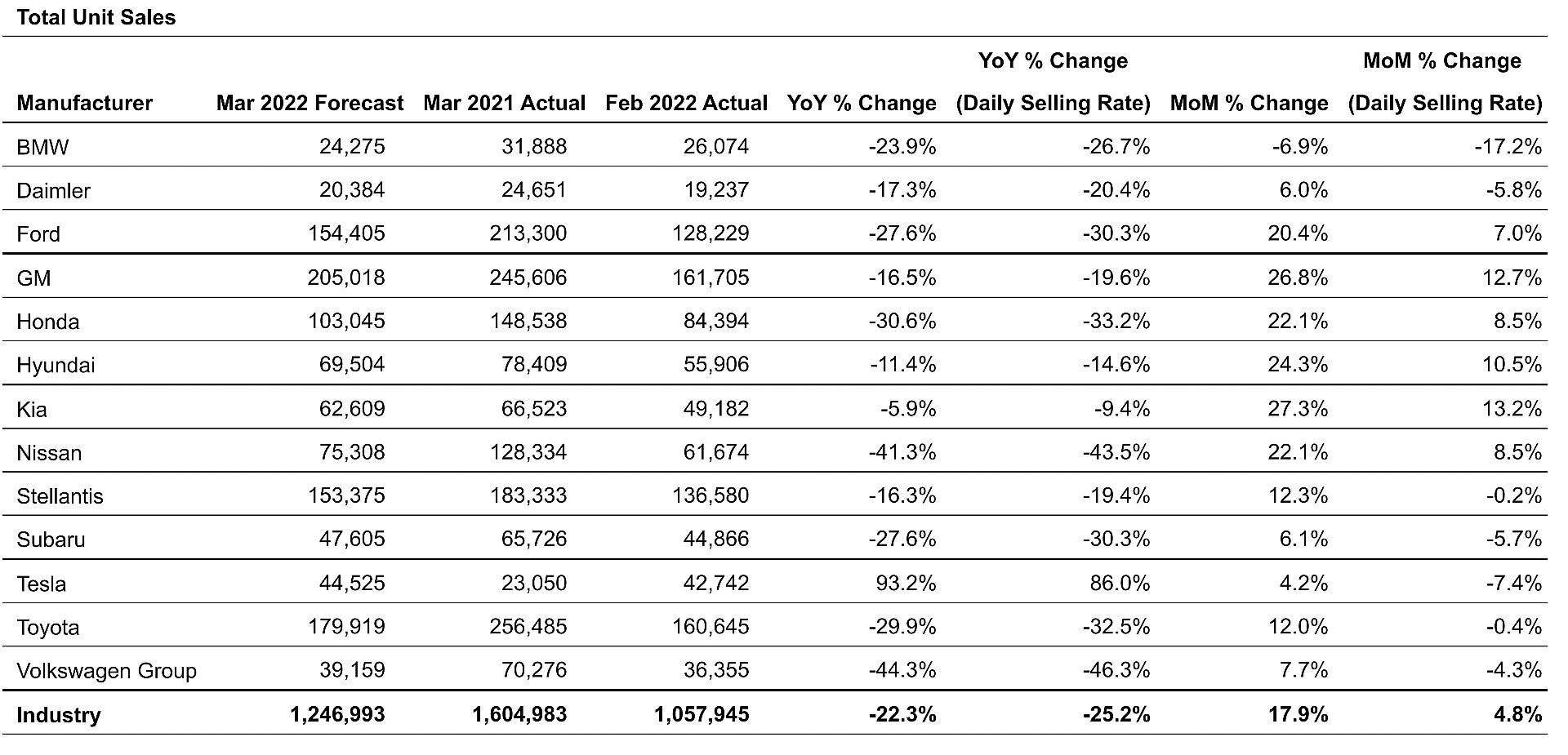

Among the major automotive manufacturers, Tesla is the only one to realize a year-over-year growth in vehicle deliveries from March 2021 to February 2022, seeing a near doubling in sales. Other companies struggled to maintain level sales this year compared to last, with the only company seeing a less than 10 percent decline being Kia.

Tesla delivered 23,050 vehicles in March 2021, according to data from TrueCar. The electric automaker saw a 93.2 percent growth in February 2022 compared to last March, delivering 42,742 vehicles last month. Tesla was an anomaly in this category when compared to other major automakers. From BMW to Ford, to GM and Stellantis, every major automotive company suffered substantial losses in deliveries year-over-year.

The automaker to suffer the most substantial loss was Volkswagen, which saw a 44.3 percent decline in automotive sales from March 2021 to February 2022. Other considerable losses came from Nissan (-41.3%), Honda, (-30.6%), Subaru and Ford (-27.6%), and BMW (-23.9%).

Credit: TrueCar

The realized gains in Tesla’s sales figures could be attributed to a more favorable consumer sentiment regarding electric vehicles over the past year, which has been led due to the company’s nearly-unanimous recognition as the leader in EVs. Additionally, Tesla was one of the only major automakers to combat the semiconductor and chip shortage with relative ease. While the company did experience delays in production last year due to parts shortages and other supply chain issues, it was widely successful in maneuvering the issues, getting cars to customers frequently.

In terms of quarterly year-over-year comparisons, Tesla was one of two automakers to see positive gains from Q1 2022 compared to Q1 2021. Tesla sold 127,432 vehicles in Q1 2022, with only 69,300 in Q1 2021, which represents an 83.9 percent growth. Hyundai saw a 0.9 percent increase, delivering 176,920 vehicles in Q1 2022, with 175,352 cars in Q1 2021.

As an industry, TrueCar expects total new vehicle industry sales to reach 1,246,993 units in March 2022, down 25 percent from a year ago and up 5 percent from February 2022.

TrueCar also offered additional industry insights:

- Total sales for March 2022 are expected to be down 25% from a year ago and up 5% from February 2022 when adjusted for the same number of selling days.

- Fleet sales for March 2022 are expected to be down 30% from a year ago and up 31% from February 2022 when adjusted for the same number of selling days.

- Incentive spend is down 54% from last year.

- Average transaction price is projected to be up 15% from a year ago and down 1% from February 2022.

- Total SAAR is expected to be down 23% from a year ago at 13.6 million units.

- Used vehicle sales for March 2022 are expected to reach 3.6 million, down 13% from a year ago and up 11% from February 2022.

- The average interest rate on new vehicles is 4.6% and the average interest rate on used vehicles is 8%.

- The average loan term on a new vehicle for March 2022 is 70 months and the average loan term on a used vehicle is about 71 months.

- Quarterly average transaction price is projected to be up 16% from a year ago and up 3.5% from Q4 2021.

- Quarterly incentive spend is down 51% from Q1 2021

I’d love to hear from you! If you have any comments, concerns, or questions, please email me at joey@teslarati.com. You can also reach me on Twitter @KlenderJoey, or if you have news tips, you can email us at tips@teslarati.com.