minnesota to facilitate helium mining, we are currently identifying these gaps, as well as stakeholders, to find the best path forward.