The Road To Price Parity: Competition Heats Up In Mexico, A Tsunami Of EVs Arrive In Colombia

Recent arrivals in Mexico and Colombia show Chinese EVs pose an ever-growing threat to mainstream automakers in Latin America.

We’ve known for a while that China is the queen of affordable EVs, yet that mattered little when Chinese brands were mostly limited to the mainland and EVs represented only a fraction of all cars sold worldwide. But that scenario no longer exists, and the world automobile market is now at stake: its future will depend on how fast the Chinese are able to conquer foreign markets, and on whether mainstream automakers will be able to offer EVs at competitive prices before that happens.

Nowadays, it seems the Chinese are winning this race. They are rapidly gaining traction on their turf, Southeast Asia, and in nearby Oceania. BYD and MG in particular have rising market share in Thailand, the Philippines, Australia, and New Zealand. And it’s becoming clear by the day that Latin America is their next target, with Mexico and Colombia having quite a bit of EV novelties in the last couple months.

I’ve long said, and I maintain, that EV price is the main hurdle for adoption in this region, as cities have strict limitations for internal combustion engine (ICE) vehicles and electricity is quite cheap compared to gasoline and diesel. Once EVs reach price parity, I predict the transition will happen very quickly. Because of this, I will compare all EVs arriving in the region to the — in my opinion — closest ICEV equivalent, to showcase how far (or how close) we are to price parity. All comparisons will be done with the entry-level ICEVs to make a more accurate “affordability index,” so to say.

BYD & Great Wall Motors (GWM) Arrive in Mexico in Full Force

Both BYD and GWM had had operations in Mexico for a while, but during the last month, both automakers announced the arrival of two very compelling and competitive models: the BYD Dolphin and the ORA 03 (ORA Good Cat). These vehicles are available at a cost of MXN $535,900 and $536,900, or $31,300 and $31,366, respectively, for their entry models. Both vehicles (but particularly the Dolphin) have received significant attention in Mexican media, and reviews have been quite positive so far. These are the first vehicles in the country offering a fully functioning car capable of short road trips, for a reasonable price. As such, we expect them to be a success.

More importantly, the two hatchbacks offer much better value for money than the available EVs in Mexico. It’s possible their arrival will trigger a price war, causing the competition to lower prices, bringing more Chinese EV models to market on the affordable(ish) side. I say Chinese EVs and not EVs in general because the cheapest non-Chinese options in Mexico — the Chevy Bolt ($46,880) and the Nissan Leaf ($56,500) — can’t dream of competing in this price bracket.

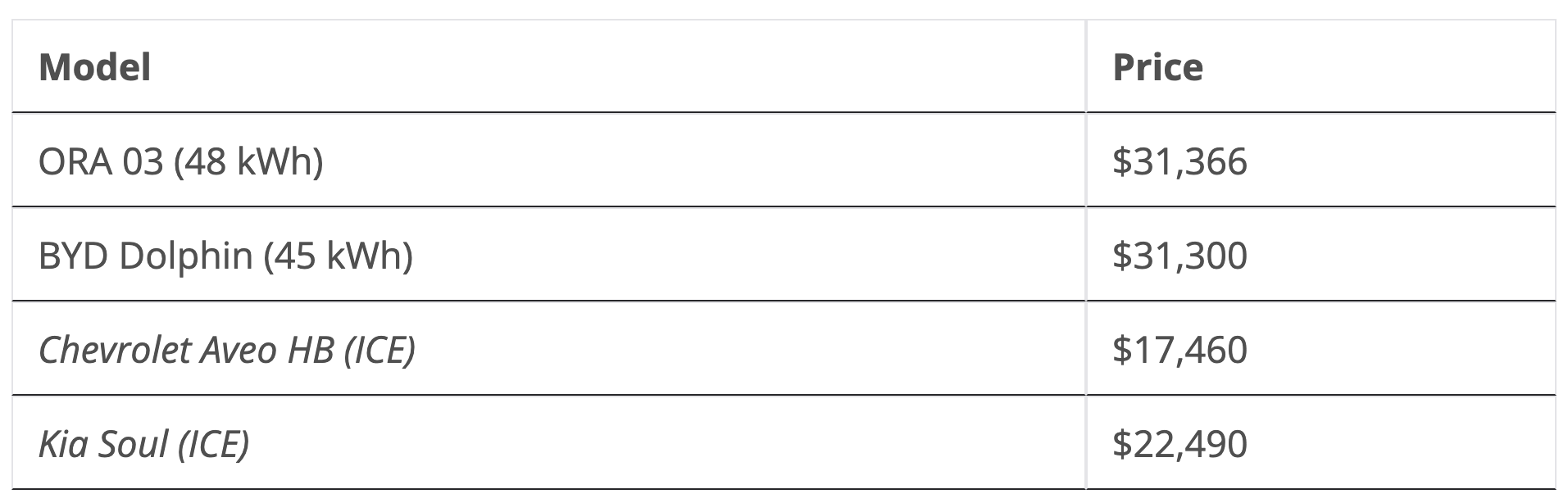

As competition heats up, it’s pertinent seeing what these cars are up against in the ICE world:

