How Much My Tesla Model 3 Depreciated In 4 Years

We used to produce a lot of total cost of ownership analyses for the Tesla Model 3 and other electric vehicles, but especially the Tesla Model 3. Something I learned from that is that one of the biggest cost of ownership factors — or the biggest — is depreciation. Or on the flip side, you could say resale value when you eventually sell your car. You subtract that figure from your original purchase price to come up with that large ownership cost. (You also have to add things like interest if you financed the vehicle, fuel/electricity, maintenance costs, insurance, etc.) When it came down to it, big differences in total cost of ownership were often due to different assumptions regarding depreciation/resale value.

Early research in the first few years after the Tesla Model 3 arrived did indeed show much lower depreciation, or better resale value, than competing low-end luxury cars like the BMW 3 Series. But depreciation is something that can vary over time quite a bit based on different macro or company factors. For example, resale value was super high (sometimes higher than original purchase price) when there were all of the supply chain disruptions from COVID-19. However, at the same time, if you sold or traded in your car when those resale values were high, you also had to buy a car with jacked-up prices (unless you weren’t buying another car). So, frankly, it’s a very tricky matter.

With all of that in mind, after nearly 4 years of ownership (~10 days away), I can finally see what my 2019 Tesla Model 3 Standard Range Plus’s depreciation is over a fairly long period of ownership (well, not long, but not super short). I was recently intrigued by the temporary option to trade in my Tesla and have Full Self Driving (FSD) transferred to a new one. (Historically, FSD, or any Autopilot add-on, sticks with the car — you can’t transfer it to a new car.) This is only available this quarter, and I’ve been wondering whether to use the opportunity — I’ll write more about that soon. So, I went into my local Tesla store and asked for an estimate on what the trade-in value of my Model 3 would be (you can’t get that online unless you proceed with an order and pay a nonrefundable deposit). I was a bit surprised to hear that my 2019 Model 3, with just over 38,000 miles (fewer than 10,000 a year), had an estimated trade-in value of just over $20,000. And as I understand it, that’s in a best case scenario — if they find any issues beyond basic wear and tear, it will presumably be lower. That seemed a bit low to me, but …

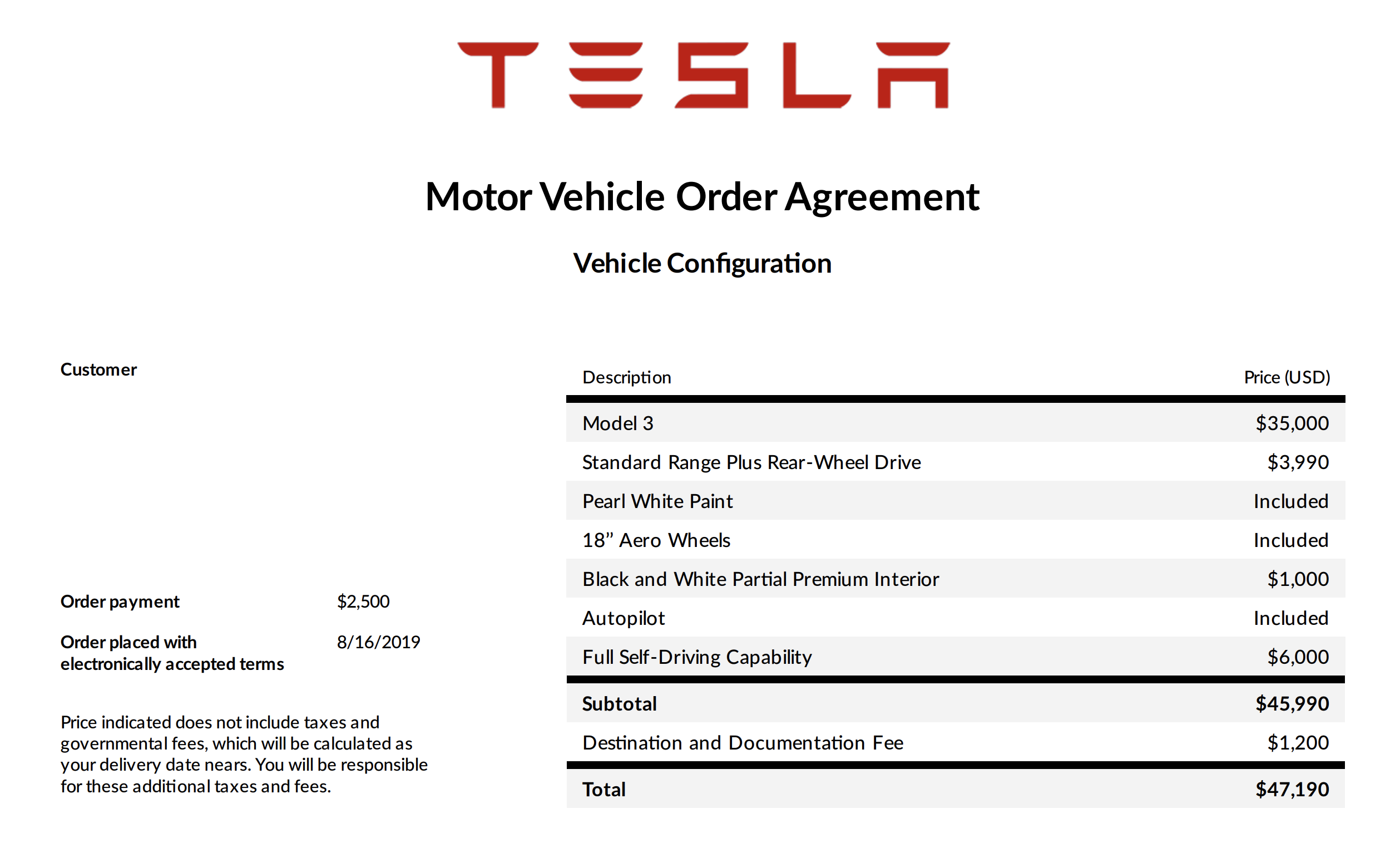

I bought the Model 3 for $47,190 when all was said and done (see above). Being worth just over $20,000 today (at least, in terms of a Tesla trade-in offer), it’s now at 42% of its initial price. So, it has seen 58% depreciation. Interestingly, that is just a bit more than I was estimating for a $40,000 Tesla Model 3 SR+ after 5 years in TCO analyses I’ve dug up. We’ll see what the trade-in value is in one year (presuming I don’t trade it in this quarter), but I don’t expect it to drop a lot more than it has so far (which is one reason I lean away from trading it in now).

All of that said, that’s not quite right. As you can see above, $6,000 of that original price was for FSD, and as you’ll remember, the reason I was looking into this was because I could transfer FSD free of charge this quarter. So, actually, we should chop $6,000 off that price. That means depreciation was actually 51.5% … for this one quarter. In reality, FSD has not held value well at all so far, and my understanding is that Tesla doesn’t give it any value on a trade-in. As you may recall, Elon Musk has spoken quite a bit about Tesla cars with FSD appreciating in value once FSD is robotaxi-capable … but we don’t know when or if that will actually be the case.

We’ll see how this evolves. I think I’m quite unlikely to trade in my Model 3. I had originally planned to keep it for a long time — maybe even till the end of its useful life — and I assume the trade-in value won’t drop a lot more in the next several years if I decide later on that I want to trade it in. But we’ll see. As always, I value CleanTechnica reader thoughts, so let us know what you think of this!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Video

CleanTechnica uses affiliate links. See our policy here.