Under promise, over deliver.

That phrase is a business principle that leaders of customer-centric companies live by. But in the automotive world and especially when related to electric vehicles, deliveries frequently fall well short of what was promised.

In particular, we often see production delays and reduced volumes from what the market was initially led to believe and what may often be well below actual consumer demand. And it is looking through that lens that I wanted to dive into GM’s most recent electric vehicle “supply” promise.

Electric Vehicle PR Is Driving Up the Stock Price

In the last year GM has initiated a full court press on the public relations front around its electric vehicle plans. It seems like a week hasn’t gone by without an email in my inbox from GM about an embargoed press release and some upcoming GM EV event or announcement.

These announcements and PR efforts are fundamentally about GM’s long-term future but they have clearly paid off in the short term as GM’s stock price has increased 55.3% in the last 12 months and 223.9% since the 2020 low on March 18 (as of February 5).

The “30 New EVs by 2025” Promise

On January 28 GM announced that it plans (aspires) to exclusively offer electric vehicles by 2035, ending production of its cars, trucks and SUVs with diesel- and gasoline-powered engines. (Read veteran EV journalist John Voelcker’s take on how much of the media got this announcement wrong.)

And then this past week, GM released its humorous “No Way Norway” EV commercial featuring Will Ferrell. At the end of the commercial, GM shares a significant EV promise: “30 new EVs by 2025.”

The 15 years in the future 2035 aspiration to stop selling gas- and diesel-powered vehicles is clearly a long way off and a lot can change in that timeframe. And so it’s basically impossible to hold GM accountable to that statement, but the 2025 promise is just a little more than a typical new vehicle product development cycle away. So I wanted to understand what “30 new EVs by 2025” actually meant and specifically as it relates to models available in the US. I wanted answers (or guesses) to questions such as:

- How many of the 30 models would be available in the US?

- What would be the mix of commercial trucks versus light passenger cars and trucks?

- What would be the estimated total GM EV sales volume per year and especially in 2025?

- What would be the average sales volume per model per year?

- What percent of GM’s total sales in 2025 would EV sales comprise?

- Will GM’s Ultium Cells battery factory in Lordstown, Ohio be able to supply enough battery packs?

In March of 2020, I and an estimated 75-100 auto/EV journalists and influencers got to see (but not photograph) 10 of GM’s future EVs. Beyond seeing these 10 EVs and hints at a few others, however, GM has shared or confirmed very little about the “30 models by 2025.” They have suggested, however, that around “two-thirds” of the the 30 vehicles would be available in the North America.

In GM teaser videos we saw hints of future electric GMC and Chevrolet pickups and what clearly looks like a Camaro.

Some of the EVs we saw in GM’s Design Dome (Cadillac Celestiq and probably the unnamed Buick crossover) are clearly targeted for China. When GM executives were asked about this they played very coy, but they also did not deny that these vehicles would likely do well in China.

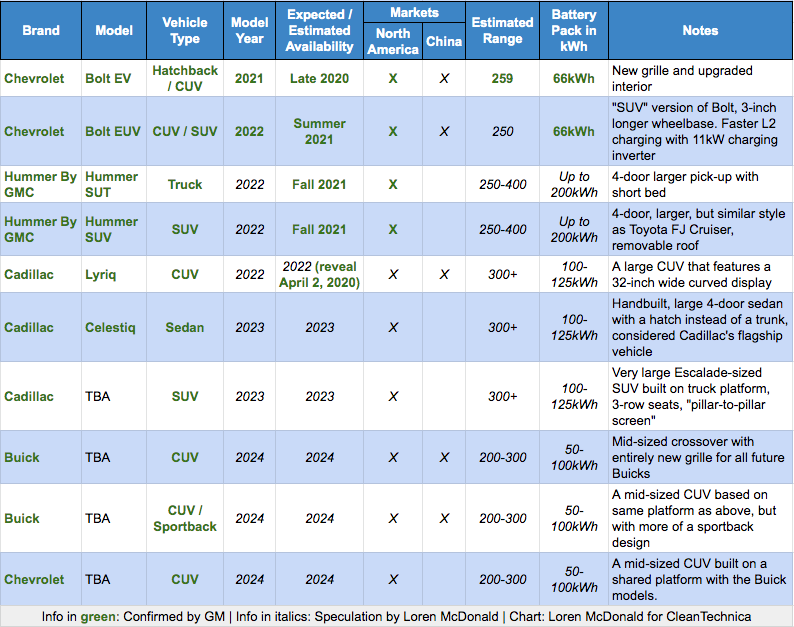

Below are two charts I created last March for inclusion in my CleanTechnica article: GM’s 10(+) Future EV Models: Our Estimated Specs & Sales Volume.

