Part 1: How automakers’ disappointment in Electrify America drove them into Tesla’s arms

Part 2: No, NACS is not today’s Tesla connector

Part 3: Why Tesla’s NACS is unlikely to kill CCS

EV charging is changing, but much remains to be settled

A flurry of news over less than a year permanently altered the US landscape for EV charging. To put these startling developments in context, Charged interviewed more than a dozen executives, engineers and analysts from automakers, DC fast charging network operators, charging hardware firms and other businesses.

Group of Seven gels, finally

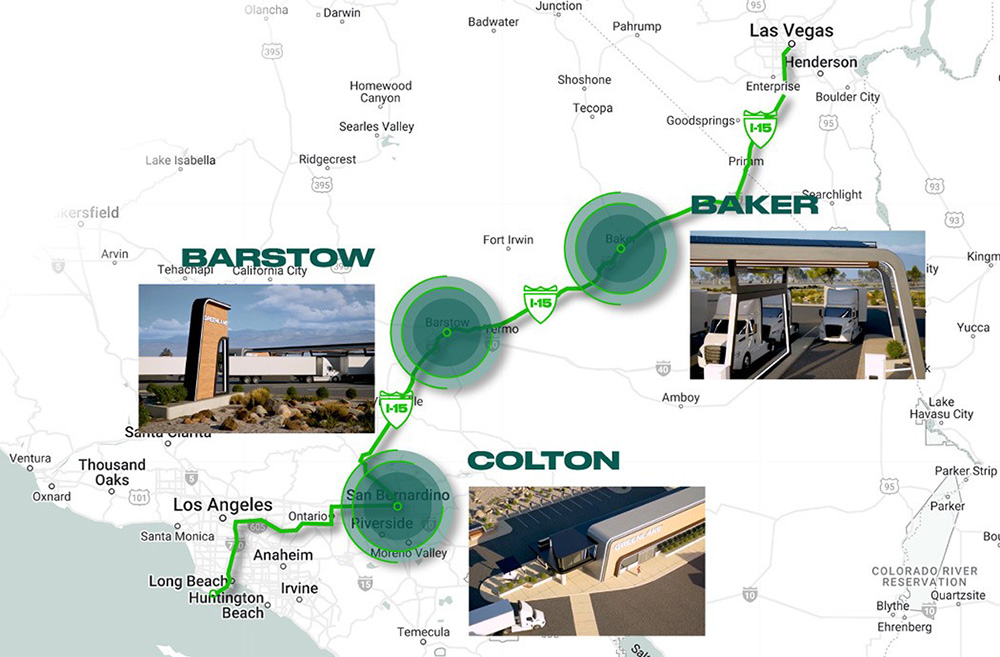

The group of automakers committed to forming a joint charging network have long had a model to follow: Ionity, the pan-European high-speed charging network. It was formed in 2017 by BMW, Daimler (Mercedes-Benz), Ford and the VW Group (Hyundai/Kia joined later), and its first stations went live in Q2 2018. By all accounts, Ionity works largely as claimed, with few reliability problems. The network plans to have a total of more than 5,000 fast charging sites in 20 countries in operation by early 2025.

An earlier version of this US group almost gelled in 2021 or 2022, according to an exec we spoke with, but some members balked at the cost to each company—hundreds of millions of dollars, to start.

An earlier version of this US group almost gelled in 2021 or 2022, according to an exec we spoke with, but some members balked at the cost to each company—hundreds of millions of dollars, to start—and its likely bottom-line impact and effect on stock prices. The German members, BMW and Mercedes-Benz, doggedly kept the plan alive.

