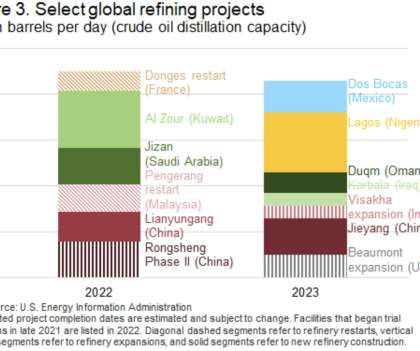

EIA: At least 9 new refinery projects to come online before end of 2023 in Asia and Middle East; 2.9 MMb/d

Green Car Congress

AUGUST 3, 2022

The new refinery projects would increase production of refined products, such as gasoline and diesel, and in turn, they might reduce the current high prices for these products. Net global capacity declined in 2021 for the first time in 30 years, according to the IEA. China’s refinery capacity is scheduled to increase significantly this year.

Let's personalize your content