As you will see in a minute, with the passing of a year and perhaps becoming a bit wiser, I’ve reduced my forecasts a fair amount for various models (although I’m comparing US and Canada to just a new US-only forecast).

In the 12 months since sharing the forecast below, multiple new crossover/SUV EVs including the Mustang Mach-E, Volvo EC40 Recharge, Polestar 2, Tesla Model Y Standard Range, Nissan Ariya, VW ID.4, Hyundai IONIQ 5, Audi Q4 e-tron, Toyota RAV4 Prime PHEV, Ford Escape PHEV, and Lincoln Corsair PHEV have either become available or likely will be in 2021. Most all of these new EVs are arguably more compelling, albeit more expensive than the Bolt EV and EUV. As such, I think without significant price discounts (all of the other EVs also have access to the Federal tax credit except the Tesla), the two Bolt models will never see sales in the US above around 35,000 per year (if that even).

And secondly, on the truck front, GM faces significant competition with the upcoming Tesla Cybertruck, Rivian R1T, Ford F-150 and Lordstown Endurance in the fleet market.

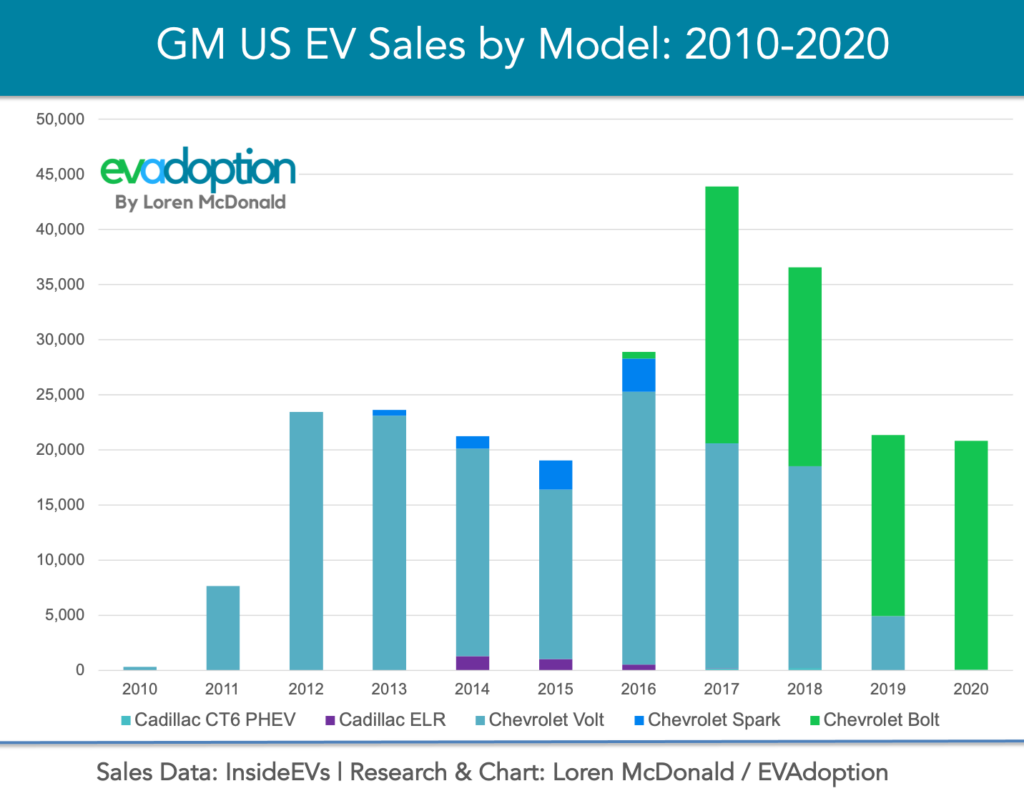

GM’s EV Sales Since 2010

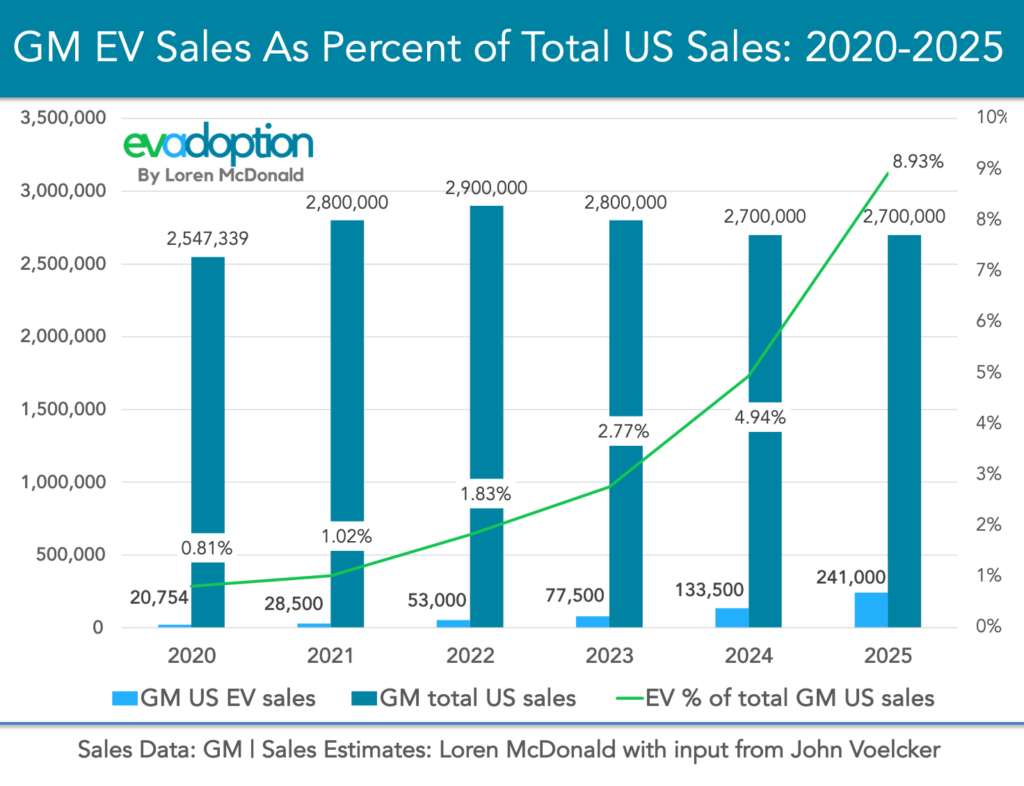

Before diving in to forecasting GM’s future sales, let’s take a look at historical sales. In 2020, GM sold 20,754 Chevrolet Bolt EVs in the US, which while isn’t huge number it actually puts the Bolt in third place after the Tesla Model 3 and Model Y in the US and ahead of the Toyota Prius Prime and Nissan LEAF.

And while it is easy to forget, in 2017 GM had US EV sales of 43,893 across 5 different models – though 3 of those barely mattered: Cadillac ELR – 17, Chevrolet Spark – 23, and Cadillac CT6 PHEV – 207. But GM also had the number 2 (Bolt EV – 23,297) and number 5 (Volt – 20,349) best-selling EVs.

GM’s Latest EV Developments

Since EV Day in March 2020, GM has provided little insight into model availability, but did have three significant announcements:

