EVs At 93.9% Share In Norway — Record High

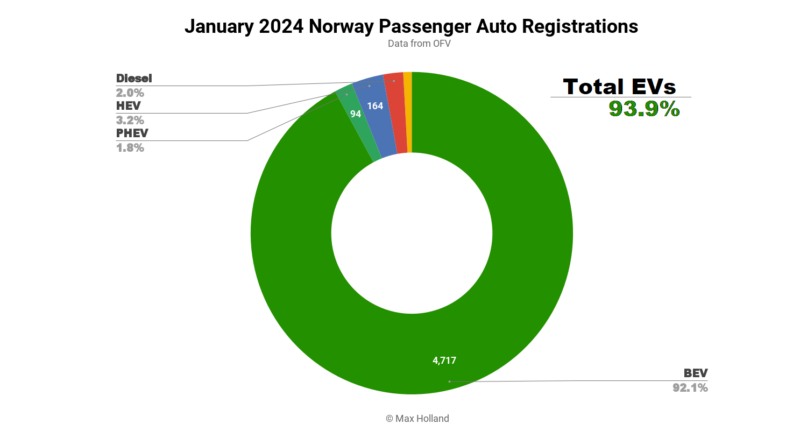

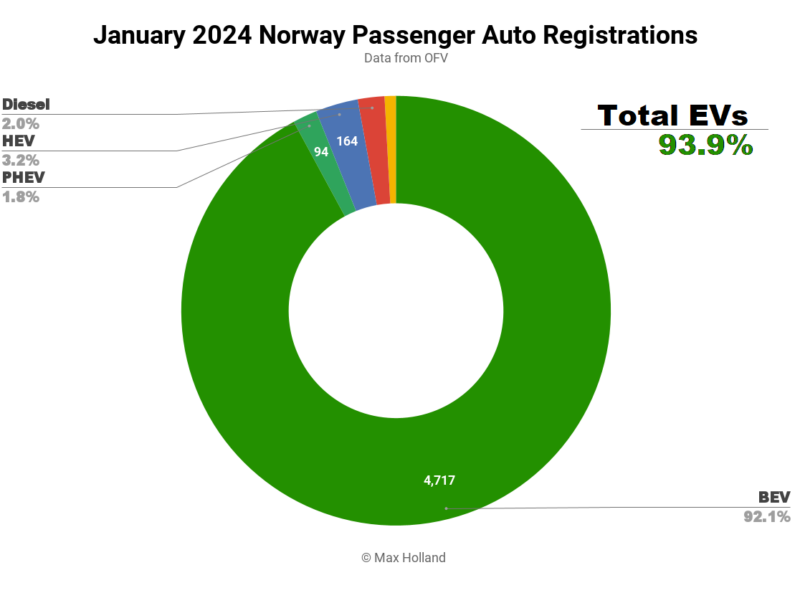

January saw plugin EVs at 93.9% share in Norway, a new record high. All non-BEV powertrains faced higher taxes from January 1st, and saw a hangover in sales, following December’s pull forward. Overall auto volume was subdued, at 5,122 units, well below seasonal norms. January’s best seller was the Tesla Model Y.

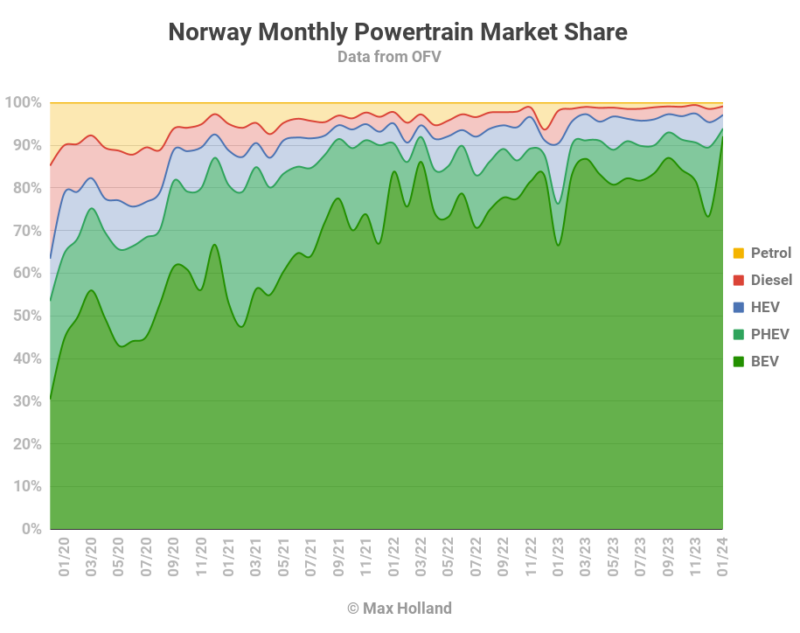

January saw combined EVs at 93.9% share in Norway, comprising a record 92.1% full electrics (BEVs), and just 1.8% plugin hybrids (PHEVs). These compare with YoY figures of 76.3%, with 66.5% BEV, and 9.8% PHEV.