The lack of entry-level EVs is no doubt hurting EVs, as the BYD/GWM duet stand at 80% more than the Aveo and 40% more than the Soul. Keep in mind that even though fuel and maintenance are cheaper for an EV, in developing countries, interest rates tend to be much higher, so the more expensive purchase price takes up a much higher toll.

Mexico has also recently seen the arrival of Auteco Blue, a Colombian company focused on EVs, bring trucks, vans, and the Zhidou D2S to market. (The D2S is a mini-car we reviewed in this article.) The Mexican market is heating up, and I expect H2 EV numbers to be much better than H1.

Colombia’s “Hall of the Automobile” Showcases the Arrival of a Tsunami of Chinese EVs

After a 5-year hiatus, Bogotá’s Hall of the Automobile was finally presented in October, and it was home to a veritable tsunami of EVs, most of them coming from China.

Even though most of the Hall was still dedicated to ICEVs, I think it’s fair to say that it was EVs that generated the most interest. I was honestly stunned by BYD’s stand, perpetually full of people impressed at the BYD Yuan Plus, checking the Dolphin’s design, and looking at the new BYD Seagull (more on that later) … and yet, more than BYD, it was Changan that got all of the headlines with its small Changan Lumin, a 13.5 kWh, two-seat, incredibly cute mini-car.

Other Chinese brands present in the Hall were JAC, JMS, Chery, MG, and Seres. Non-Chinese brands presenting EVs were limited to Renault (though, the Kwid E-Tech is made in China), Hyundai/Kia, and some luxury brands. None of these, other than the Kwid E-Tech, fall on the affordable side, so I won’t mention them much.

Aaaaand there was Toyota, showcasing its BZ4X, which it plans to start selling in … 2028. Seriously. Toyota, why even bother?

In any case, let’s look at every segment separately:

City Cars: JMS EV3, Changan E-Star, JAC E10X, Renault Kwid E-Tech, BYD Dolphin Mini.

As of today, the city-car segment in Colombia is starting to get overcrowded.

The arrival of the BYD Seagull (rebranded “BYD Dolphin Mini”), the Renault Kwid E-Tech, and the JMS EV3 heat up competition in a segment that for over a year had been left solely for the Changan E-Star (Changan Benni) and the JAC E10X.

