EV adoption in the US passed the tipping point for mass adoption a while ago. By Q1, 2021, 5% of all new car sales in the US were EVs. This is great news for the environment, but the US needs the infrastructure in place to keep all those EVs charged. While massive federal funding is helping to grow the nation’s public charger network, 80% of charging still happens at home, at work, or at fleet depots. What does that mean for utilities?

Grid congestion is imminent

If we look at the big picture, EV charging only accounts for about 4% of total demand for electricity; not something for utilities to be alarmed about. But here’s the problem. The demand comes in peaks. Perhaps utilities should look again.

Let’s cross the Atlantic and see what’s happening there.

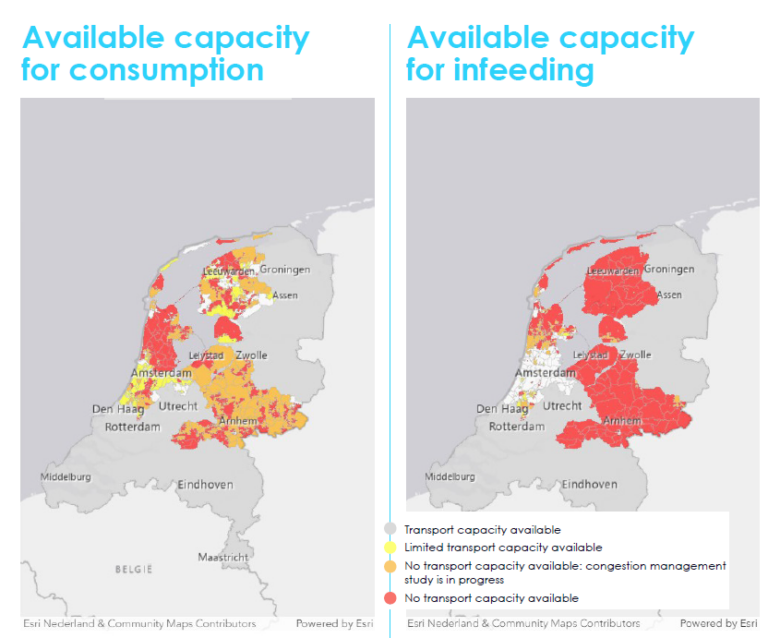

Countries like the Netherlands and Norway are front-runners for EV adoption in Europe. In June 2023, plug-in car sales reached 45% in the Netherlands. In Norway, that number exceeded 90%. With over 123,000 public and semi-public charging stations in the Netherlands, the grid is already experiencing severe congestion. In many areas, the country’s infrastructure cannot deliver any more energy for consumption or accept any more energy for infeeding back to the grid. In many areas, businesses requesting electricity are being denied or postponed. By 2025, some research estimates that 3,000 neighborhoods will not be able to accommodate any more new EV charging points.

Source: Liander (accessed September 28, 2023)

In the US, states like California, that are leading the charge for EV adoption are on the same path to grid saturation. By 2030, California will need to support 8 million EVs. Studies run or commissioned by the California Public Utilities Commission (CPUC) are estimating that the state will have to invest between $15B and $50B in infrastructure by 2035 to support EV charging. So, while EV adoption is not causing grid congestion in the US yet, front-runners like California are feeling the financial pressure, and other states will follow.

The opportunity of EV adoption for US utilities

While the exponential growth of EV adoption is causing some electric headaches, there is also an opportunity for utilities to grab. Utilities are perfectly positioned to become fully-fledged EV Service Providers (EVSPs) – they can own and operate a charger network, and they also have the opportunity to build up a subscriber-base of EV drivers.

Here are a few advantages they have:

- Utilities don’t have to build their market from scratch. They already have a wide customer base, and insights into their customers’ behavior around usage of electricity, enabling them to target customers who are ripe for EV adoption.

- They already have the customer service infrastructure in place with open channels of communication with their subscribers, field technicians, and support centers.

- Since utilities “own the electricity,” they are in a great position to offer incentives for EV charging and can implement initiatives to promote smart energy management that will relieve localized strain on the grid.

- They also have infrastructure in place already with ongoing plans for upgrades. With a stake in EV charging, they can get direct insights into usage and future needs to plan out those upgrades over the next decade.

- They can form strategic partnerships with other players in the EV charging ecosystem, such as CPOs, site owners, fleets, and more.

With US utilities as EVSPs, everyone wins

When US utilities embrace the change and step up to the role of EVSPs, there are benefits all around:

| Charger availability | Easy monthly payments | Resilient charger network |

|

|

|

| Charger availability will increase, especially for drivers in low-income and rural areas where private business is less likely to invest. | Drivers can enjoy seamless EV charging with payment being an integral part of the monthly electricity bill. | The charger network will remain resilient since maintaining infrastructure in the best working order is part of their core competence. |

| Grid resilience | Monetization | Accelerate Fleet Electrification |

|

||

| Through smart energy management and use of renewable sources, utilities can prevent EV charging from becoming a local burden on the grid. | The monetization potential is huge with some estimates going as high as $2.9 billion in new value for the average utility. This value will come from the operation and maintenance of the charger network, and perhaps also emerging Vehicle to Grid (V2G) opportunities. | Utilities will have all the moving parts in place to accelerate fleet electrification for their customers and for themselves. |

By taking advantage of their unique position in the EV charging ecosystem, utilities can own and operate charger networks for home charging, public charging, commercial and industrial (C&I) installations, multi-dweller units (MDUs), fleets and more. As household brands, they can launch EV charging apps that will serve their subscriber base with a seamless charging experience, while building brand loyalty, and even integrate those apps with home energy management systems (HEMS).

So, the bottom line is that due to the rapid growth in EV adoption, utilities will have to upgrade their infrastructure over the next decade to accommodate the demand for EV charging. They don’t have much control over that growing trend, and in any case, it’s part of their natural upgrade path. But they do have control over how they approach this emerging challenge. By embracing change and becoming a part of this evolution they open up the opportunity for loyal subscribers, enjoying a seamless EV charging experience, and the ensuing billions of dollars in new revenue from installing, operating, and maintaining EV charging points, and providing software services such as energy management, fleet electrification, V2G solutions and more.