The year on year comparison looks favourable due to incentive changes at both ends. January 2023 was a big hangover for BEVs (and to some extent, all powertrains) after new weight taxes and some sales taxes were applied for the first time. January 2024 sees a hangover for all non-BEVs after their December pull-forward, ahead of higher emissions taxes now in effect — and thus gives a boost to BEV share. See last month’s report for a detailed look at these latest tax changes.

These short term disjunctions from incentive changes — pull-forwards and hangovers — take a while to work through, and we will have to wait until mid to late Q2 to see the auto market resettle to its new equilibrium. PHEVs will likely resume at somewhere in the range of 3% to 6% of the market, with HEVs a bit lower.

As I’ve said previously, you can’t brute-force your way to full BEV adoption by punitive policies on alternatives, unless there exists a spectrum of available product offerings that meet the requirements of all buyers. For BEVs to become viable in the remaining 10% to 15% of the market will require inexpensive-and-competent BEV models to be available to buy in Europe, including in Norway, to compete with the inexpensive-and-competent ICE models that are currently entirely unchallenged in those segments.

Such models do exist in the world of BEVs — they include China’s 6th best selling BEV in 2023, the BYD Seagull (over 250,000 units sold), and the 11th best selling Wuling Bingo (over 165.000 sold). Both models offer variants with around 40 kWh (gross) LFP batteries, which are capable of over 300 km real world range (over 400 km CLTC), when driven sensibly.

They can be DC charged to 80% in around 40 minutes, and can do 130 km/h. These simple BEV models are thus capable of occasionally going on long journeys, with a modicum of patience. They are priced in the neighbourhood of €11,000 to €12,000 (pre sales tax) in China.

Wuling Bingo. Image Courtesy: Wuling

Wuling Bingo. Image Courtesy: Wuling

The affordable prices are achievable because, according to the latest surveys by TrendForce, LFP cells for EVs are now priced at €56 / kWh, on average, for large contracts. Medium or large auto brands can probably negotiate even lower prices. This means that the ~40 kWh battery packs for these vehicles — even with some basic thermal management — can be made for around €3,000 (or perhaps less).

These are the kind of vehicles that Norway, and the rest of Europe, now need to make the EV transition more accessible for families who don’t have deep pockets, nor have a company car. Otherwise we will fall into an elitist two tier auto market with most BEVs priced over €30,000, whilst economy segments (€10,000 to €20,000) get stuck with ICE model options only.

European consumers’ buying preferences demonstrate that affordable-and-competent BEV models are desperately wanted. The 2023 versions of the Dacia Spring and Fiat 500, neither of which are yet fully affordable-and-competent, were nevertheless ranked in Europe’s top 10 best selling BEVs last year.

Back to Norway’s current auto market. Combined combustion-only powertrains took just 2.9% of the market in January. This was the third time in the past 5 months that their combined share was under 3%.

Best Selling BEVs

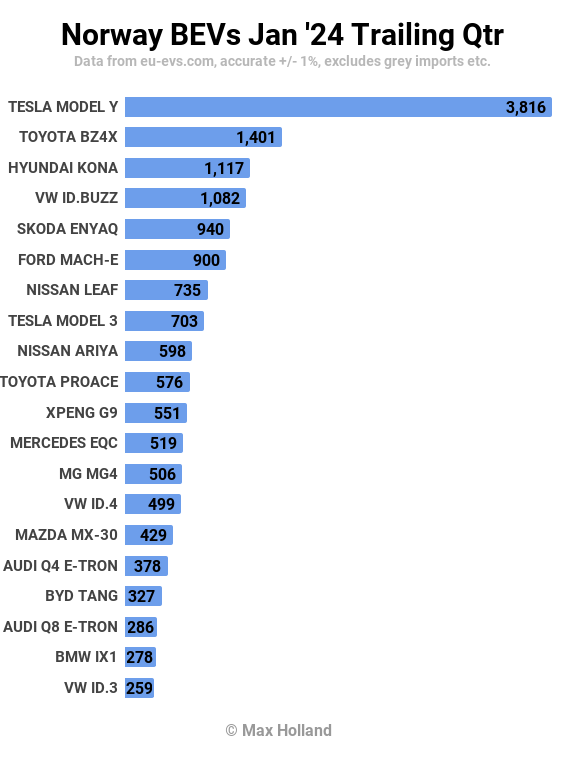

Once again, the Tesla Model Y was the best selling vehicle in Norway in January, with 960 units registered. This follows from it taking the top spot in 10 out of 12 months in 2023.