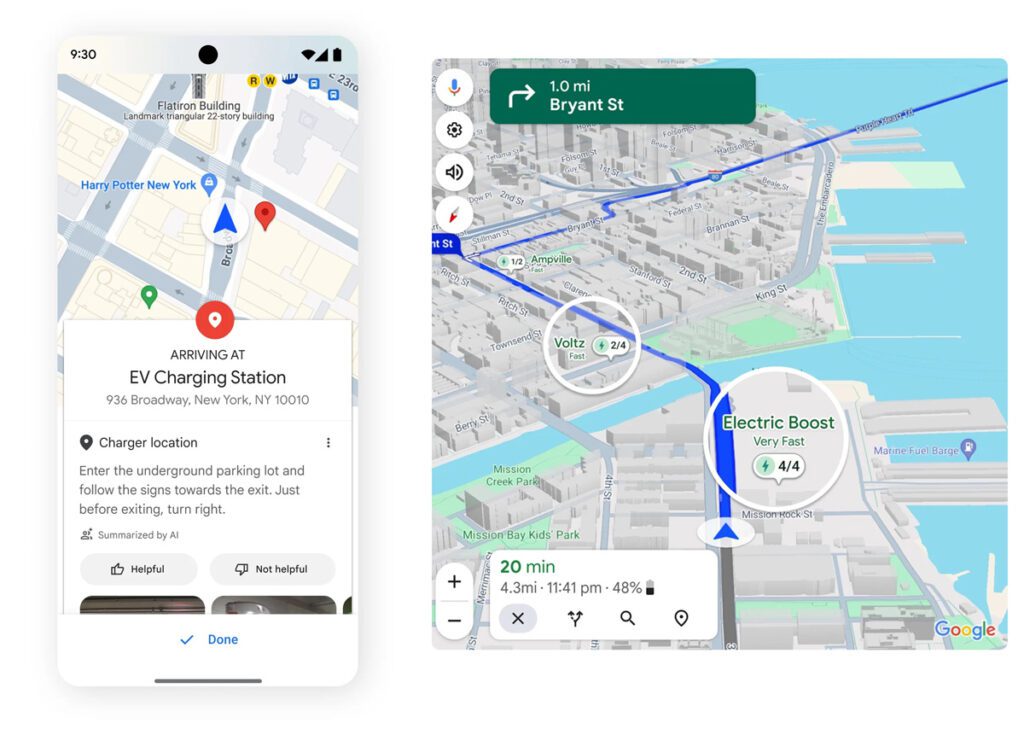

By the middle of this year, it was clear that the reliability of nationwide DC fast charging remained unacceptable. Something had to be done—and cash was available to do it. Both the National Electric Vehicle Initiative (NEVI) within the 2021 Infrastructure Bill and EV charging allocations within the 2022 Inflation Reduction Act provide funds for the manufacture, purchase and/or installation of EV charging stations.

The Group of Seven has two US members, GM and Stellantis; two German makers, BMW and Mercedes; two Korean members, Hyundai and Kia; and one Japanese maker, Honda. Not all of them say they plan to adopt the Tesla connector. After Ford’s Tesla announcement, BMW and Mercedes in particular are said to be fearful that Tesla—which has eaten meaningfully into the Germans’ birthright of fast, luxurious, expensive vehicles—would end up controlling their own EV customers’ charging technology and experience.

Not all of them say they plan to adopt the Tesla connector. After Ford’s Tesla announcement, BMW and Mercedes in particular are said to be fearful that Tesla—which has eaten meaningfully into the Germans’ birthright of fast, luxurious, expensive vehicles—would end up controlling their own EV customers’ charging technology and experience.

