EVs At 89.6% Share In Norway — Incentive Change Turbulence

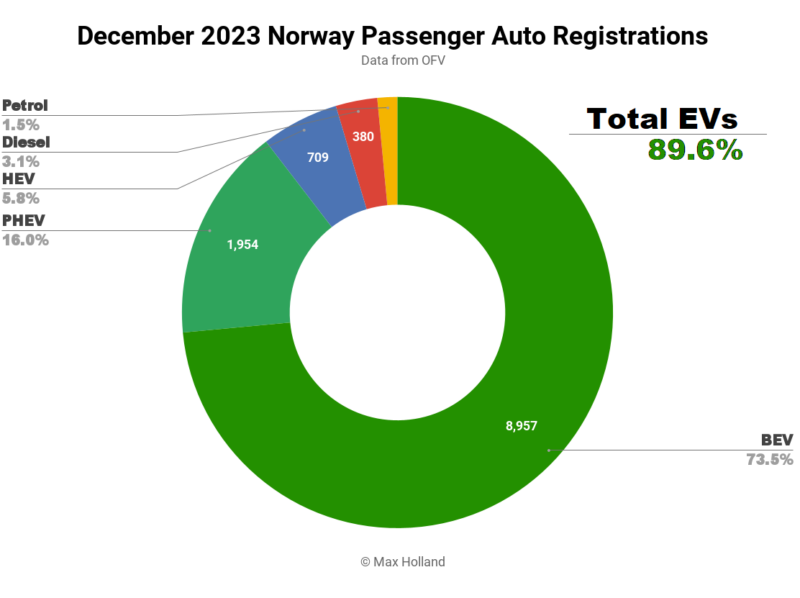

December saw plugin EVs at 89.6% share in Norway, up just 2% from 87.6% year on year amidst temporary incentives turbulence. PHEVs saw a rare 16% share due to a significant pull forward ahead of large tax increases from January 1st. ICE vehicles saw a similar, though smaller pull forward. Overall auto volume was 12,183 units, down from last year’s rush, but closer to seasonal norms. Norway’s best selling vehicle in December, and for the full year, was the Tesla Model Y.

December saw combined EVs at 89.6% share in Norway, comprising a relatively weak 73.5% full electrics (BEVs), and 16.0% plugin hybrids (PHEVs). These compare with YoY figures of 87.6%, 82.8%, and 4.8%, respectively.

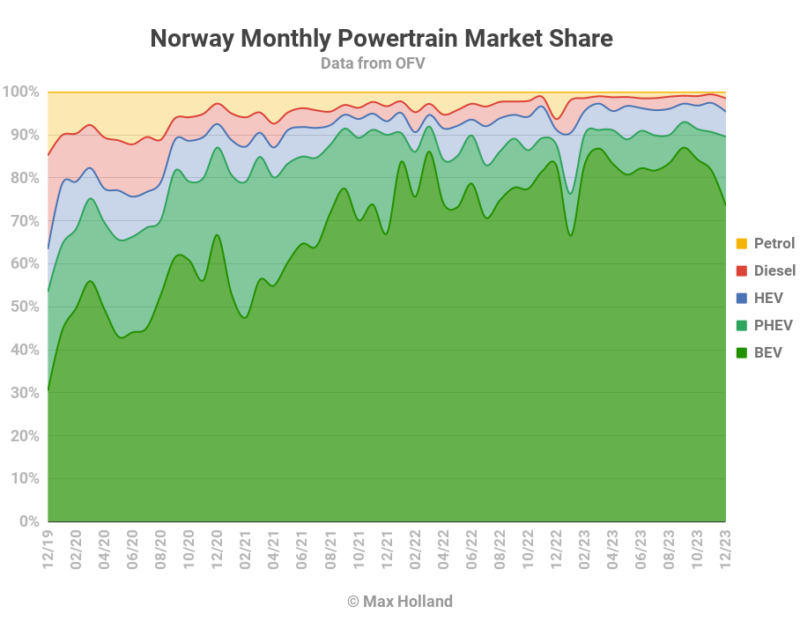

Plugin sales in Norway have hovered close to 90% for the past two years. PHEVs have typically been in the 10% to 7% range, and slowly trending down. While BEV volume remained roughly in line with recent months (8,957 units), a surge of pull forward PHEV sales in December, amounting to 1,954 units (2.6x their average monthly volume) upset the usual balance. Thus in terms of market share, PHEVs jumped up significantly, and BEVs took the corresponding hit.