A long way further back, the Volkswagen ID. Buzz took second, and the Hyundai Kona took third.

Every model in the top 25 saw reduced volume in January compared to recent averages. The only exception was the Nissan Leaf (in 4th spot), which somehow managed 10% more volume than recent months. This January fall-off is a somewhat normal seasonal pattern, but was a bit more pronounced this year.

In 26th spot, the new Opel Astra stepped up volumes to 39 units, having debuted in December with 5 units. The Astra comes in both hatchback and touring-wagon variants. First appearances suggest that the Norwegian market strongly favours the touring-wagon (still a rare format in BEV world), which represented 32 units of the 39 total. Let’s see if this pattern holds in the coming months.

For technical specs on the Astra, see our coverage of its twin-cousin, the Peugeot e-308. The e-308 hasn’t yet seen big volumes in Norway, with just 18 units in January. We will keep an eye on both these models.

There were 3 new BEV model debuts in January, though all at low volumes. Perhaps the most significant in terms of potential volume was the BYD Dolphin, one of the best value BEVs available in Europe, which saw just 3 units registered.

For now, these seem to be demonstration units, as the Dolphin is not yet listed on BYD Norway’s website. To preempt some hate-speech in the comments section, the supremacist China-FUDsters are out of luck here — Norway’s sovereign wealth fund has recently increased its investments in BYD (as well as in Tesla).

Another debutant was the Ssangyong Korando, with an initial 5 units in January. Earlier ICE generations of this model have been on sale in Europe for decades already, and the first BEV variant had its global launch in mid-2021. It started to arrive in some parts of Europe (e.g. the UK) at the end of 2021, and has belatedly made it to Norway.

The Korando’s specs are modest, similar to those of its older Korean counterparts, the first generation Kia Niro and Hyundai Kona, but in most regions the Korando is priced competitively. Ssangyong Norway is not yet listing the BEV on their website (nor providing pricing information), so they may just be testing the market for now. Let’s see.

The last new BEV debutant was the new BMW iX2, which registered just 1 (one) initial unit in January, but will surely grow volume from here. As with all of BMW’s even-numbered SUVs, the iX2 is essentially the coupe-back version of the existing iX1. It is slightly shorter than the iX1 in height, and longer, with slightly different styling, but with the exact same technical underpinnings. Its price point, in a segment already well furnished with BEV options, means the iX2 is hardly a change-maker, but it’s good to see BMW progressing on its internal transition to BEVs.

Let’s check the trailing quarter rankings:

The Tesla Model Y is hugely dominant in Norway, with more volume than the next 3 models combined.

The Toyota BZ4x has climbed one spot to second, with the Skoda Enyaq, previously in second, dropping down to 5th.

The Hyundai Kona, recently refreshed, climbed to 3rd spot in the rankings, up from 7th in the prior period. Most other movements in the top 20 were more subdued.

I intend to publish a Norway fleet transition update in the next few days.

Outlook

Beyond the lacklustre volumes of the auto market, Norway’s broader economy was in negative territory as of latest data, with 2023 Q3 at negative 1.9% GDP trend YoY. Inflation remained flat at 4.8%, with the interest rate flat at 4.5%. Manufacturing PMI fell to 50.7 points in January, from 51.6 in December.

January’s upbeat BEV share of 92.1% is an anomaly, shaped mainly by the hangover for other powertrains. Nevertheless, 2024 should anyway see gradual growth in BEV share over 2023’s share of 82.4%.

Rising share is one thing. but decent BEV sales volumes are now what is needed to transform the existing fleet of ICE vehicles on Norway’s roads over to BEVs.

But volume will suffer so long as the broader economy is weak. As the OFV puts it “many people have tighter finances due to interest rate increases and price increases” (Øyvind Solberg Thorsen, OFV director, machine translation)

Do you have any thoughts on Norway’s EV transition? Please join in the discussion in the comments section below.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Video

CleanTechnica uses affiliate links. See our policy here.