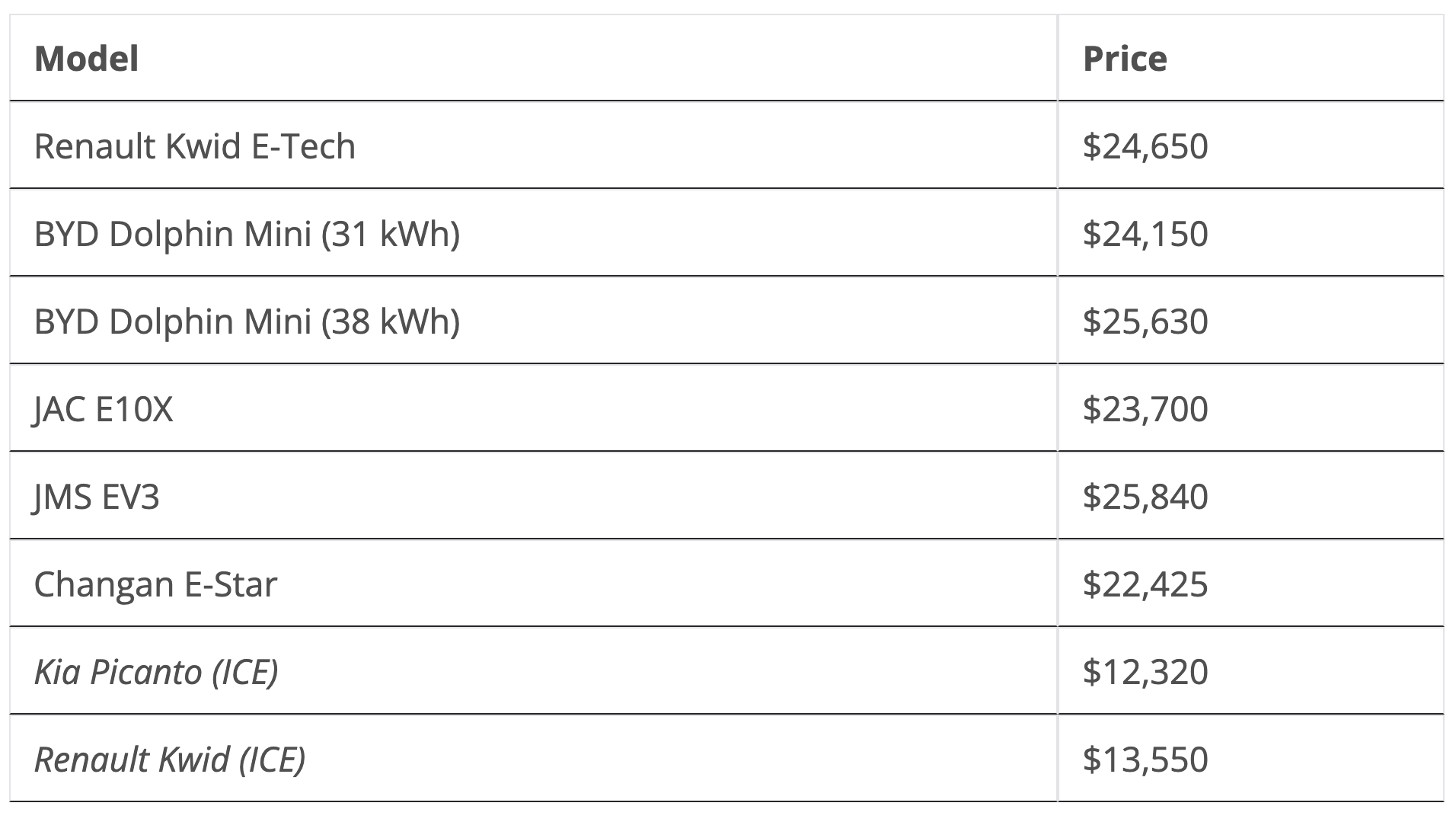

The models present surprisingly consistent specs, with 31 kWh batteries for all of them except the Kwid E-Tech (27 kWh) and the long-range BYD Seagull (38 kWh). Pricing, however, is more variable, and regardless of model, still shows a significant distance between EVs and the ICEV competition:

At 65% higher cost in the best of cases, and 106% in the worst, this segment is still far from price parity, particularly so when we consider that the only EV capable of traveling is the BYD Seagull LR. I expect market saturation to make a dent in sales, and eventually force prices down … but we’ll have to wait and see.