- General Motors and Honda to Jointly Develop Next-Generation Honda Electric Vehicles Powered by GM’s Ultium Batteries (April 2, 2020): General Motors and Honda agreed to jointly develop two all-new electric vehicles for Honda, based on GM’s Ultium battery-powered EV platform. The exteriors and interiors of the new EVs will be exclusively designed by Honda, while the GM platform wil be engineered to support Honda’s “driving character.” The Honda and Acura EVs will be manufactured at GM plants in North America. Sales are expected to begin in the 2024 model year in Honda’s United States and Canadian markets.

- GM Launches BrightDrop, a New Business That Will Electrify and Improve the Delivery of Goods and Services (January 12, 2021): BrightDrop is a new GM business unit that will provide a total solution for last mile delivery and includes the EV600 electric delivery van with up to 250 miles of range.

- GM to Supply Navistar With Hydrotec Fuel Cell Power Cubes for Electric Vehicles (January 27, 2021): General Motors will supply its Hydrotec fuel cell power cubes to Navistar for use in its production model fuel cell electric vehicle (FCEV) – the International® RHTM Series. Navistar’s FCEV will get energy from two GM Hydrotec fuel cell power cubes.

Forecasting GM’s Future US EV Volume

I took a recent forecast I had done where I projected sales for more than 240 electric vehicles that might be available in the US between 2020 and 2030 and extracted just the GM brands and models and did some additional updating and tweaking to this previous forecast.

I then hopped on the phone with veteran EV journalist John Voelcker, formally editor of Green Car Reports (follow John on Twitter), to get his expert insights and takes on GM’s electrification plans, models likely destined for the China versus US, potential US sales volumes, which vehicles GM is likely counting toward the 30 models, and to test my numbers.

