Tesla Sales Crash — But Will They Bounce Back?

As you’ve surely seen by now, Tesla sales slumped a lot in the first quarter. In fact, I think it’s fair to say they crashed. The following charts will visualize that for you, and if you’re a Tesla fan (or shareholder), you have to admit they’re a little scary.

After sharing and briefly commenting on each of the charts, I’ll return to the broader discussion we and others have been having for the past 6 months or so — or, genuinely, since before the first Model S was delivered in 2012! (Wow, it’s hard to believe that was 12 years ago — I remember it like it was last month. But that sentiment is also part of the story and discussion today.)

First of all, yes, there’s the dip, or crash. It was the lowest sales quarter since the third quarter of 2022. But the question is whether it’s more like the 2nd quarter of 2022 and we’re going to see a long and big rise now, or its own thing and the future is not so rosy.

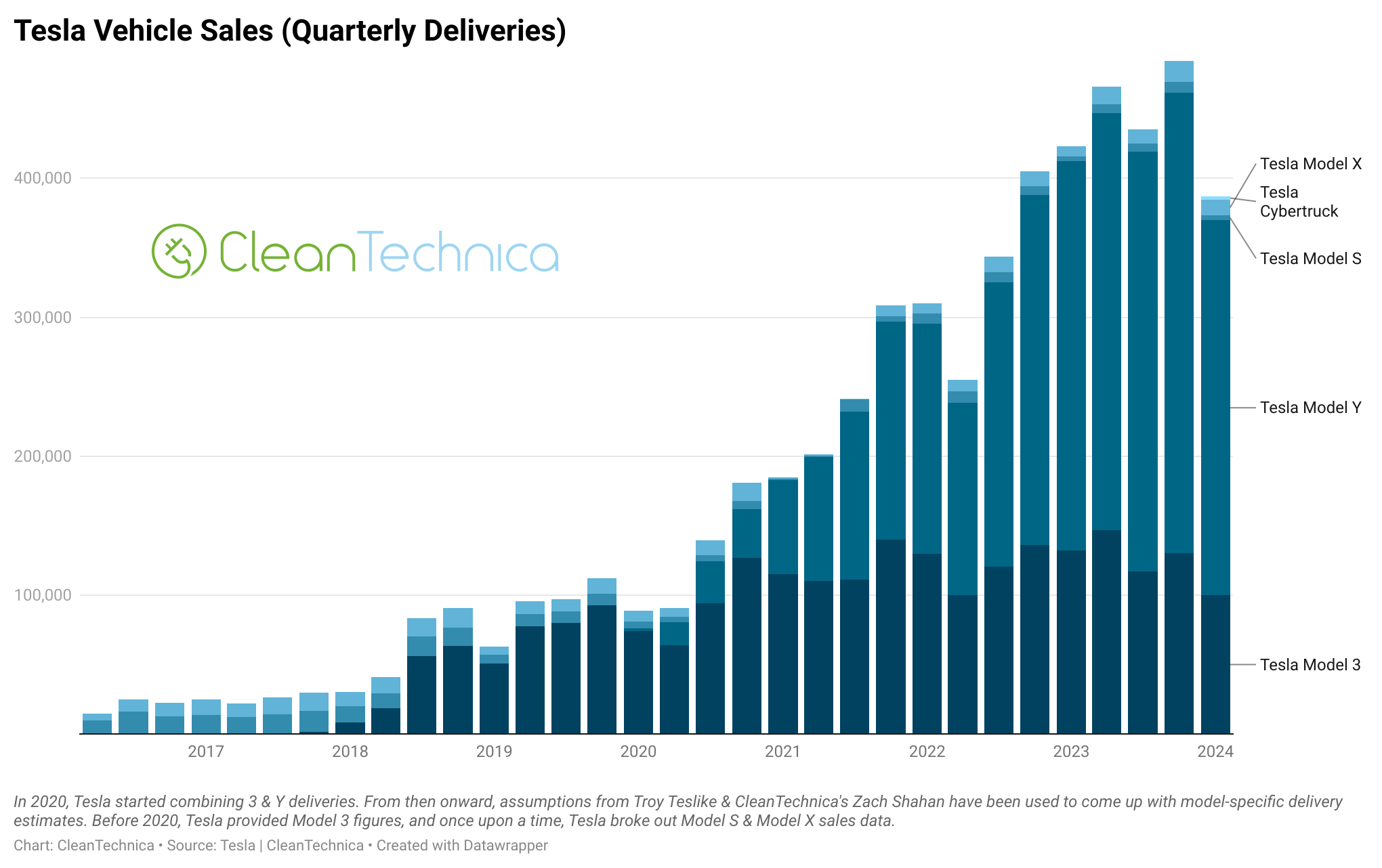

Broken down by model (informed estimates), you can see that essentially all of Tesla’s growth and potential comes from two models — the Model Y and Model 3. As we keep repeating, Tesla needs more models. Tesla’s competitors in China roll out new models all the time. It’s hard to put Tesla on the same ground as them in the biggest EV market in the world when there’s such a difference here.

Looking at it a different way, as a line graph, it’s interesting to see how the models are either stagnating or dipping. Just note that these are estimates since Tesla doesn’t release individual model sales or production data.