Market Responds to Latest Policy Adjustments

The PHEV surge was a pull-forward ahead of large tax increases on PHEVs from January 1st. Norway’s auto tax landscape is labyrinthine (we’ve reported on the similarly complex Danish auto taxes previously), but the main change affecting PHEVs appears to be the removal of a previously active waiver for vehicle weight taxes. Because PHEVs have additional batteries, inverters, cables and motors on board, they are usually heavier than ICE-only vehicles. This extra weight was previously given a pass by the tax system, but not any more.

One downside of this round of policy changes is that PHEVs are taking a bigger hit than even ICE cars this time around (though ICEs still have a heavier tax burden overall). With the new policy, BEVs in general have seen only very modest tax increases, typically amounting to a fraction of 1% of their total price. HEVs (and ICEs) have seen a tax burden increase of roughly 2.5% to 4% of their price. Average priced PHEVs on the other hand are seeing 5% to 10% increases in price due to the new tax policies.

To give a snapshot of the pricing landscape for different powertrains after the latest tax changes, let’s look at the BMW 5 series. The base HEV now starts from NOK 805,200 (€71,320), a price increase of 3.3%. The base PHEV from NOK 740,600 (€65,600), up 6.1%. The base BEV (i5 eDrive40) from NOK 685,900 (€60,750), up just 0.11%.

Here we can see that the change between December and January has most strongly impacted PHEV prices. This is not just affecting more premium models. In fact, relatively compact and efficient PHEVs, like the Mazda MX-30 with Range Extender, are seeing price increases of around NOK 53,000 (€4,700) from January 1st, according to the OFV tax calculator. This is a roughly 10% increase compared to 2023 prices. Even smaller models like the Ford Kuga PHEV could see NOK 33,000 increases (5% to 6% of value). Large and heavy PHEVs, like the Range Rover, and Mercedes S-Class, see effective price increases of NOK 70,000 to 80,000 (around 4% of their value).

Given the PHEV price hike, the December pull-forward volume makes sense, and we will see a corresponding hangover in Q1 2024 PHEV volumes.

The tax change also impacts the price of combustion-only vehicles, though a bit less strongly, typically in the 2% to 4% range, though as much as 7.5% for economy vehicles (e.g. Toyota Aygo X). Diesel-only sales were up in December 1.5x over their YTD averages, and petrol-only were up almost 1.6x. HEVs, due for a roughly 3% to 4% price hike, were only up 1.13x, perhaps because of some pricing policy by Toyota (the main HEV seller). We should also expect to see a corresponding hangover for some of these powertrains in Q1 (and a bump in BEV market share).

Full Year Figures

Looking at full year 2023 cumulative figures — the overall auto market was down 27% to 241,721 units, in large part because of the timing of the various policy changes. Full year BEV share came to 82.4%, up modestly from 79.3% in 2022. BEV full year volume dropped by some 24% compared to 2022, to 104,589 units, just staying ahead of the overall market drop. PHEV share dipped from 8.5% to 8.0%, and a total of 10,170 units. HEVs increased from 5.4% to 6.0%, and 7,584 units.

The 2023 cumulative share for combustion-only vehicles was just 3.6%, and 4,609 units. This was down from 6.7% and 11,721 units in full year 2022. This is positive progress. We can see that it is being achieved by policies that make even economy ICE cars (like the Toyota Aygo X mentioned above) effectively expensive and poor value.

That’s all fine and good, but where are the economy BEVs to replace them? Are new cars are to become an elitist item again, like they were in the late 1800s and first half of the 1900s? The squeezing out of basic ICE cars from the market must be replaced by options for good-and-affordable BEVs. These are still nowhere to be seen from Europe’s legacy car makers. Just as a reminder, VW Group made €22 billion in profits in 2022, Stellantis made €16.8 billion, and even a small player like Renault made €2.6 billion.