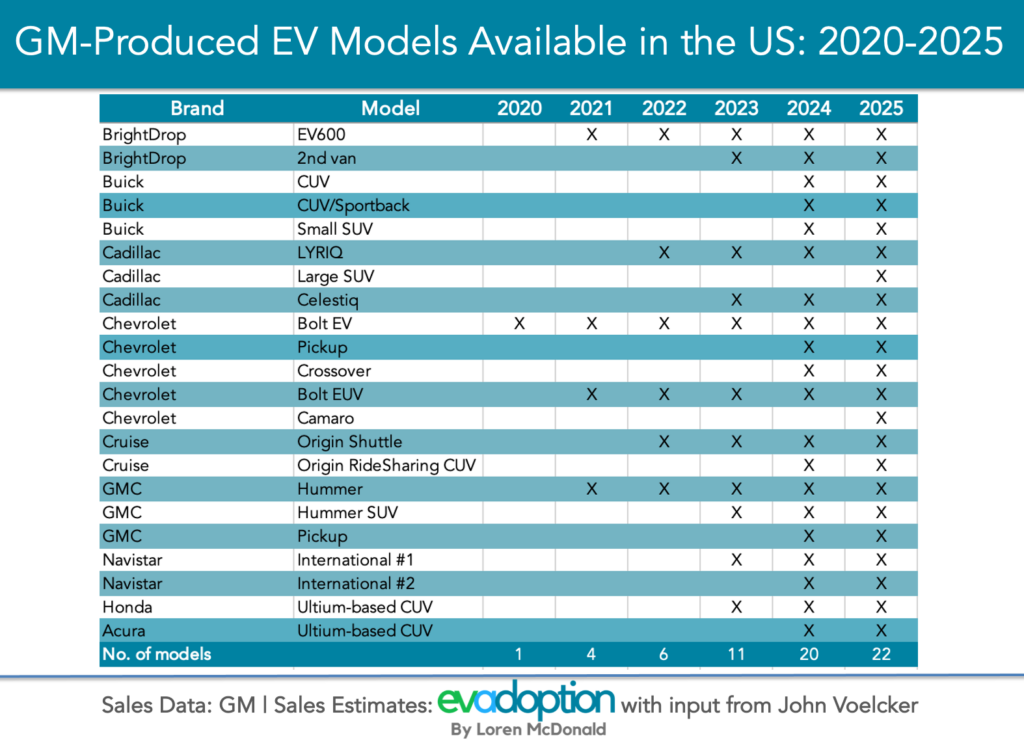

A couple of assumptions that John and I generally agreed on are: 1) The “2/3” of the 30 obviously equates to roughly 20 models to be available for the North America (US and Canada) markets, and 2) That GM is including the following vehicles toward the “20” models:

- Updated Chevrolet Bolt EV and new Bolt EUV.

- Two BrightDrop delivery vans – the EV600 and one more unnamed variation.

- The Cruise Origin electric autonomous shuttle and one more Cruise autonomous vehicle, perhaps a mid-sized CUV for ride sharing companies.

- Two Navistar fuel cell-powered long-haul trucks.

- Two Honda and Acura EVs that GM will build at its North American plants.

Clearly the Bolt EUV, BrightDrop, and Cruise models are included in GM’s “30 EVs by 2025” but we may be wrong on the Honda/Acura and Navistar inclusion.