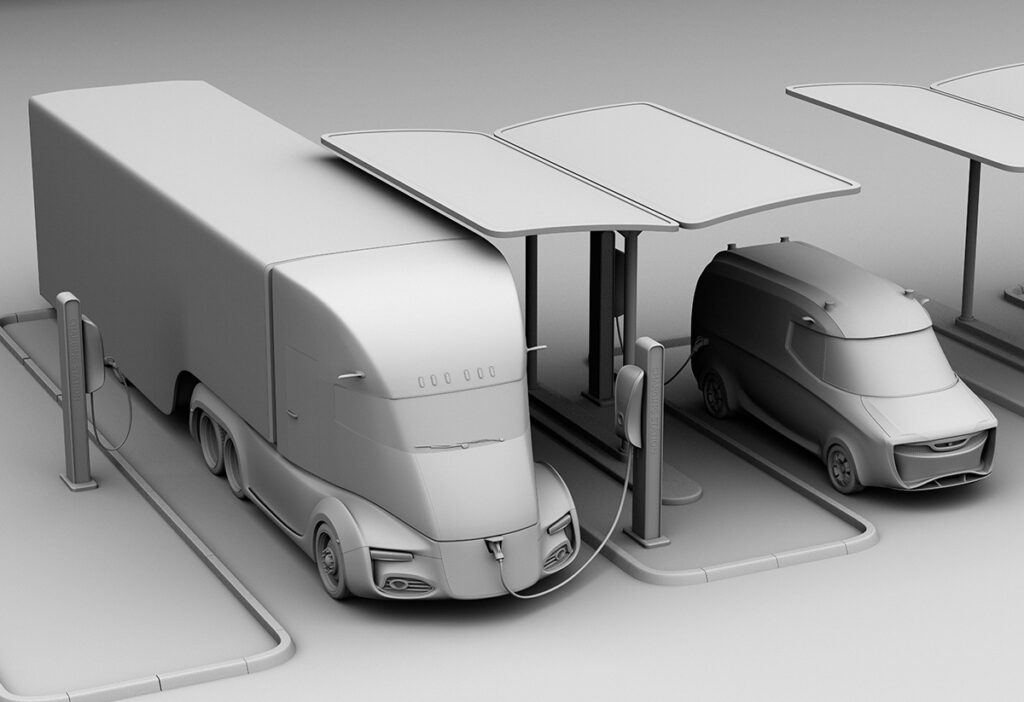

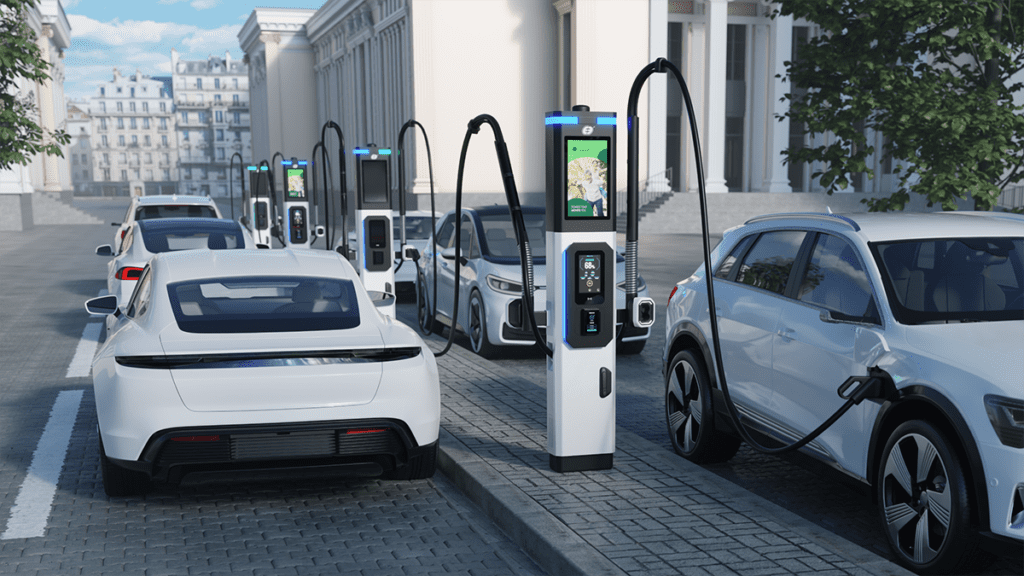

The two German brands also wanted a new experience for their EV drivers, highlighted by Mercedes-Benz with its plan to create a more pleasant network of 10,000 charging sites across multiple countries and a reservation-only concept station in Berlin pioneered by Audi. (Porsche has its own as well.) Mass-market brands may decide a charging session on a rainy night at an unsheltered Electrify America site in a grimly lit Walmart parking lot meets the need for on-road charging; Mercedes-Benz and Porsche very clearly disagree.