Best Selling BEVs

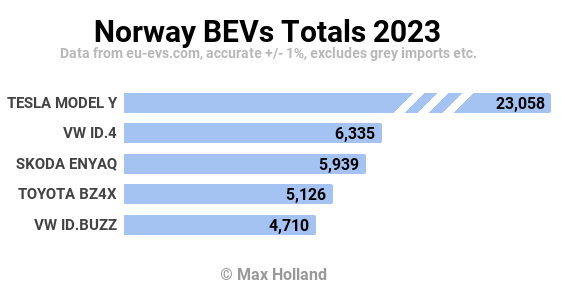

The Tesla Model Y was the bestseller in December, as it has been for almost every month of the year, and for full year 2023. The Toyota BZ4X, and the Ford Mach-E, were December’s runners up.

The Skoda Enyaq, normally in the top 3, had a quiet month, presumably due to temporary shipping allocations. The Tesla Model 3, now in the newly refreshed version, had a decent jump up, and saw 6th spot in December. The BYD Han also stepped up, with its biggest volume in 12 months (125 units), and grabbed 17th spot.

There was only one notable model debut in December, the Opel Astra (in both hatchback and tourer formats), with 5 initial units. However, across all its models, Opel is not pushing large volumes to Norway at the moment, with only 11 passenger vehicle units in December, half of which are the new Astra. This is not just a December phenomenon. Q4 saw a total of 150 sales, down from 543 in Q3.

Other Stellantis BEV brands are seen similar trends in Norway (and also in Sweden) – if anyone has insights into Stellantis’ Nordics strategy, please let us know in the comments.

Let’s check up on the trailing 3 month rankings:

Here the Tesla Model Y is similarly dominant, although Q4 actually saw volume about 15% down from the previous period (July to September, Q3).

The Toyota BZ4X has stepped up steadily, with volume up 1.74x, and now takes 2nd spot, from 4th in Q3. This has displaced the Skoda Enyaq down to 3rd, and the previously 3rd placed VW ID.4 is now all the way down in 8th.

Further down, Mercedes have been running a Q4 clearance campaign for the long-in-the-tooth EQC, which has now just finished (campaign website closed). The big push allowed the EQC to climb to 9th from 39th previously! Mercedes already ceased selling this model in neighbouring Sweden back in June (and only sold 23 Swedish units in H1), and closed order books in several other European markets in July. The slightly modest range (411 km WLTP) for the price point, may be less of an issue in Norway with very dense charging infrastructure in the populated areas. It is still a very quiet and comfortable car, if not as efficient as more recent models.

Back in 13th spot, the new Xpeng G9 joined the top 20 for the first time, with 577 sales.

Let’s look at 2023 totals:

The full year top 5 ranking has no big surprises, though it is good to see a minibus format vehicle in the mix. Note that the scale is broken by the Tesla Model Y, with a volume greater than the next 4 models combined! For more geek details on models and trends, see my other graphs.

In case you missed it, I did a deep dive into Norway’s fleet transition progress a few weeks ago.

Outlook

December’s lacklustre auto market volumes were on par with a broader economy now in negative territory, with Q3 at negative 1.9% GDP growth (Q4 figures not yet available). Inflation increased to 4.8% in November, having been on a downward trend from May to September. Interest rates were up to 4.5% in December from 4.25% in November. December’s manufacturing PMI score was however up slightly to a positive 51.7 points, from 50.1 in November, which suggest things may improve in the coming months.

The OFV says that “it will be hard to reach the goal that all new passenger cars must be emission-free from 2025. To catch up on all the last 17-18 percent in less than a year, becomes challenging, says Solberg Thorsen [OFV director]. And although the proportion of electric cars will probably continue to increase in 2024, at the current pace of the new car market, it will take longer than desirable to replace most of the petrol and diesel cars to zero emissions… The high level of interest rates and tightening of loan regulations have a strong impact on new car sales, and the last thing the market needs is even higher car taxes if we are to achieve the green shift.” (Machine translation).

Norway is certainly at the upper inflection point of the technology adoption S-curve. In my view, the hold up is with prices and model variety. As the pioneer, Norway is ahead of the mass of the auto market, and the model variety and competitiveness at the value end of the market has simply not kept pace with Norway’s transition. At least in terms of those BEVs on sale in Europe, since China has plenty of value BEV options, as Jose Pontes regularly reminds us. Other regions that are transitioning a few years behind Norway will see a higher and less horizontal upper part of the curve, by the time they get there.

What are your thoughts on Norway’s final stage of the transition to EVs? Jump in below to join the discussion.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Video

CleanTechnica uses affiliate links. See our policy here.