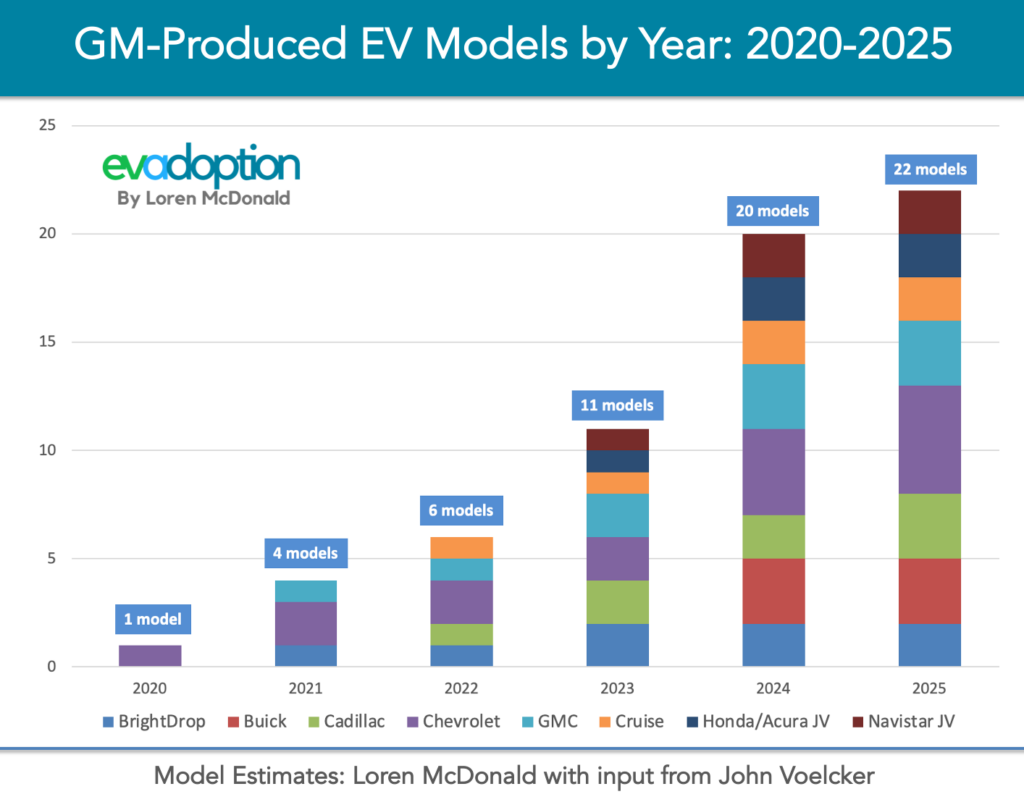

In the chart below you’ll see what the number of models by brand, including the joint-ventures, might look like between 2020 and 2025. If the forecasted models becomes anything close to reality, then 2024 is when GM really kicks it into gear, at least from a number of models perspective.

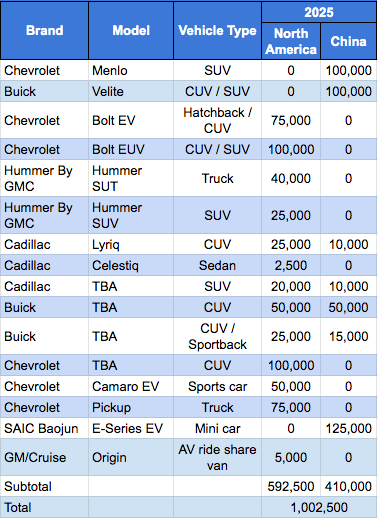

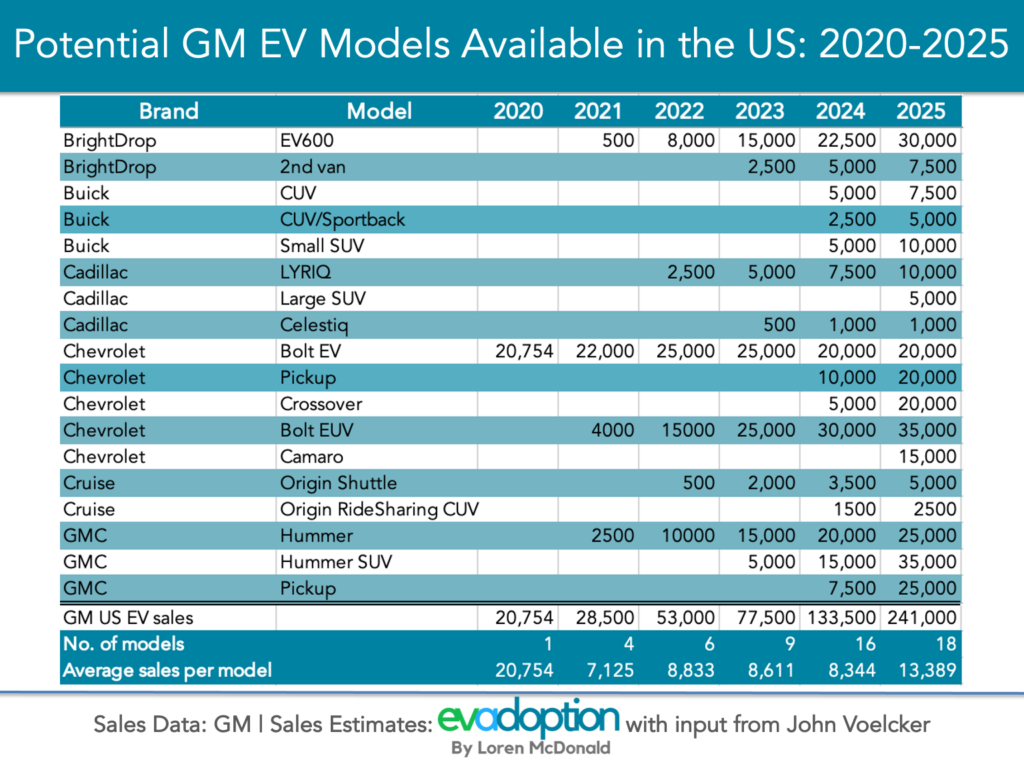

And here is my forecast of annual sales volume for just the 18 GM-owned models:

When forecasting sales of just GM’s expected 18 passenger and light commercial EV models in the US (including models from Cruise and BrightDrop, but not Honda/Acura or Navistar), the company would reach sales of less than 250,000 by 2025. And because many of these models would be higher-end GMC and Cadillac models, the overall average volume per model comes out to less than 13,400.

