Sales of the EV models with automaker reported sales were up 11.6% in Q3 versus Q2 2022, according to new analysis from EVAdoption’s EV Sales Scoreboard. While solid overall growth, this was a decline of roughly 34 percentage points from the second quarter increase of 45.3 percent over Q1.

Average US sales of the 32 EV models for which OEMs reported sales and that were available in the period July-September, were up an average 10.5%. On a median basis, however, sales declined 23.5% in Q3 over Q2.

View the Q3 Sales Scoreboard: a sortable database-driven version of the table

Nine BEVs and PHEVs had positive growth in Q3, while 19 models saw declines in Q3, although two of those models (Honda Clarity and Mazda MX-30) have been discontinued, sales of the Toyota bZ4X were halted while they fixed a mechanical issue; and the Mitsubishi Outlander PHEV is in transition to the new 2023 model. Five other models were new to the market in Q3 and did not have sales in Q2.

EVs With the Biggest Q3 vs. Q2 Sales Increase and Decrease

Five EVs had a greater than 100% Q3 sales increase:

- Volkswagen ID.4: 301%

- BMW i4: 206.6%

- Ford F-150 Lightning: 181.5%

- Chevrolet Bolt EV/EUV: 111.8%

- Lucid Air: 105.9%

10 EVs had a decline of greater than 40%:

- Mitsubishi Outlander PHEV: -98.5% (Transitioning to an upgraded version for 2023)

- Honda Clarity: -98.1% (Discontinued but Honda is still reporting sales)

- Mazda MX-30: -94.1% (Production for the US discontinued)

- Volvo C40: -62.4%

- Nissan LEAF: -60.8%

- Chrysler Pacifica Hybrid: -49.0%

- Audi e-tron Sportback: -48.9%

- Porsche Taycan: -47.5%

- Audi e-tron: -40.2%

- Ford E-Transit: -40.2%

Notes On the Sales Data

As a reminder, sales of US EVs (BEV and PHEV) for models where the OEM publicly reports sales numbers. Not included in this table: EV models from automakers that do not break out either or both of BEV or PHEV sales by model for the US, including Tesla, Volvo (PHEVs and the XC40), Polestar, BMW (PHEVs), Ford (PHEVs), Land Rover, Jaguar, Kia (PHEVs), Hyundai (PHEVs), and Audi (PHEVs). Rivian does not break out sales of the R1T and R1S models, but reports the combined sales. Lucid Motors reports deliveries during its quarterly earnings call.

EVAdoption estimates sales for those models that are reported on, and will provide those numbers through an upcoming EV sales data subscription.

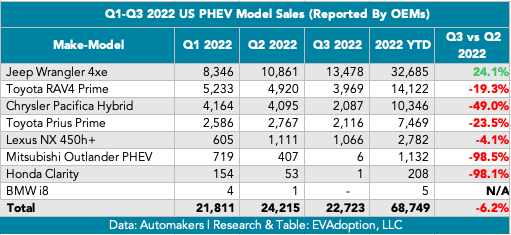

PHEV Sales Trends

Overall PHEV model sales were down 6.2 percent for Q3 versus Q2, and individual model sales were down an average 38.4% and on a median basis, declined 23.5%. With a sales increase of 24.1%, the Jeep Wrangler 4xe was the only PHEV with positive QoQ growth. The strong sales of the Wrangler 4xe continue in 2022, with solid increases in each quarter. The Wrangler 4xe is on pace to finish 2022 as the highest selling PHEV for the second consecutive year and also as the highest-selling EV in the US after the Tesla Model Y and Model 3 BEVs.

The Toyota RAV4 Prime PHEV had a very disappointing Q3 with a 19.3% decline over Q2 and continuing QoQ declines in 2002. The Chrysler Pacifica Hybrid (PHEV) had a sales decline of 49%, perhaps due to strong sales of the Toyota Sienna minivan, which is now available only as a regular hybrid.

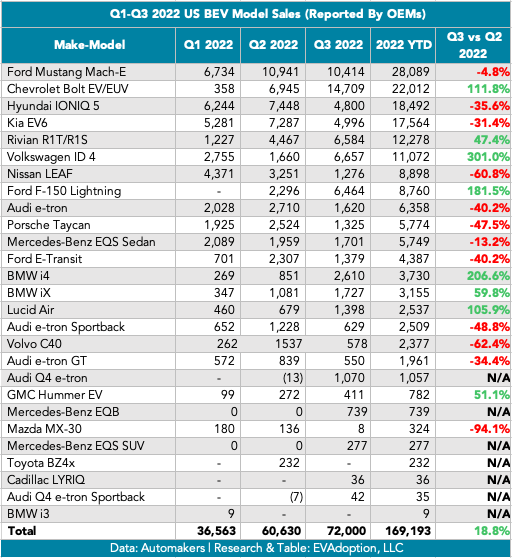

BEV Sales Trends

Overall BEV sales of OEM reported models increased 18.8% in Q3 versus Q2. The average sales change for individual models was up 27.6%, but the median sales change was a decrease of 22.3%. Twelve BEVs saw sales declines in Q3, while 8 had sales increases. Seven BEV models we considered not applicable as the models either began selling in Q3, were discontinued in earlier quarters, or in the case of the Toyota bZ4X sales were halted due to recall.

Despite a 4.9% decline in Q3 sales, the Ford Mustang Mach-E is on track to end 2023 as the top-selling non-Tesla BEV. The two Chevrolet Bolt EV and EUV models would have to outsell the Mach-E by more than 6,000 units in Q4 to surpass the Ford BEV. The 301% increase for the VW ID.4 was impressive and the model could continue to see strong growth as production volume scales as it is now being produced in Volkswagen’s Chattanooga, TN factory.

The Ford F-150 Lightning also had strong growth of 181.5%, but was still only on a monthly pace of around 2,150 units. At this pace, the Lightning would only reach annual sales of roughly 26,000. I expect Ford to continue to scale up production in Q4 and in 2023, and potentially reaching sales of 50,000 units next year.