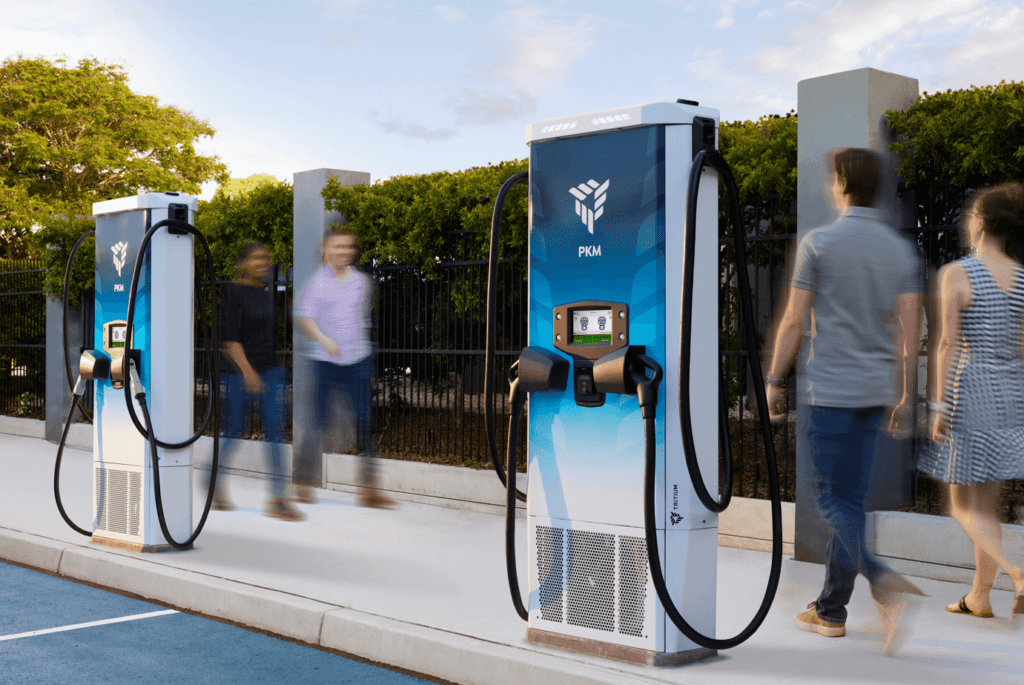

Can this unnamed new company build a reliable network, with more driver amenities, for $1 billion, when the VW Group hasn’t done so for $2 billion? “They are all in, now,” said a participant—and the billion dollars is “just the tip of the iceberg.” Initial sites have already been identified, and the goal is to have 6 to 10 charging cables capable of 350 kW at each, sheltered from the elements, in safe, well-lit locations with facilities akin to airline lounges, including bathrooms and refreshments.

Optimism that the group can pull it off stems from European makers’ experience with Ionity, in which the partners appear to play well together, plus a lack of pressure to drive toward profitability above anything else. Most importantly, a source said, “We will set expectations clearly, for the right equipment, the right experience,” from the start. Uptime and a pleasant experience will be paramount.

Two Japanese makers were invited to take part—they declined. Ford remains an open question. The US arms of two overseas makers wanted to join the group, but were vetoed by their headquarters. Rumor has it that Volkswagen of North America was not invited to join.

Much remains to be done by the new company, or at least made public. A name may be revealed soon and perhaps a headquarters location. (A site in the greater DC area might make sense.) It’s possible that other automakers will be added to the group over time. Two Japanese makers were invited to take part—they declined, for various reasons. Ford remains an open question. The US arms of two overseas makers wanted to join the group, but were vetoed by their headquarters. Rumor has it, however, that Volkswagen of North America was not invited to join.

Part 1: How automakers’ disappointment in Electrify America drove them into Tesla’s arms

Part 2: No, NACS is not today’s Tesla connector

Part 3: Why Tesla’s NACS is unlikely to kill CCS

This article appeared in Issue 65: July-September 2023 – Subscribe now.