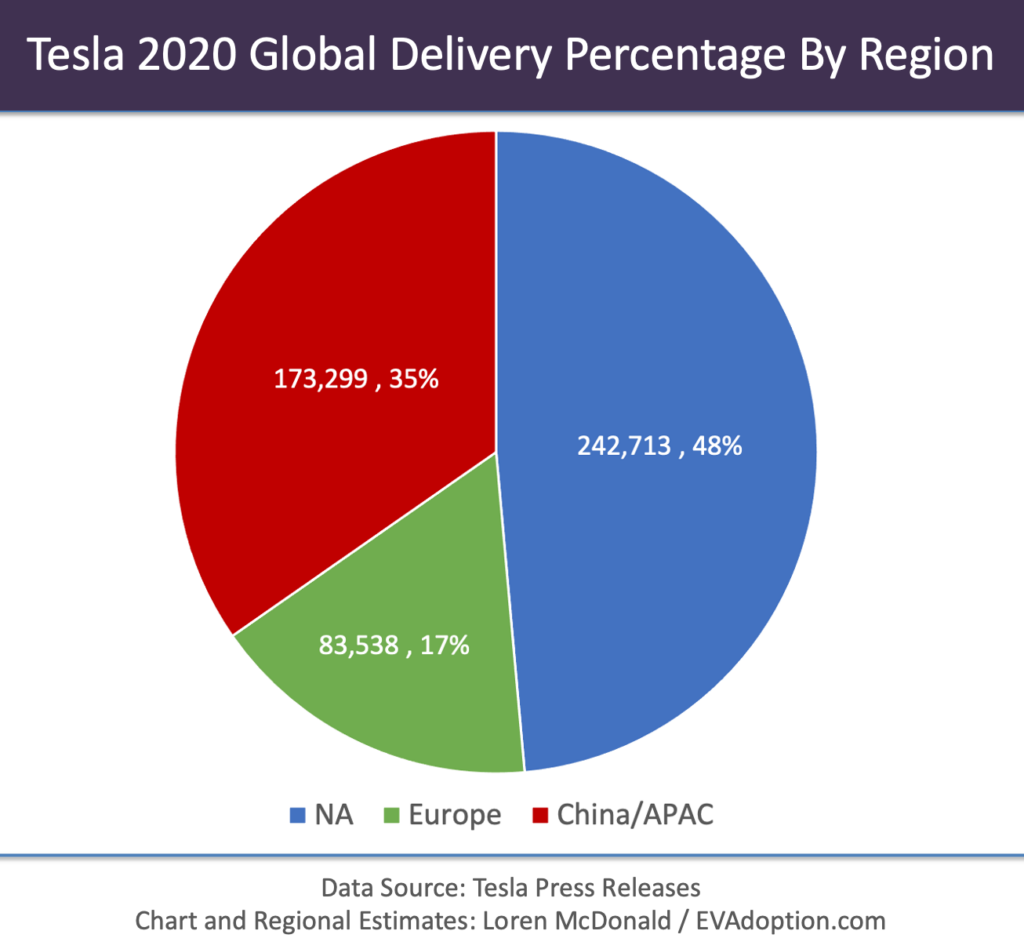

By comparison, in 2020 Tesla sold an estimated 242,713 units in North America (US and Canada).

EVs as a percentage of GM’s overall US sales would be just less than 9% in 2025.

