Xpeng expects third-quarter deliveries of 29,000 to 31,000 units, up only about 13 to 20.8 percent year-over-year.

Xpeng Motors today reported second-quarter revenue that exceeded expectations, but weak guidance for the third quarter and a significantly wider net loss.

The company reported second-quarter revenue of RMB 7.44 billion ($1.11 billion), above the RMB 7.2 billion expected by analysts in a Bloomberg survey, according to unaudited earnings released today.

That was up 97.71 percent from RMB 3.76 billion in the same quarter last year and essentially flat from RMB 7.46 billion in the first quarter.

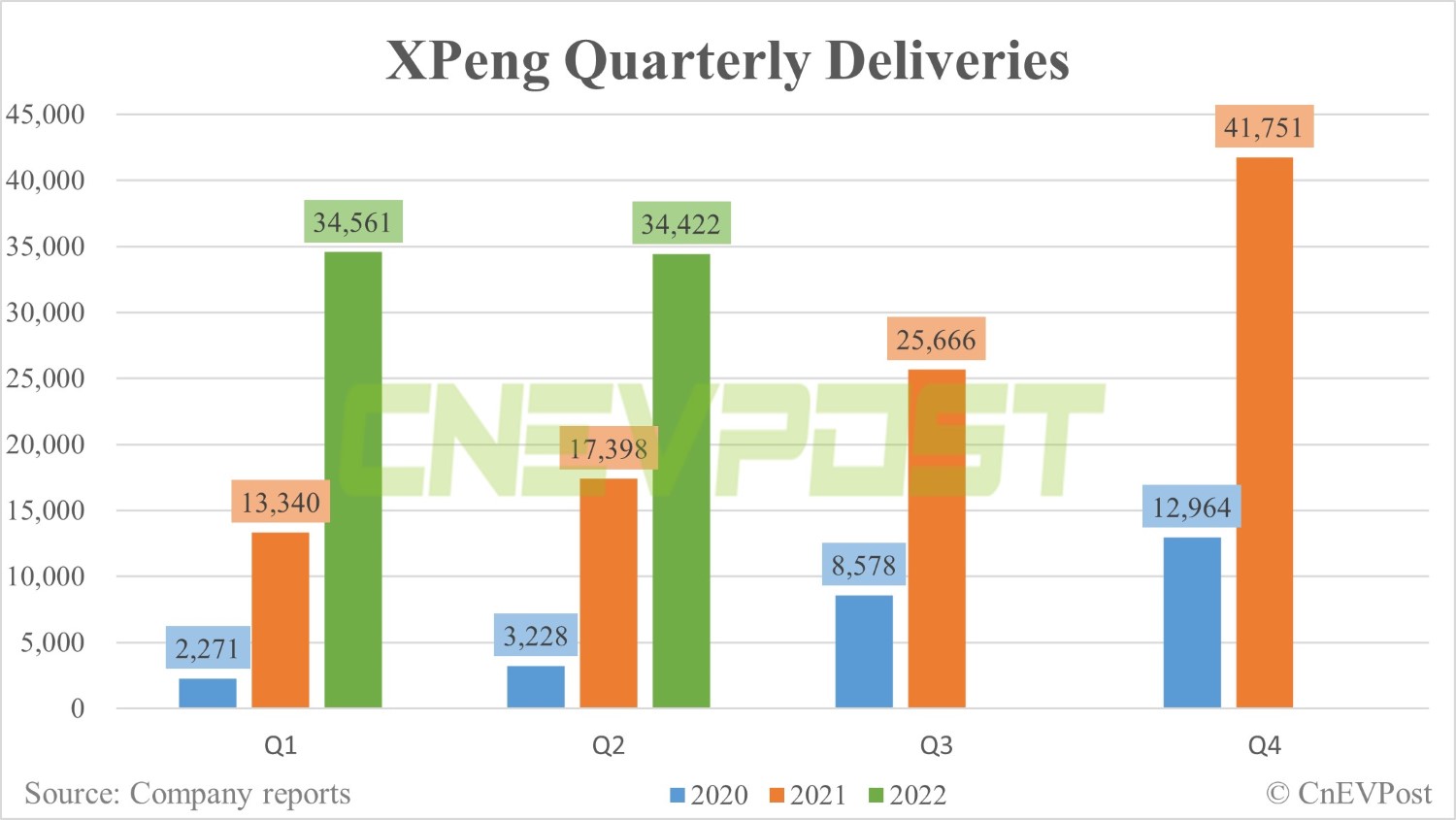

Previously released data showed that Xpeng delivered 34,422 vehicles in the second quarter, above the upper end of the guidance range of 31,000 to 34,000 vehicles. This was up 97.85 percent from 17,398 vehicles in the same period last year and essentially flat from 34,561 vehicles in the first quarter.

Xpeng previously expected second-quarter revenue of RMB 6.8 billion to RMB 7.5 billion. The latest reported figure lies near the upper end of the range.

The company reported revenue of RMB 6.94 billion from vehicle sales in the second quarter, up 93.6 percent year-on-year.

It reported a net loss of RMB 2.7 billion in the second quarter, up 126.1 percent from RMB 1.2 billion in the same period last year and up 58.81 percent from RMB 1.7 billion in the first quarter.

Excluding share-based compensation expenses, non-GAAP net loss was RMB 2.5 billion in the second quarter, compared with RMB 1.1 billion for the same period of 2021 and RMB 1.5 billion for the first quarter of 2022.

Xpeng's gross margin was 10.9 percent in the second quarter, down from 11.9 percent in the prior year period and down from 12.2 percent in the first quarter.

Xpeng's vehicle margin was 9.1 percent in the second quarter, down from 11 percent in the prior year quarter and 10.4 percent in the first quarter.

Research and development expenses were RMB 1.27 billion for the second quarter, representing an increase of 46.5 percent from RMB 863.5 million for the same period of 2021 and an increase of 3.6 percent from RMB 1.22 billion for the first quarter of 2022.

The year-on-year and the quarter-on-quarter increases were mainly due to (i) the increase in employee compensation as a result of expanded research and development staff, and (ii) higher expenses relating to the development of new vehicle models to support future growth.

"We expect our investments in R&D to bear fruit in the upcoming quarters with the roll-out of multiple new products, which will unleash new growth potential and reinforce our leading position in the smart electric vehicle industry," said Brian Gu, honorary vice chairman and president of Xpeng.

"We are accelerating the pace of new product launches to round out our offering with vehicles priced between RMB 150,000 to RMB 500,000. In 2023, we plan to roll out two new competitive models that will further propel rapid sales volume growth," according to He Xiaopeng, chairman and CEO of Xpeng.

Xpeng expects third-quarter deliveries of 29,000 to 31,000 units, representing year-on-year growth of about 13 percent to 20.8 percent.

Considering the company delivered 11,524 vehicles in July, the guidance implies cumulative deliveries for August and September are expected to be in the range of 17,476 to 19,476 vehicles.

The company expects third-quarter revenue of RMB 6.8 billion to RMB 7.2 billion, implying year-on-year growth of 18.9 percent to 25.9 percent.

Xpeng's cash and cash equivalents, restricted cash, short-term deposits, short-term investments and long-term deposits were RMB 41.3 billion at the end of the second quarter.

As of press time, Xpeng was down 3 percent in pre-market trading on the US stock market.