Crypto Mining for a More Stable Grid?

Is cryptocurrency the magical Texas route to resource adequacy? Or just magical thinking?

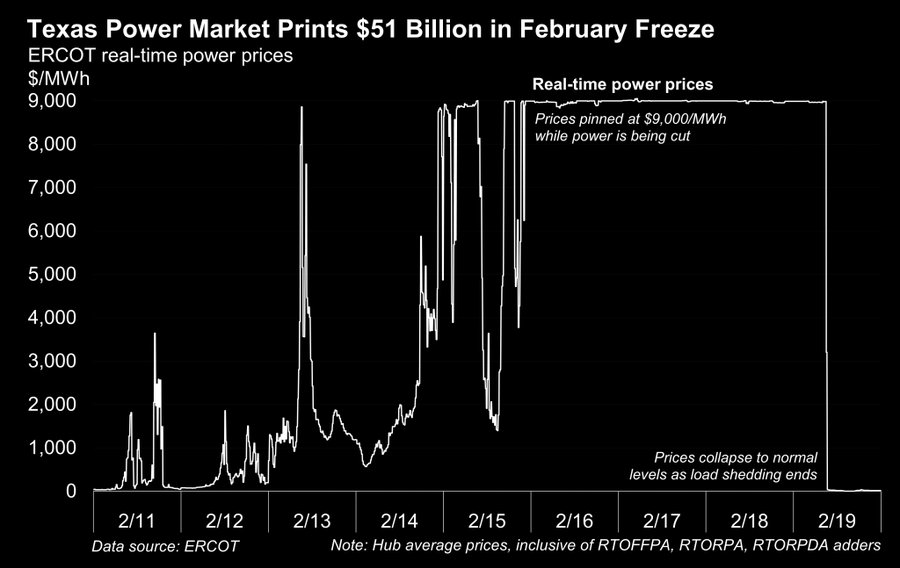

Of all the proposals to avoid another Texas electricity crisis like February 2021, surely the most outside-the-box is Gov. Abbott’s plan to increase electricity demand from electricity-intensive cryptocurrency mining. The idea is to beef up electricity demand with new crypto mining, which will then attract new supply. And then scale back the crypto demand when the grid is strained and have that supply available for other consumers. Clever, right? Or maybe a bit too clever.

Of course, crypto currencies themselves are controversial: are they a Ponzi scheme or brilliant currency innovation? Does their mining destroy the environment or support a clean energy transition? Is crypto mining an economic boost for surrounding communities or a visual and noise nuisance? I’m going to set those issues aside today and focus on whether the Texas plan for grid reliability through crypto mining will work.

(Source)

(Source)

At first, the answer may seem to be obviously no: Adding demand will just make a grid tighter and increase capacity problems.

But promoters of this plan highlight that their economic thinking goes beyond the short-run demand increase to consider the longer-run additional supply that the demand would elicit. Plus, the plan recognizes the heterogeneity among electricity buyers, that crypto mining electricity demand is likely to be highly price-responsive and nimble, so it would quickly disappear when the price shoots up.

Boosting Capacity or Just Picking Up Excess Supply?

But the actual impact of this demand on market equilibrium will be more nuanced, and probably not in a way that is good for the plan. If crypto mining demand goes away during price peaks, then it doesn’t boost profits of electricity sellers at those peak times, profit that is a significant driver of new generation capacity investment.

In fact, if crypto demand is only a factor when low-cost supply is abundant (that is, very elastic supply, in econospeak), then it is unlikely to raise price much in those hours, so it doesn’t make new capacity investment more profitable. More generally, increasing demand at times when capacity is not scarce does not raise long-run investment in capacity (as I demonstrated in a 2005 paper, but I’m sure others had shown previously). Even if it increases price during off-peak times, that just leads to substitution of baseload for peaker capacity, but not more capacity.

Basically, crypto miners would just pick up the excess supply from existing capacity in off-peak hours, creating little or no need for new capacity. If no new capacity is needed, attracting crypto to an area doesn’t address peak capacity shortfalls.