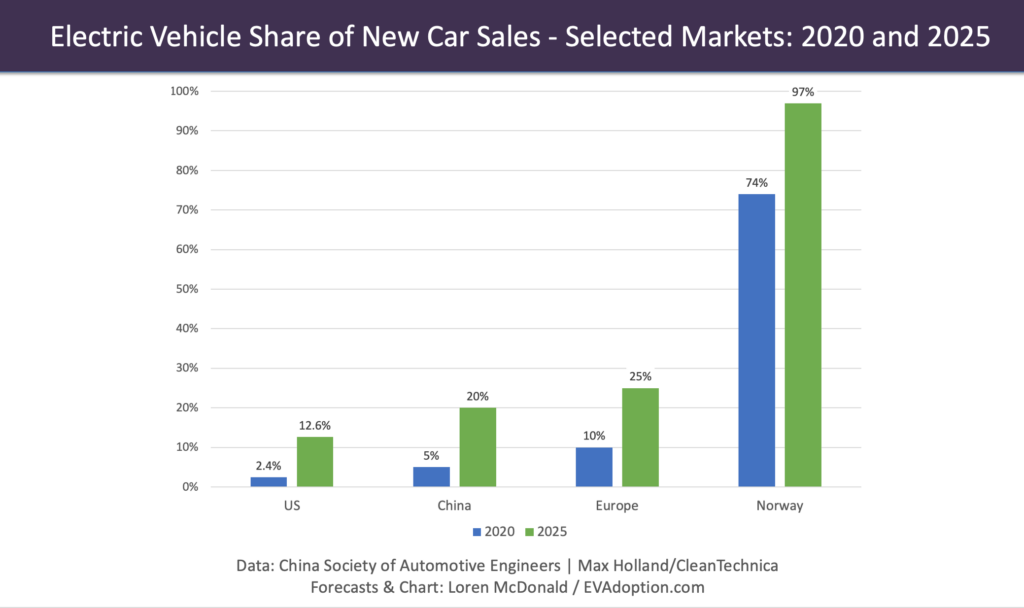

If GM achieves an EV sales share in the US of around this 9% level, then based on my recent US EV sales forecast of 12.6% in 2025 (which could be a bit aggressive), they would be below the national average for new EV sales share. Ouch.

Lordstown Battery Capacity

The key to volume production of electric vehicles is the supply of battery packs. GM is currently sourcing battery packs for the Bolt EV and the upcoming Bolt EUV from LG Chem. But all other new GM EVs will use the Ultium batteries produced in the LG Chem joint venture Ultium Cells LLC factory in Lordstown, Ohio.

GM has said that the factory will have an annual capacity of “more than 30 gigawatt hours and room for expansion.” Using my forecast, GM would require just under 24 gigawatt hours to supply the 20 EV models (including the Honda/Acura EVs, but not the Navistar fuel cell trucks).

This suggests that if my forecast of just under 250,000 EVs by 2025 is low, GM still has an annual cap of likely 300,000 to 325,000 units based on supply of the Ultium batteries. However, GM has stated that the Lordstown battery factory “… will have annual capacity of more than 30 gigawatt hours and room for expansion.” So if demand for GM’s EVs increased significantly, presumably the the Lordstown factory could be expanded fairly quickly.

So What Does It All Mean?

GM has been telling a great story the last 12 months and investing heavily in everything from factories – the Hamtramck conversion, Ultium Cells plant – to designing new EVs – Hummer, LYRIQ, and Bolt EUV. However, the actual near-term EV sales volume in 2025 across 18 GM-owned models could be less than the 270,000 units of the gas-powered Chevrolet Equinox sold in 2020. Ouch #2.

To this observer, GM is actually quite serious about being a leader in electric vehicles in the future, but they aren’t going to drive demand in the US anytime soon with their current planned models. Instead they will focus their EV strategy on paralleling along with US consumer interest. At the March 2020 “EV Day” event Mary Barry said something very telling which she shared again during a fireside chat a few months later.

EVs will allow us to grow as a company. If you think about General Motors, we are strong in the middle of the country. Our share isn’t as strong on the coasts, where EVs are having the most success. So we think that gives us a chance to continue with strong sales from internal combustion engine perspective across our brands, and EVs are very additive.

Mary Barra, CEO – General Motors

In essence Mary is saying that for the next several years, until electric vehicles go mainstream in the US, GM is going to focus its EV strategy on models that are attractive to a non-traditional GM brand buyer. Hence the focus on high-end models such as the GMC Hummer and Cadillac LYRIQ. And in fact those models and the niche Celestiq Cadillac models are really all about reinvigorating the GMC and especially Cadillac brands. (read my CleanTechnica article, Can The New Cadillac Lyriq Ev Reinvigorate The Cadillac Brand?)

Meanwhile, the Chevrolet Bolt EV which has been the top-selling BEV in the US not sold by Tesla in recent years, continues to get only a little love with a minor refresh and the addition of the new more SUV-like version, Bolt EUV. But, these two BEVs still don’t have all-wheel drive (fine in California, not so much in cold-winter markets), can only accept up to 50 kW fast charging, and will continue to use the LG Chem-sourced battery packs rather than the Ultium battery packs.

Without the benefit of the Federal EV tax credit, GM has been very aggressive on price incentives for the Bolt EV and we could see them get even more aggressive in the coming year to increase sales volume and better compete with more competitive and attractive small/mid-size SUV/CUV EVs mentioned earlier that are coming to market in 2021 and 2022.

But while most industry analysts and observers focus on the price of batteries and EVs reaching cost parity, the key for mass consumer adoption in the US is a ubiquitous, seamless, and convenient charging customer experience. American’s love their road trips, and without ample and super fast, fast charging, EVs are simply a non-starter for many Americans, regardless of price parity. Tesla figured this out from the very beginning and continues to invest in its Supercharger and Destination Charging networks.

Tesla has several advantages over legacy automakers, and from a consumer perspective – myself included as a two-time Model S owner – Tesla’s charging networks basically eliminate range and charger anxiety for most EV buyers. And until GM and the other automakers take a more direct and active role, including significant investments in building out charging infrastructure in the US, sales of their EVs will lag that of Tesla.