Hatchbacks: BYD Dolphin, MG4

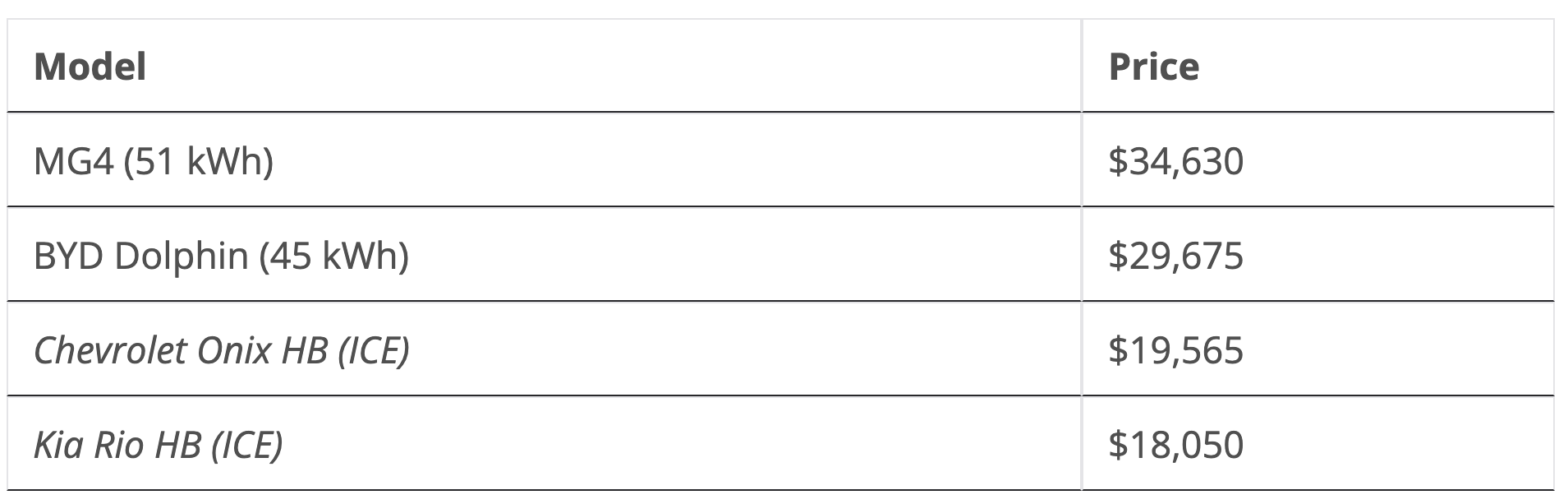

This segment is mostly limited to the BYD Dolphin and the upcoming MG4. Though announced, the MG4 was not presented in the Hall, but MG representatives told me the expected price was $34,620 for the cheapest version — a disappointing figure if I’m being honest.

The Dolphin, however, surprised me. According to BYD representatives, the price at the Hall was COP $120,000,000, or $29,675. This is coming down from $38,100 just a few months ago, showing that BYD may be finally getting serious about competing in this market, instead of using its brand recognition to get a few very profitable sales. Non-Chinese EVs in this segment are limited to the Nissan Leaf ($39,500) and the Renault Zoe ($42,000), once again so far up in the price range that they can’t meaningfully compete here. As for the ICE competition:

The BYD Dolphin, the cheapest of the two, is roughly 50% to 65% more expensive than a comparable ICEV. However, in this case, the competition is fiercer, because the Dolphin has decent range (unlike the city cars previously mentioned) and better equipment. Sadly, in practice, the Dolphin stands alone in this segment, and if BYD jacks prices up again, then competition will cool down. We need MG to lower prices, or GWM (already present in the country) to bring the ORA 03, just like it did in Mexico.

Crossovers: MG ZS EV, Seres 3, BYD Yuan Plus, JAC E40X

To be fair, though presented in the Hall, none of these vehicles were announced there. They all arrived in Colombia earlier this year. Still, the crossover segment is very popular and aspirational and, as we will see, may be the closest one to ICE price parity.

Even though the segment as a whole still has a ways to go, we can see that when comparing the cheapest EV (Seres 3) with the most expensive ICEV (Toyota Corolla Cross), we find a mere 15% difference. At this point, we’re certainly past the point where the EV has a lower total cost of ownership. Seres — a brand built by a DFSK/Huawei joint effort — doesn’t have any sort of brand recognition (unlike BYD and Toyota), nor a strong local ally to promote sales (like JAC and MG), so the comparison is not really apples to apples, but still, there’s hope here.

Non-Chinese EVs in this segment are more plentiful: the Renault Megane E-Tech (presented in the Hall in its 60 kWh version), the Chevy Bolt EUV (65 kWh), the Hyundai Kona EV (40 kWh), all costing $49,400, as well as the Kia Niro (65 kWh, $53,230). Once again, as much as I absolutely loved the Megane E-Tech design, I find it hard for it or any of these models to compete: their slightly larger batteries don’t make up for such a significant cost difference (and the Kona has no justification for it at all).

Final Thoughts

Competition is heating up, and even if prices haven’t come down as fast as we would’ve wished, they have significantly improved in 2023.

At this point, I feel the EV segment is lost to mainstream brands. They’re offering the same value (perhaps a little more range) for a lot more money … and they seem to be falling behind more and more as we speak. European brands, in particular, are still giving up a fair fight, promising more affordable EVs as early as 2025 (VW ID2, Renault 5, Citroën ë-C3), and the Korean duet Hyundai/Kia seems to be gearing up as well … but I have less faith in North American brands, which have apparently given up in the fight, focusing on highly expensive SUVs that they’re not even exporting to the region.

As for Japanese brands, who knows?

But my real question is not about EVs, but about ICEVs. As prices fall, how long until EVs start eating up ICEV market share? Already, we’ve seen BYD, GWM, and MG take more and more of Toyota’s, Honda’s, and Nissan’s piece of the cake in China and Southeast Asia, and with BYD’s ute in the making and very competitive prices for its other vehicles, Australia and New Zealand are not going to be far behind. For now, mainstream brands in Latin America are relatively safe, only losing a percentage of market share to newcomers in a segment they didn’t really seem too interested in … but this, I foretell, won’t last long.

What do you guys think? Will mainstream automakers be able to leverage their knowledge and brand recognition to maintain control of the market? Or is it time for them to start panicking?

Featured image: Ora 3 courtesy of Ora

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Video

CleanTechnica uses affiliate links. See our policy here.