President Biden calls on Congress, States for fuel tax holiday; increase in refinery capacity

Green Car Congress

JUNE 23, 2022

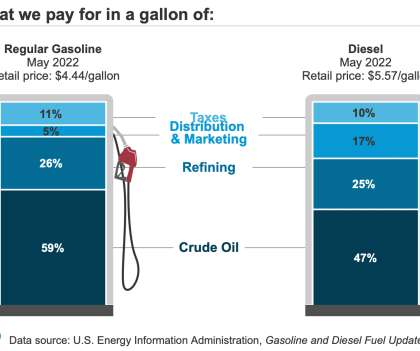

According to the US Energy Information Administration (EIA), as of 13 June 2022, the average price of US regular gasoline was $5.006 per gallon, up $1.937 from a year ago. (An The average price of US on-highway diesel was $5.718 per gallon, up $2.432 from a year ago. Hence, the importance of increasing crude oil production.

Let's personalize your content