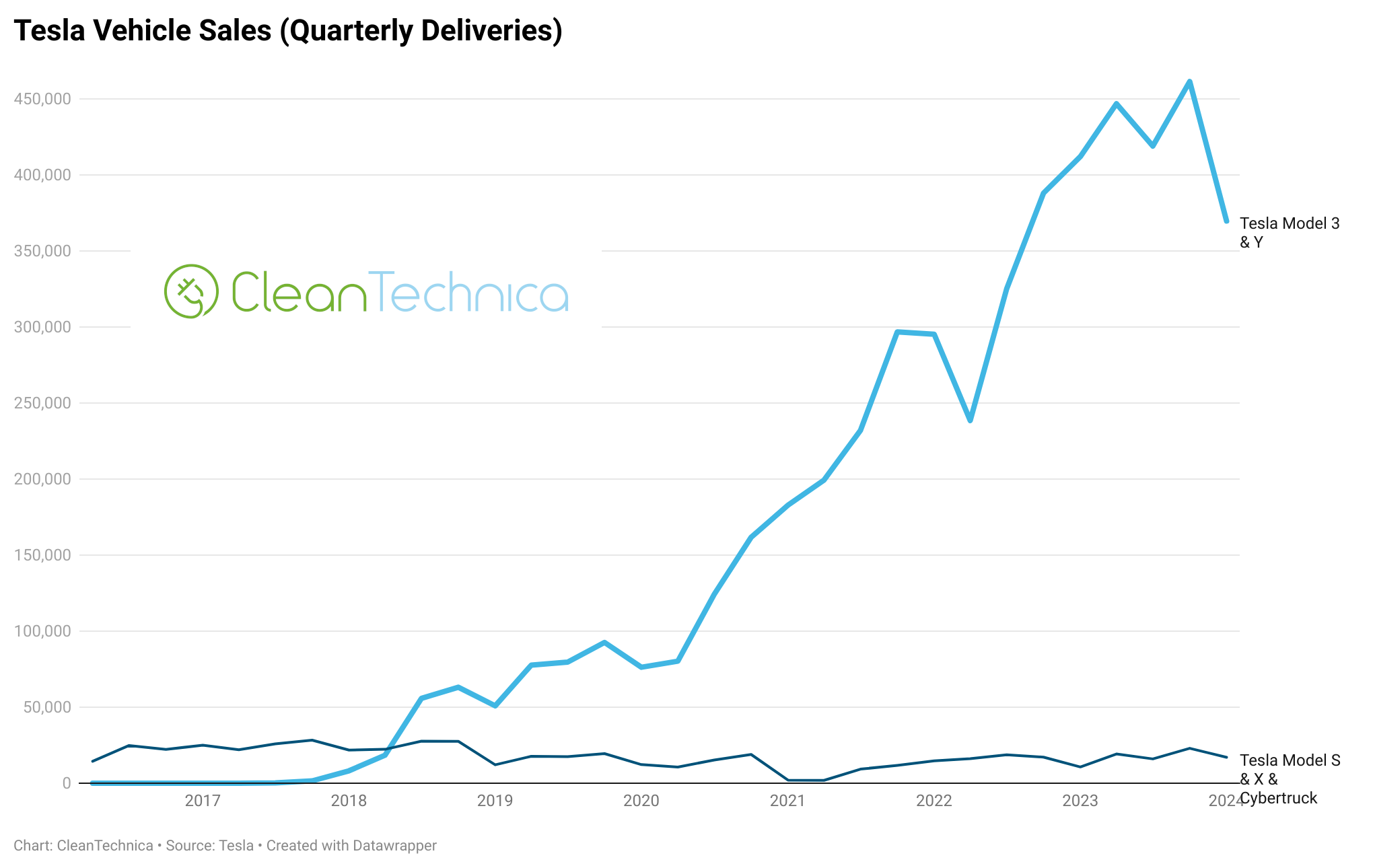

Just using the official data from Tesla — which combines Model 3 and Model Y sales and also combines Model S, Model X, and Cybertruck sales — we can see that the latter are relatively stable but far down below the Model 3 and Model Y, and we can also see that the Model Y and Model 3 took a dive.

The four charts above are all cumulative sales charts. Perhaps, as a response to the Q1 2024 sales dip, we may be inclined to say: See, these charts show how much Tesla has grown and how much it has achieved in such a short time! Exactly — Tesla has sold a lot of vehicles in the past three years. How many people are on the market for a Tesla in 2024? Is it really the same number as in 2023? Is word of mouth going to stimulate as many sales now as it did two years ago? How many buyers from 2021 or before are already looking for an upgrade? Remember the “Tesla stretch” when many people who had never bought a new car bought a Tesla Model 3, or moved from a Honda Civic of Toyota Prius to a Tesla Model 3? How many of them are planning to stay in their Model 3 for a long time? How many early Tesla buyers actually now want to try something different or aren’t into some of the changes at Tesla (or with Elon)? One has to consider all of these things if they want to objectively think about Tesla’s future.

I wrote about the broader questions around Tesla stock recently. Key topic number one was how much Tesla sales would grow (or not) in coming quarters and years. As we saw in the first quarter, the obvious answer was “not.” Tesla had a few succinct explanations for that: “Decline in volumes was partially due to the early phase of the production ramp of the updated Model 3 at our Fremont factory and factory shutdowns resulting from shipping diversions caused by the Red Sea conflict and an arson attack at Gigafactory Berlin.” But note the word “partially” there. As we’ve also noted recently, Tesla is engaging in a lot more email marketing, text message marketing, and advertising. And that’s following significant price cuts that have chopped down Tesla’s gross margin. To be frank about it: Tesla is struggling to find the consumer demand that it wants. Otherwise, there’s no doubt about it — Tesla wouldn’t be advertising all over the internet and Tesla owners like me wouldn’t be getting so many requests to upgrade to a new Tesla if the company had enough natural demand rolling in.

