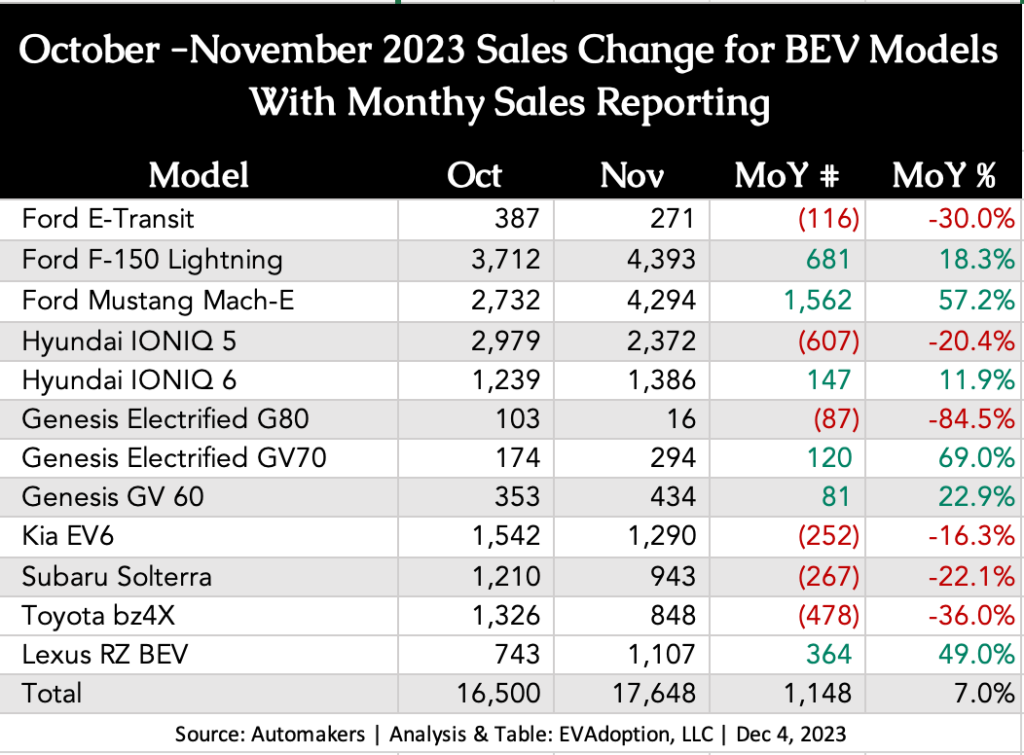

While many news stories, automakers, and analysts continue to claim that demand has fallen greatly for EVs and inventory is ballooning at dealers, actual reported sales continue to be relatively strong, despite a 20-year high in auto loan interest rates. Based on reporting from automakers for 12 BEV (full battery electric) models sold in the US, November sales were up a combined 7% versus October.

Note: Most automakers now report vehicles sales on a quarterly basis, and we are only able to obtain monthly sales on a small number of models. And in fact, many automakers don’t breakout sales of their BEVs, and very few report sales of their PHEV models.

The month-over-month (MoM) sales change was quite a mixed bag, with six models seeing an increase and six a decrease. The Ford Mustang Mach-E continues to see strong sales (up 57% MoM), the F-150 Lightning had its best sales month ever (up 18%), the Lexus RZ BEV saw a very solid increase at 49%, as did the Genesis Electrified GV70, albeit on small volume, (up 69%).

On the downside, the Genesis Electrified G80 had the steepest drop at 85%, but at a tiny volume to begin with. From a volume decrease perspective, the Hyundai IONIQ 5 had a decrease of 607 units (-20%) and the Toyota bz4X slipped 478 units (-36%) from October. Interestingly, the other two models based on the bz4X platform, the Lexus RZ BEV (up 49%) and Subaru Solterra (-22%), were split with the much more expensive Lexus BEV perhaps stealing some share, although at quite a premium to the buyers.