And, of course, there is also the question of whether the crypto mining industry is the sort of long-term stable demand augmentation that capacity investors would be looking for. The volatility of crypto currency values isn’t the most reassuring signal to generation investors. Nor are plans to drastically reduce energy used in crypto mining.

Whether crypto mining in Texas will significantly increase supply available during grid emergencies is ultimately an empirical question, but it is far from the slamdunk that some advocates suggest. If this is anyone’s idea of a serious response to the February 2021 electricity crisis, they really need to consider alternatives.

Mining Demand Response Payments

My concern about plans to use crypto mining for grid reliability, however, goes beyond whether it will really incentivize new generation capacity investment.

Most of the discussions envision miners cutting back during peak times as part of a demand response program. Demand response programs pay customers to reduce usage of electricity that they would have otherwise consumed. That can make some sense if the customer is buying at an inflexible retail rate and otherwise has no incentive to adjust (though even then such programs are subject to potential waste and abuse).

But, the crypto mining business model is based on buying electricity at wholesale prices or on a real-time variable price tariff. They would already have a strong incentive to cut back during grid emergencies without the additional payments from the demand response program, especially in Texas with its $5000/MWh wholesale price cap. That means the mining companies get paid for taking demand off the grid that they never would have put on the grid at those high prices anyway.

(Source)

(Source)

Actually, the interaction of crypto mining and demand response payments is even more concerning, because the payments are based on reductions from a baseline, which is usually determined by the customer’s consumption in certain previous hours. There is an industry of consulting firms set up to teach customers how to “optimize” payments from such programs, what some people would call maximize abuse of the system.

The constraint on such “optimization” is the customer’s limited ability to move around demand to create as high a baseline as possible and then reduce from that baseline when the demand response program is activated. 30% to 40% of crypto mining electricity usage is for fans and other cooling technologies that can suck up power on demand? What a great technology for increasing baseline quantities to “optimize” profits from demand response programs.

Well, actually it’s even worse than that. Just as paying polluters to capture their emissions – such as with the HCFC-22 refrigerant or methane from cattle – can encourage creation of such polluting activities by adding to the polluters’ operating profits, paying crypto mining for demand response is likely to encourage more crypto mining.

(Source)

(Source)

Is crypto mining the Ivermectin of grid reliability?

I admit, I’m not a crypto fan. I lean towards the environmentally-damaging, Ponzi-scheme view. But even if it is a brilliant financial innovation, it’s unlikely to be much help in the electrical engineering of a grid. Adding demand that disappears when the grid capacity is strained doesn’t create much incentive to add grid capacity, and that goes double for demand from an industry whose future is far from certain. At the same time, crypto mining is just about perfect for exploiting poorly-designed demand response programs, which would mean paying millions to “reduce demand” that was never going to be there in the first place.

Find me @BorensteinS most days tweeting energy news/research/blogs.

Keep up with Energy Institute blog posts, research, and events on Twitter @energyathaas.

Suggested citation: Borenstein, Severin. “Crypto Mining for a More Stable Grid?” Energy Institute Blog, UC Berkeley, March 21, 2022, https://energyathaas.wordpress.com/2022/03/21/crypto-mining-for-a-more-stable-grid/Categories

Severin Borenstein View All

Severin Borenstein is Professor of the Graduate School in the Economic Analysis and Policy Group at the Haas School of Business and Faculty Director of the Energy Institute at Haas. He received his A.B. from U.C. Berkeley and Ph.D. in Economics from M.I.T. His research focuses on the economics of renewable energy, economic policies for reducing greenhouse gases, and alternative models of retail electricity pricing. Borenstein is also a research associate of the National Bureau of Economic Research in Cambridge, MA. He served on the Board of Governors of the California Power Exchange from 1997 to 2003. During 1999-2000, he was a member of the California Attorney General's Gasoline Price Task Force. In 2012-13, he served on the Emissions Market Assessment Committee, which advised the California Air Resources Board on the operation of California’s Cap and Trade market for greenhouse gases. In 2014, he was appointed to the California Energy Commission’s Petroleum Market Advisory Committee, which he chaired from 2015 until the Committee was dissolved in 2017. From 2015-2020, he served on the Advisory Council of the Bay Area Air Quality Management District. Since 2019, he has been a member of the Governing Board of the California Independent System Operator.