As Steve Hanley wrote yesterday, “On April 1, 2024 (no, that is not a joke), Caliber told Reuters that the consideration score for Tesla has dropped from a high of 70 percent when it first started tracking the company in November 2021 to 31 percent in February of this year.” The consideration score is what percentage of potential buyers would consider a Tesla.

One more thing that I think needs to be said, though, is that Tesla sales are not low. Nearly 387,000 deliveries for a brand that has just two mass-market models is still quite astounding. But that’s the point. How much more room is the for the company to actually grow without more mass-market models? The Tesla Model Y already became the best selling vehicle model in the world. Is it expected to keep growing in sales? Can we not consider the possibility that it might see a sales drop if there aren’t enough new buyers interested in it? I know it’s blasphemy, but what if there aren’t 400,000 new buyers a quarter ready to buy a Model 3 and Model Y? What if there are “just” 300,000, or 250,000? Those would still be very high selling models. Consider how many of Tesla’s sales are in California, and then consider how many Californians are remaining to buy new Teslas, and how many of those people actually want one. Conduct a similar exercise for China, for some European markets, for the Pacific Northwest.

This is not a knock on Tesla. What Tesla has already achieved is nearly unbelievable. It’s a stunning business success story that must be taught at business schools around the world every day. But just because previous bullish predictions about Tesla were right doesn’t mean current ones are.

As noted near the top, the Model S came out in 2012, nearly 14 years ago. The company has seen almost constant growth since then. But we have to be cautious sometimes and realize that the past is indeed over and the future is unpredictable. Storylines can change, and, in fact, they normally do.

Regarding the question in the title, I don’t know the answer. But that’s the point. And you don’t either. We shouldn’t assume something will happen just because we want it to happen. We should keep our minds open.

For more chart fun, here are interactive versions of some of the charts above:

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Video

CleanTechnica uses affiliate links. See our policy here.