On this front, in 2020 GM teased us with a Bechtel partnership (but neither company was going to contribute capital) to build out fast charging, but my sources suggest that deal is dead and never got traction. And GM’s charging partnership with EVgo to install 2,700 fast charging stations over 5 years, which I covered here, amounts to a very modest 500 ports per year. But even more telling, GM is apparently actually investing very little of its own money. Ouch #3.

GM and EVgo would not share specifics on the dollars that would be invested, but they will leverage private investment and government grant and utility programs to help fund these 2,700 additional DC fast chargers.

I believe GM will reach or at least come close to its aspiration of no longer selling gas- and diesel-powered vehicles by 2035, but based on the reality of its “30 EVs by 2025,” the company will have to really turn up the volume in the last half of this decade.

9 Responses

Have you considered the Caddilac Optiq & Symboliq Crossovers, the Sedan/Coupe Cross (“low roof EV”) or a next generation Chevrolet Bolt in 2023?

What about the trademarks for “Cadillac Optiq” and “Cadillac Symboliq” or a next generation Cherolet Bolt in 2023?

https://www.motorauthority.com/news/1129102_optiq-and-symboliq-trademarks-hint-at-future-cadillac-evs

Stephan, there are a lot of potential vehicles that GM might develop. My forecasted vehicle models were based on: 1) What GM showed us and shared at “EV Day” in March of 2020 and best guesses. The trademarks are interesting, but unless I can tie them to specific planned vehicles it is hard to convert into numbers in an Excel spreadsheet. On a next gen Bolt, I hope GM remakes the Bolt, to date they have not hinted that one is coming. It seems for now they are going to focus on making it a lower-end model and increasing sales volume and not investing in a new version. 2023 might be a little early for a next gen Bolt using Ultium batteries – but would be great if it actually happens.

I am also trying to track all new BEV launches in the next years and it is often confusing. I also read this about GM:

“While the company wasn’t ready to go into specifics, they confirmed a number of upcoming North American releases including “Low Roof Entries” from Cadillac. GM teased this back in 2017, but it’s finally official and likely means there is an electric sports car or coupe on the horizon.”

What model could they mean?

https://www.carscoops.com/2020/11/gm-announces-a-slew-of-new-electric-vehicles-including-what-sounds-like-an-electric-sports-car-from-cadillac/

This is overview I made for all brands. (“new BEV models” tab/sheet)

https://docs.google.com/spreadsheets/d/1tUYfLuzui3ygxZpPFvCX9zr1liI47_3c6Cl3j_PGNQg/edit?usp=sharing

On the “low-roof” entry .. that might be the Camara and perhaps a Cadillac roadster … but not something GM has teased in the last year.

Nice data BTW!

Thanks (took quite some time, especially the model years), I appreciate your articles as well. Any updated forecast on EV sales in the United States in 2021 would be greatly appreciated. S&P Global Platts recently came out with a forecast of roughly 500,000 EVs sold in the United States in 2021. You forecasted 585,000 units and that was before the presidential election. Do you see that number higher now, given what has been revealed so far?

https://www.spglobal.com/platts/en/market-insights/latest-news/electric-power/012821-us-ev-sales-tumble-in-2020-but-ev-load-increases-with-more-charging-stations

US auto manufactures face the same problem that Kodak had. Kodak built the first digital camera and was the first to market it. The problem was that they were making 60% profits on film, and they could not believe that digital would ever be better than film. And what CEO would willingly kill a 60% golden goose? Except perhaps Steve Jobs.

GM may advertise EV’s, but they will sell ICEs.

I like Mary Barra and tend to believe that what she says publicly is more than just hype. If Biden reforms the $7,500 tax credit, increasing the sales threshold to bring Tesla and GM back into eligibility, GM will benefit greatly but so will Tesla. The big question mark right now is what the regulatory structure is going to look like. Gov. Newsom floated the 2035 date for ending the sale of ICE vehicles in California, then a few weeks later Barra tosses out the same date for GM. Biden could theoretically direct his EPA to push an EV mandate similar to California’s that phases in from 2026 to around 2035 with no provision for a midpoint review process.. The federal regs from 2021 to 2025 will likely revert to Obama’s standards, killing off Trump’s SAFE standards, and California will get its waiver back. Bottom line: If Biden can get an EV mandate similar to California’s, EV adoption nationwide will accelerate briskly in the decade running from 2025 to 2035 to keep pace with the regs. GM will tread water on EVs until then. Look for an amicable tentative agreement between EPA and the major automakers on future emission standards similar to the Obama deal at the beginning of his presidency. EPA is in the driver’s seat now because EVs are entirely feasible. Battery advances have altered the legal landscape. The automakers want one set of standards, and that could be part of the package starting in 2026 to close the deal, with CARB on board.