Hi Severin,

Crypto mining operations is a very flexible demand asset and would be a mistake not to harness its load flexibility to provide services in the wholesale and retail energy markets. We have two such projects in the international markets to do just that. They energy source is on-site renewable energy. Of course I agree that the baseline calculation problems for mining operations modeled as DR assets will get worse, but many sophisticated methodologies are currently being developed to drastically address some of these problems.

There are plenty of ways to use up excess electricity, e.g. desalinization of water in the west?, (carbon capture?, pumping water out of raising oceans?) or just store it (batteries, hydro etc) when the price is negative;

The only issue are the capital costs to do so (e.g. desalinization plants). I doubt that the GPUs, CPUs, or ASICS, motherboards, etc to do cryptomining can be cost effective in any way if they only run a few hours a day.

Given events in Eastern Europe the DOE could consider going green and look at running damage estimates when curtailment levels are high. Many evaluations could have been run on the 18th of this month on the CASIO grid for minimal generation charges to the DOE. Personally I’d charge the DOE 10 times the normal distribution and transmission changes to get the energy to the servers, but others might disagree with this approach.

My old neighbor had some responsibility for military assets and their use (tanks, artillery and shell details, aircraft and their ordinances) near the 49th parallel. Around the time Mike was on the DMZ the use of neutron bombs were taken off the table. As the market design at CASIO is leading to over supply (curtailment) the DOE could be called on to meet their on- going green objectives by running models solely with green generation.

Amen

I would suggest that this discussion should be had without bias for or against crypto currency. It is time for monopolies and governments to stop choosing winners and losers. Rather, the electric industry should simply look at a load’s characteristics and provide prices accordingly.

I would argue that if there are customers out there that can increase the utilization of resources by paying a rate that is greater than incremental costs it can only be a good thing for the industry and the economy.

To avoid the games that might be played using demand reduction credits, rates must change to reflect the realities of the electric energy business. (Rates should not be used to implement policies that redistribute wealth or charge based on a customers ability to pay.) Rates should be established to reflect costs. That means rates may not be as simple as they were in the past. For example, rather than giving some load a credit for reducing load at time of peak, all load should be charged properly for creating or contributing to peak loads. Load that does not contribute to the system peak, should not need to pay for the resources required to supply that system peak. If they ever want or need firm power, they should pay an amount greater than the cost of new resources. That might mean that new customers might be required to commit to years of service to assure that they can pay for fixed resources that are installed for their benefit.

.

Such an approach may lead to residential rates that are beyond the means of some consumers. I would posit that to the extent that is true, the state may need to initiate a utility support program similar the food stamp program. Such a subsidy would then be paid by tax payers throughout the state budget. Those subsidies would need to be directly approved by the legislatures rather than being hidden inside the rate structures of the utility. With cost based rates, the legislatures would need to directly tax their constituencies to implement some of the polices.

Toyota’s head of energy and environmental research, Robert Wimmer, testified before the Senate this week, and said: “If we are to make dramatic progress in electrification, it will require overcoming tremendous challenges, including refueling infrastructure, battery availability, consumer acceptance, and affordability.”

As energy policy planners, we need to try out new ideas for implementation in the next five to ten years. At the same time, we need to address how these new ideas will be applied to meet the demand for carbon free energy past 2035, and on out to our target date of 2045.

I agree with you, crypto mining does not appear to be useful now on in the future.