We at EVAdoption are not fans of deriving much meaning from MoM sales data, as sales of EVs (and vehicles in general) can fluctuate widely from month-to-month, and believe that you generally need 4-6 months to get a reasonably accurate view of sales trends for an individual model. That said, with so many companies, reporters, and industry observers claiming the bottom has fallen out of the EV market in the US, we thought it was worth analyzing and sharing these recent MoM numbers.

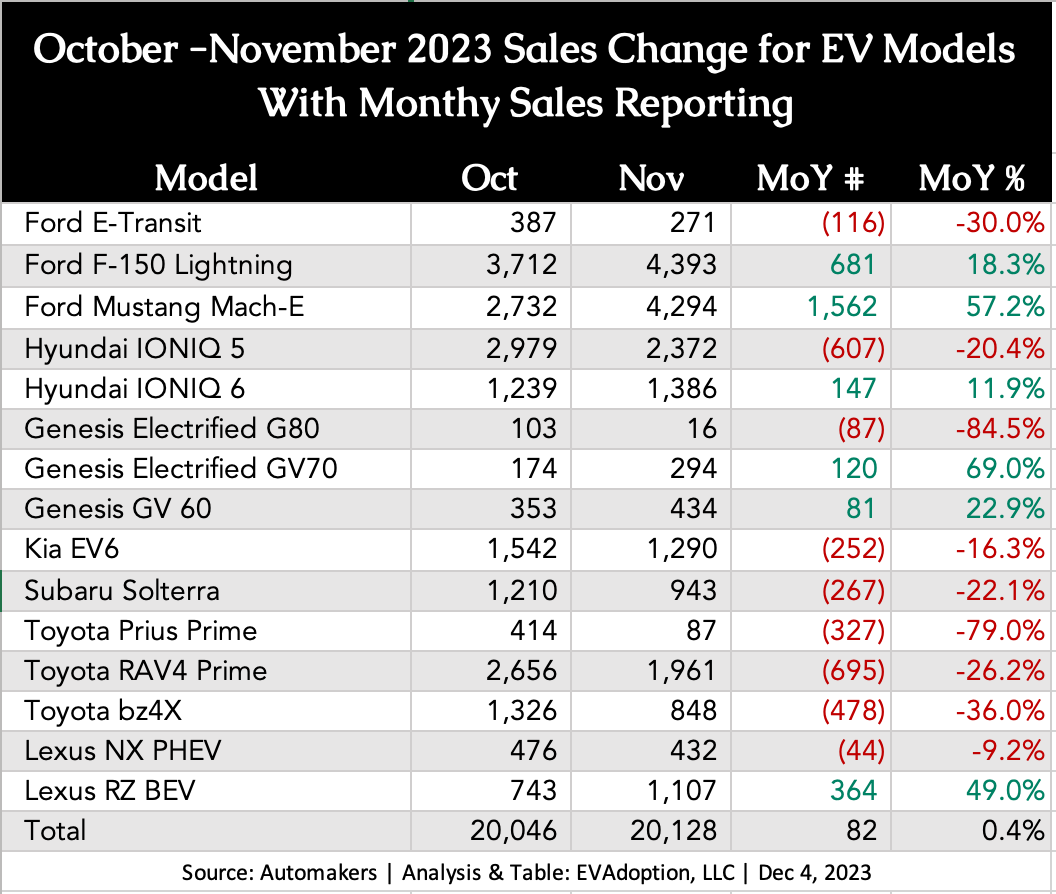

In the table below we’ve added the three PHEVs from Toyota/Lexus, the only PHEVs where we can obtain monthly sales data. All three PHEVs saw MoM declines, however, the Prius Prime decline has nothing to do with demand, but rather battery supply issues and Toyota likely prioritizing battery cells for BEVs and regular hybrids. If you include these three PHEVs in the mix of models, then sales were up only 0.4% across 15 EV (BEV and PHEV) models where monthly data is available.

What does it all mean? Very little, except that as always, sales are up and sales are down for EV models every month … but at least across the 12 BEV models analyzed above, it doesn’t look like the sky is falling on EV sales in the past few months. And in many cases, the fluctuation in sales can be more attributed to temporary supply issues, rather than a significant change in demand.

At least for now, Chicken Little can rest easy, that no acorn EVs are likely to fall on his head.