Gary

Reading this piece I couldn’t help but think of the demand response problems that arose with California’s electricity “interruptible” programs during the electricity crisis of 2000-01. The programs existed well before the crisis and were popular with large industrial customers that in the aggregate consumed more than 3000 MW of load. They received about a 25% discount on their rates for signing up for the program. Prior to the restructuring of the market in 1998, Edison and SDG&E had NEVER interrupted these customers, and PG&E had done only a few times mainly due to grid instability in the Bay Area. That changed when the wholesale-cost crisis began in spring of 2000.

In August of 2000, Gov. Gray Davis received a report from the California PUC and the now-defunct Electricity Oversight Board which noted the following: “The interruptions are voluntary, and utility ratepayers spend over $200 million per year to obtain the right to interrupt certain customers in times of short supply. The lower rates interruptible customers pay year round average out to $60,000 to $70,000 per megawatt per year in benefits for interruptible customers.”

The problem was that these interruptible customers had, by and large, signed up for these programs with the expectation that they would never, or almost never, be called upon to significantly curtail their load. But the crisis necessitated not only significant curtailment but for extended periods of time. According to the PUC/EOB report, “Hewlett Packard reports that a 20-minute outage at a circuit fabrication plant would result in the loss of a day’s production at a cost of $30 million. For purely digital companies, such as Oracle, the price of a power interruption is ‘millions of dollars per hour,’ according to the company’s energy director.” Simply put, these costs would (and did) quickly offset the customer savings from the rate discount, damaged the economy, and had minimal, if any, impact on alleviating the crisis. The interruptible programs became politically, economically and operationally untenable.

Crypto customers, as Severin is highlights, do appear more “nimble” in their demand. But there is a parallel to what happened in California in his observation that “crypto mining is just about perfect for exploiting poorly-designed demand response programs.” While the potential negative consequences for the plan proposed for Texas are arguably not as dire, proponents of this plan — and especially those deciding whether or not to implement it — need to think long and hard about the law of unintended consequences and the long-term financial and environmental sustainability of cryptocurrency for ERCOT ratepayers.

The BIP discount programs in the 1990s were used as “wink, wink” discount rates for industrial customers. Utility reps even told customers that they wouldn’t be interrupted. It was a way around the CPUC’s reluctance to give larger customers lower rates which would have meant either residential customers pay more or utility shareholders couldn’t earn as much. While they might have gone through the charade of designing interruptible rates, no one outside of the CPUC believed that they would actually be used. There was a group of “ratehawks” who worked with they customers to choose the best rate under this assumption.

Two thoughts: First, in the 2005 Statewide Pilot, the results showed that introducing TOU pricing delivered most of the demand reduction impacts with critical peak pricing (CPP) adding a smaller amount on top of that. Second, I’m not sure that the principle that peak demand drives capacity investment holds in a storage-constrained system. The Pacific Northwest system was long driven by energy demand because it has so much excess hydro capacity. And as we become more dominated by renewables, we will likely overbuild capacity to produce energy to be stored for later off peak periods.

Dear Severin,

While I share your concerns about crypto mining as an endeavor, I do not think your point about conventional demand response programs is relevant to the ERCOT part of Texas. Besides the specific ERCOT emergency response service, I am not aware of any baseline-based demand response programs provided by competitive retailers in ERCOT. That is, the miners in ERCOT will presumably all be reacting to either wholesale prices directly or whatever commercial arrangement they have with their retailer. Your point is well-taken that the usual problems with baseline-based demand response programs will be even more serious with cryptominers in other jurisdictions.

Ross

thanks Ross. I am glad that you agree with the concern in places where there are demand response programs with baseline calculations. I actually think there are plenty of examples of such demand response programs in ERCOT. there are a couple of links in the blog, and here are a few more.

http://www.energychoicematters.com/stories/20211016b.html

https://bridgevue.com/resources/faqs/

https://eepm.oncor.com/load-management-program.aspx

I would rather save the excess wind energy for charging up EVs than waste it on bitcoin computers.